Register company in Isle of Man

To register company in Isle of Man is straightforward if you know the exact steps required. With Tetra Consultants at the wheel, you will be able to dedicate your time and resources to other more important business channels.

With our lean-and-mean mentality, you can rely on our team of experts to provide you a seamless experience throughout the whole process to register company in Isle of Man. Our ultimate goal is for your Isle of Man company to be operationally ready within the stipulated time frame.

Our service package includes everything you will require to set up business in Isle of Man:

- Isle of Man company registration

- Local company secretary and registered address

- Isle of Man business account

- Annual accounting and tax services

Located geographically in the British Isles, Isle of Man holds definite advantages for companies looking to trade in other jurisdictions or to hold investments. A low tax jurisdiction, the jurisdiction is also home to many well-crafted legislations meant to facilitate and build a pro-business environment. As such, many foreign investors are looking to register company in Isle of Man.

How long does it take to register company in Isle of Man?

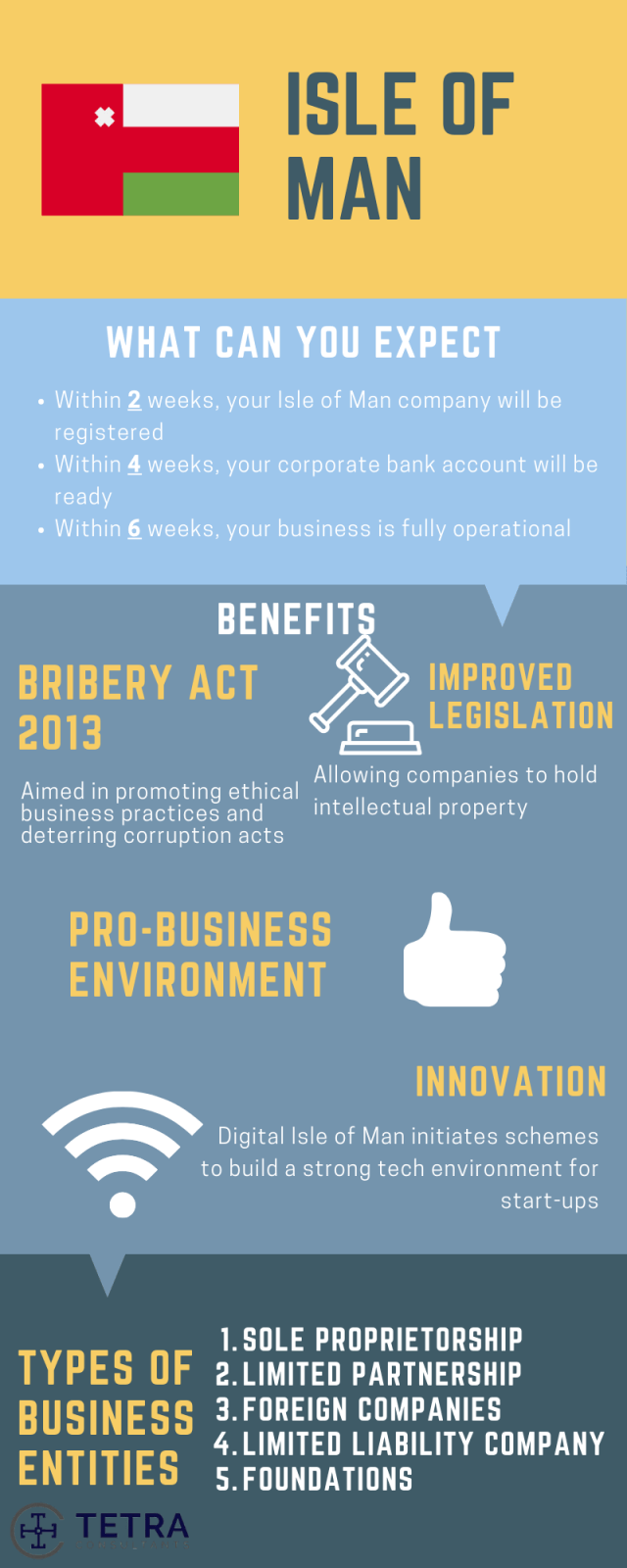

- Tetra Consultants will complete the process to register company in Isle of Man within 2 weeks.

- After receiving due diligence documents of the directors and shareholders, our team will search for the availability of your preferred company name and prepare all required incorporation documents.

- Tetra Consultants ensures to register company in Isle of Man without the need for the prospective owners and incorporators to be physically moved to the nation. Throughout the Isle of Man company registration process, you will not be required to travel overseas.

- After Tetra Consultants has incorporated your Isle of Man company, you can expect to receive the documents of your new company including the Certificate of Incorporation, Memorandum and Articles of Association as well as register of directors and shareholders.

- Within 4 weeks after Tetra Consultants register Isle of Man company, we will open an Isle of Man business account. Alternatively, Tetra Consultants can assist you to open an offshore corporate bank account in your preferred jurisdictions.

- As such, you can expect your company to be fully operational and ready for operation within 6 weeks from engaging Tetra Consultants.

Can a foreigner register company in Isle of Man?

- Isle of Man’s government offers foreign investors several options on the different types of business entities to choose from when registering a company in Isle of Man. Tetra Consultants will advise you on the steps and requirements for starting business in Isle of Man.

- There is no requirement for a resident director in Isle of Man, unless the company holds an Isle of Man Gaming License. A company that provides gambling services and plans to apply for an Isle of Man Gaming License must have at least 2 resident directors.

- Otherwise, a company in Isle of Man can be wholly foreign-owned. Generally, companies in the Isle of Man that do not engage in gambling activities only require one director and one shareholder of any nationality.

- There is no minimum paid-up share capital requirement for a company that does not provide gambling services.

- However, all companies must have a registered address in Isle of Man and appoint a local registered agent.

- There are many types of business structures in Isle of Man. When deciding the most suitable entity type, it is important to consider various factors that include but are not limited to availability of personal liability protection, ownership and management flexibility as well as compliance requirements. Each business entity will come with its distinctive features.

- Before the start of the engagement, Tetra Consultants will fully understand your business before recommending the most optimum business entity in Isle of Man. Some considerations we take into account include the type of business activity, tax obligations and nationalities of shareholders and directors. Our consultants will also offer more information on the requirements imposed to set up these entities.

What types of companies are there to be considered to register company in Isle of Man?

Prior to starting the process to register company in Isle of Man, it is essential to choose the most suitable type of company. Before moving to register company in Isle of Man, it is essential to consider factors such as personal liability protection, tax ramifications, ownership, management flexibility as well as compliance requirements. Each business entity will come with its distinctive features.

Tetra Consultants will fully understand your business before recommending the most optimum business entity in Isle of Man. Some considerations we take into account include the type of business activity, tax obligations and nationalities of shareholders and directors. This is to ensure that the Isle of Man company is most suited to your business needs and long term goals.

Limited Liability Company

- Formed under the Limited Liability Companies Act 1996, an Isle of Man limited liability company reserves the privilege of being granted a separate legal entity, distinct from its members, manager and registered agent.

- As a separate legal entity, the liability of its members is capped and limited to the extent of their contribution to the capital. As such, in the event of winding up, you will not be personally liable for the debts and obligations incurred by your limited liability company. Otherwise, there are also restrictions imposed on the transfer of members’ shares in the company.

- To register a company in Isle of Man in the form of a limited liability structure, it is important that you have a local registered agent. During the process of Isle of Man company registration, Tetra Consultants will provide your firm a local registered agent. This individual will be the point of contact between your company and the local government and banks.

- In addition, Tetra Consultants will also provide a local registered address. This is to ensure that all notices and announcements can be duly received. On a side note, there are no requirements to appoint a local director.

Limited Partnerships

- Governed by the Partnership Act 1909, limited partnerships can be formed by 1 or more persons, as per capped to 20 members. With a minimum mandate of at least 1 general partner with unlimited liability, the general partner will have the authority to manage and bind all other partners in contracts with external stakeholders. However, the catch is that all general partners will be liable for all debts and obligations incurred by the partnership in the event of a winding-up.

- To register a limited partnership, it is important that you file your company’s application with the Companies Registry. In general, there are no limitations as to the residency of the partner and that there is no requirement for a minimum authorised capital.

Foreign Companies

- Under the Foreign Companies Act 2014, a foreign company is a company incorporated in an external jurisdiction which is out of the Isle of Man. However, the foreign company has since established a place of business or owns land in the Isle of Man.

- To register a foreign company in Isle of Man, you will require to submit all necessary registration documents to the Isle of Man Companies Registry, within 1 month since the establishment of your place of company. These registration documents include providing relevant information about your company in its home country, a registered address in the Isle of Man and information regarding your directors.

- Following which, foreign companies are also legally obliged to make an annual return within 1 month of the anniversary date of incorporation in its home jurisdiction.

Foundations

- When registering a company in Isle of Man, an increasing number of foreign investors are looking to register a foundation. A foundation owns a corporate personality and is commonly set up for a specific purpose related to charity or for the benefit of its specific beneficiaries. With stricter restrictions, foundations are not permitted to engage in commercial trading.

- To set up a foundation, your registered agent should file an application. The application should include the foundation’s name and address, its objects, registration number, and the registered agent’s name and address. On approving the application, you can expect to be issued a Certificate of Establishment.

Trust

- Businesses that intend to provide financial services such as wealth management and real estate planning can consider setting up a trust company.

- A trust company is a legal entity that acts as the trustee or agent for a person or business. In essence, a trust company will administer and manage the assets on behalf of its beneficiaries and any gains to the assets will eventually be transferred to the beneficiaries.

- All trust companies that operate in the Isle of Man are required to provide their services through an Isle of Man based corporate trustee.

- The trustee will handle the beneficiaries’ assets as if they were its own assets, limited only by the terms listed in the trust deed.

- A trust company can provide family office services to serve the needs of wealthy families in the Isle of Man.

How to register company in Isle of Man?

Step 1: Choosing an optimum business structure

- Prior to company formation, it is essential to choose the correct type of company. Based on your business structure and long-term goals, Tetra Consultants will advise you on the most optimum business entity, paid up share capital and corporate structure.

- Generally, the most common type of company in Isle of Man is a limited liability company.

Step 2: Reservation of company name

- Tetra Consultants will check for the availability of your company name through the Company Registry in the Isle of Man government website. Once the availability of your company name has been confirmed, Tetra Consultants will reserve your company name.

Step 3: Appointment of registered agent

- While a limited liability company in the Isle of Man is not required to appoint a resident director, the company must employ a registered agent who is regulated by the Isle of Man Financial Services Authority.

- As such, Tetra Consultants will recommend and appoint a registered agent on your company’s behalf.

Step 4: Preparation and submission of relevant documents

- Before Tetra Consultants can incorporate your company in Isle of Man, you are required to provide a list of required KYC documents. Some of these documents include the names of directors, company’s resolution and identification proof.

- Based on the documents provided, Tetra Consultants will draft and notarize the Memorandum and Articles of Association, business plan and other incorporation documents.

- After preparing the required documents, Tetra Consultants will register your company under the Companies Act 2006.

- Upon successful registration of company, Tetra Consultants will courier the Certificate of Incorporation, Memorandum and Articles of Association and other corporate documents to your preferred address.

Step 5: Corporate bank account opening

- Depending on your business structure, the documents required to open a corporate bank account will be slightly different.

- Tetra Consultants will help in consolidating the documents and opening a corporate bank account with a reputable bank of your choice.

- Typically, directors and shareholders are not required to travel to Isle of Man to open the corporate bank account. However, if travel is required, we will have a representative accompany you to the bank meeting. Alternatively, our team will negotiate with the banks to conduct a conference call instead or to request for a waiver.

- Once the bank account has been successfully opened, Tetra Consultants will courier the internet banking token and access codes to your preferred address.

Making changes to existing companies/businesses in the Isle of Man

- In the Isle of Man, companies are required to file certain changes to their existing structure with the Companies Registry. These changes may include alterations to the company’s name, registered office address, share capital, directors and secretary details, and other significant events that may affect the company’s legal status. The Isle of Man Companies Registry operates an online system for companies to make these changes electronically, or they can be submitted by post or in person. It is important for companies to ensure that they comply with the legal requirements for filing these changes, as failure to do so may result in fines or penalties.

- Company name: Changes to a company’s name must be approved by the Isle of Man Companies Registry, and a fee is payable for the application. If the change is approved, the company must then update all relevant documents and inform its clients and stakeholders of the new name.

- Registered office: Changes to the registered office address must also be filed with the Companies Registry, and evidence of the new address must be provided. The same applies to changes to the share capital of the company, and in certain circumstances, shareholders may need to give their consent to the change.

- New director and secretary: Changes to the directors and secretary details of the company must also be filed with the Companies Registry, and any changes to the company’s constitution must also be documented and submitted. Other significant events that may affect the company’s legal status, such as mergers, acquisitions, or changes in ownership, must also be reported to the Companies Registry. Companies should ensure that they keep accurate records of all these changes and file them promptly with the Registry to avoid any legal issues or fines.

Annual Obligations

- The address of the company’s registered office and the registered agent must be renewed annually.

- All companies are required to pay an annual renewal fee.

- Every registered business is required to file an annual declaration through the submission of the Form ADB to the Companies Registry. In the annual declaration, the business must verify that they will continue to trade and that it does not need to make any amendment to its particulars. The annual declaration is to be filed on the anniversary that the trade name was registered. No registration fee will be charged for the annual declaration.

- If the company wishes to make any amendments to its particulars, it must submit the appropriate form to the Companies Registry within 14 days in which the change occurs. No fee will be charged if the form is submitted within the 14 days.

- All companies in the Isle of Man are also required to file an annual return even if they have not conducted business activities within the jurisdiction.

- In accordance with the Income Tax Act 2006, companies will be taxed based on assessment during the accounting period. Returns will be issued to the company when the company’s accounting period ends.

- While the general corporate tax in the Isle of Man is 0%, companies that engaged in banking or retail businesses in the Isle of Man will pay 10% taxes. Income from land and property in the Isle of Man are subjected to a 20% tax rate.

- The deadline for the filing of the annual return is 12 months and one day after the company’s accounting period has ended.

Why should you register company in Isle of Man?

Political

- Introducing the Bribery Act in 2013, the Isle of Man Government is committed to promoting ethical local and international business practices and deterring bribery or corrupted acts.

- A special investigation titled the Paradise Papers revealed many financial crimes of offshore multinational companies which used the country as part of its tax avoidance scheme, highlighting the lack of transparency.

- Police harassment and corruption are not new on the Isle of Man. There have been past allegations of such crimes in Isle of Man with one leading to the 2010 protest.

Economic

- The country’s pro-business environment can be seen in its efforts to partner with the United Kingdom. With a customs and excise agreement between the 2 countries, they are viewed as 1 territory when it comes to customs duties and VAT taxes. This ensures that there is greater stability in the Isle of Man Customs and Excise affairs and at the same time provides more flexibility for the Isle of Man to set its own tax rates. Hence, if you are looking to expand your operations into the United Kingdom, Isle of Man is a good place to start.

- Isle of Man companies enjoys one of the lowest tax rates in Europe. With no capital gains tax, inheritance tax and stamp duty, the simple taxation regime of Isle of Man are indeed attractive. Dividends made to non-residents are also taxed at 0%.

- The customs agreement between the UK and the Isle of Man helps to facilitate trade between the two jurisdictions. Due to the geographical location of Isle of Man, companies also have easier access to EU markets and enjoy shorter time span for goods transferred through the supply chain in the EU.

Social

- The main language of the Isle of Man is English. Hence, you will not have to worry about potential communication barriers when conducting your business activities in the country.

- Poverty is a prevalent issue in Isle of Man with its policy and reform minister highlighting the seriousness for greater support towards the homeless.

- The crime rate on the island has increased by 10% over the year 2018 to 2019. This included rising records of violent crimes and drug offenses committed on the island.

Technological

- Created to support the thriving digital sector, Digital Isle of Man provides support through initiating schemes collaborated with educational institutions to establish a strong environment for its tech companies.

- Launching Blockchain Isle of Man, the country is committed to providing support and guidance to eGaming business through facilitating a strong regulatory environment.

- By introducing the B2B Software Supplier License, Isle of Man is committed to developing a jurisdiction with high standards for corporate governance and fair game.

Legal

- With a commitment to the Paris Convention on Patents and Trademarks, an Isle of Man company is suitable and ready for holding intellectual property.

- Enacting the Designated Business (Registration and Oversight) Act 2015, cryptocurrency businesses are heavily regulated by the Isle of Man, deterring potential financial crimes.

- The Economic Substance legislation as contained in the Isle of Man’s Income Tax Act 1970 suggests the country’s commitment against developing a tax haven

Environmental

- The newly initiated Agricultural and Fisheries Grant Scheme 2019 is designed to support farmers in protecting and enhancing the Island’s landscapes.

- Isle of Man is constantly on the lookout to increase its environmental efforts with the latest being the introduction of a carbon-reducing plant to reduce emissions rate.

- Awarded a UNESCO Biosphere Reserve title, the country follows a strong and commendable approach aimed at achieving sustainable development and environmental protection.

Monetary

- Isle of Man is home to many attractive business grants aimed at helping a business to develop. The Department for Enterprise primarily aims to develop grants that will provide support for new companies.

- The Business Improvement Scheme (BIS) provides funding for businesses that assists other firms in areas such as marketing, business advisory, website, legal advice, and environmental efficiency. The maximum grant offered is £5,000 per project or £10,000 for projects related to digital marketing and website consultancy.

- Companies can also apply for the Vocational Training Assistance Scheme to upgrade their workers if they have a registered office and provide employment to the locals in the Isle of Man. The scheme contributes 30% towards all course fees incurred in training the workers and examination fees.

- Enterprise Development Scheme (EDS) was implemented to help start-ups that focuses primarily on the export sector. The scheme provides loans of between £10,000 and £1 million to eligible businesses.

How to proceed to register company in Isle of Man?

- Under the Companies Act 2006, a company incorporated in the Isle of Man must have at least 1 director of any nationality, 1 shareholder and a registered agent that resides in the Isle of Man. The director and the shareholder can be the same person. There is no minimum share capital requirement, but the company must have a registered address in the Isle of Man.

- You can search for the availability of your trade name via the Register Search function in the Isle of Man Financial Services Authority website.

- After you have drafted the relevant documents, you be required to submit them to the Financial Services Authority. This includes a business details form, risk assessment form, the company’s Memorandum of Association and Articles of Association.

- It is recommended that you enlist the service of a company setup service provider or registered agent when Incorporating a company in Isle of Man, especially if you are not familiar with the legislation.

Contact us to find out more about how to register company in Isle of Man. Our team of experts will revert within the next 24 hours.

FAQ:

Where is the Isle of Man located?

- The Isle of Man is located in the Irish Sea near the northwest coast of England. It is a self-governing British Crown Dependency that is not part of the United Kingdom (UK) or European Union (EU). However, residents in the Isle of Man are classified as British citizens.

Can you set up a company on the Isle of Man?

- Yes, you can set up a company on the Isle of Man as long as you have one director, one shareholder and a registered office. There are no capital requirements or restrictions to the nationality of the director, but you will need to employ a registered agent to manage your trading activities.

- For a quicker and simpler set up of an offshore company, you may wish to employ Isle of Man company formation services.

How much does it cost to start a company in the Isle of Man?

- The engagement fee depends on the services you require from Tetra Consultants. Prior to each engagement, our team will fully understand your business needs and inform you of the exact services you require.

- For example, you may not require our bank account opening services if you already have a bank account with some banks.

- Tetra Consultants’ fees include government fees such as business name reservation charges, Isle of Man company incorporation fee and other miscellaneous fees.

How many businesses are on the Isle of Man?

- As of March 2021, there are 15,667 companies incorporated under the Companies Act 1931 and 9,675 companies incorporated under the Companies Act 2006. A company can choose to register a business in Isle of Man through either Act.

How do I become a resident of the Isle of Man?

- If you wish to become a permanent resident of the Isle of Man, you must either have a relative or family member living in the Isle of Man, or be a UK resident. The Isle of Man residency requirements for a UK citizen requires you to have lived in the UK for a substantial period of time.

- If you wish only to be considered as a tax resident in the Isle of Man, you will have to be present in the Isle of Man for a minimum of 183 days in a tax year. Alternatively, you will be regarded as a tax resident of the Isle of Man from the beginning of the fifth year if you have spent more than 90 days in the Isle of Man in the last 4 years,

What is the tax in Isle of Man?

- The corporate tax in the Isle of Man is generally 0%, except for companies that engage in banking, retail, and real estate activities. Such companies are subjected to a tax rate of 10% or 20% accordingly.

- The maximum cap for personal income tax in the Isle of Man for locals is 20% and most people pay a tax rate between 10% and 20%. The Isle of Man non-resident income tax is 20% for all brackets of income.

- In addition, there are no capital gains tax, inheritance tax and stamp duty. Dividends made to non-residents are also taxed at 0%.

Is the Isle of Man VAT exempt?

- No, the Isle of Man is not VAT exempt. The standard rate of VAT for non-essential goods and services is 20%. The amount of VAT charged on different goods and services in the Isle of Man is largely similar to that of the UK. In addition, goods transferred between the Isle of Man and UK are subjected to VAT instead of import duty. The Isle of Man has its own independent tax authority that works closely with the UK tax authorities.

Does the company’s bank account have to be opened in the same location as the company?

- No, the company’s bank account does not need to be opened in the same location where the private limited company was registered.

- However, you may still wish to open an Isle of Man business current account. Isle of Man bank account benefits include better regulation due to the large banking sector and greater transparency in the legal system. A foreign company can also easily open a bank account in the Isle of Man without travelling directly to the jurisdiction.

What is the best business in Isle of Man?

- Business owners can consider setting up a business in major industries such as the finance and eGaming industries in the Isle of Man.

- The finance sector in the Isle of Man contributes significantly to the economy, with the banking sector accounting for approximately 9% of the country’s GDP. High levels of confidentiality, asset protection, minimal tax liability and paperwork are some of the reasons why business owners may choose to set up a company in the Isle of Man to provide financial services.

- Another popular industry is the electronic gaming (eGaming) industry. One of the largest employers in the Isle of Man, the eGaming sector is a popular choice for foreign business owners. In fact, some of the largest gambling sites such as PokerStars are located in the Isle of Man. Foreigners that wish to provide gambling services tend to incorporate in the Isle of Man because of the international reputability of the Isle of Man gaming license, skilled labour force equipped with experience in the IT industry and low gaming taxes.