Compliance officer services for Mauritius Investment Dealer license

- Services of a compliance officer for Mauritius Investment Dealer license are necessary for companies looking to enter the financial sector in Mauritius while ensuring compliance to all regulatory standards.

- The role of the compliance officer is fundamental to continuing compliance with the legislative framework established by the Financial Services Commission (FSC) and helps to support risk management, reporting, and ongoing filings. Getting a Mauritius Investment Dealer license give you recognition and credibility and allows you the freedom to provide different securities and brokerage services globally.

- To register company in Mauritius, and start conducting business, you are required to appoint a qualified compliance officer if you want to navigate and manage the fast changing regulations.

- At Tetra Consultants, we can assist at the level that you need from company registration including offshore company incorporation, acquiring the Mauritius Investment Dealer license, or appointing a qualified compliance officer. We will ensure that the licensing process and ongoing compliance is smooth so you can initiate your business in Mauritius without any delays.

Benefits of Mauritius Investment Dealer license compliance officer services

Regulatory compliance and risk mitigation

- By appointing a compliance officer, a firm can establish compliance with Mauritius’ regulatory framework and the FSC’s requirements. It reduces any possibility of non-compliance with regulations and subsequent fines, or the loss of a license, by establishing sound internal controls and fulfilling its anti-money laundering (AML) and counter-financing of terrorism (CFT) needs.

Overall credibility and investor confidence

- A compliance officer with the appropriate qualifications demonstrates a firm’s openness, ethical standards adherence, and commitment to regulatory standards of best practice. This gives comfort to investors and counterparties, which positions the firm favorably in the view of international financial markets.

Efficiency and ongoing support

- Compliance officers develop and manage strong compliance systems, which includes inquiries, compliance reports, and filing obligations to regulators in a timely manner. This is more efficient for the firm’s operating processes while placing the company in a better position to concentrate on its core investments, brokerage, or advisory roles, with minimal compliance disruptions.

Enables market access and growth

- Achieving and maintaining compliance is critical to taking advantage of Mauritius’ position as a gateway to Africa and Asia. This provides easy access to new markets and collaborative opportunities which can lead to growth and diversification.

Tax optimization and financial upsides

- Compliance frameworks are necessary for reaping the financial benefits of Mauritius’ attractive tax environment by labelling eligible jurisdictions for as much as 80% tax forgiveness and no capital gains tax but only if compliance with all resulting local requirements for such financial benefits are fully adhered to.

Investor and client asset protection

- While compliance officers look for proper segregation and protection of client funds, they synthesize risk management systems, and investor protection standards in a way to best protect the parties interests and integrity of the company.

Who should appoint Mauritius Investment Dealer license compliance officer services?

Entities applying for, or holding, a Mauritius investment dealer license

- In the case of all investment dealer entities, irrespective of whether it is also a Full Service Dealer (with or without underwriting), Broker Dealer, or a segment licensee, a Company is required to appoint a compliance officer as part of its licensing and ongoing compliance obligations.

Global Business Companies (GBC) licensed investment dealers

- Only Global Business Companies that wish to operate as licensed Investment Dealers – as categorized under the Financial Services Act and Securities Act are required to appoint a compliance officer and a Money Laundering Reporting Officer (MLRO).

Corporate bodies and partnerships applying for investment dealer licenses

- These legal entities must indicate the particulars of, and identity of, their compliance officer during the application process and maintain this appointment during the duration of the license as required by the Financial Services Commission (FSC).

Eligibility for Mauritius Investment Dealer license compliance officer services

- Must hold a relevant qualification in finance, capital markets, financial services, business administration, or a related discipline from a recognized institution.

- Should have sufficient relevant experience, typically anywhere from 4 to 8 years in investment business (or similar financial sector type background).

- Must fit all the fit and proper criteria, which includes good financial standing, integrity, reputation (meaning takes care to protect their reputation) and, importantly, can conduct its compliance functions honestly and efficiently.

- Must be able to demonstrate advanced knowledge of securities principles, regulatory frameworks, fund management and other associated technical competencies as required by FSC competency standards.

- Must be resident in Mauritius, or otherwise the finance community would typically expect it to be local for efficiency of accessibility and regulatory governance.

- Appointment would typically include titles like compliance officer, Money Laundering Reporting Officer (MLRO) and deputy MLRO.

- Must continue to meet continuing professional development and further training on anti-money laundering (AML)/ compliance standards will be required to stay current.

- Should be independent from the Board of Directors, as complaints are made to the Board upon IGI non-compliance risks (which serve to ensure independent oversight).

Mauritius Investment Dealer license compliance officer services assistance

- The officers of compliance that are licensed under our Mauritius Investment Dealer have designations as Certified Anti-Money Laundering Specialist (CAMS) and Certified Financial Crime Compliance professionals, have at least five years of practical experience in the offshore financial licenses services sector, and have a thorough understanding of the regulatory framework in Mauritius, the Securities Act and regulations, AML/CFT compliance criteria, and all reporting obligations necessary to keep your Mauritius Investment Dealer license.

- At Tetra Consultants, we can keep your investment dealer business completely compliant by creating a customized AML/CFT framework based on your operational model. We also take care of all ongoing reporting obligations, are your single point of reference with regulators, and provide licensed compliance officers with integrity and professionalism that comply with Mauritius’ financial regulations. Having this comprehensive collaboration softens the blow of risks that impact your firm’s public reputations and provides for the efficient and smooth operations of business under a Mauritius Investment Dealer license.

Services offered by Tetra Consultants Mauritius Investment Dealer license compliance officer

- Ensure compliance with:

- Financial Services Act 2007

- Securities Act 2005

- Securities (Licensing) Rules 2007

- FSC Guidelines, Circulars, Conditions of License

- Act as the main point of contact with the FSC (e.g. during audits, inspections, regulatory review)

- Submit or supervise and review submissions of:

- Annual and quarterly compliance reports

- Financial statements

- Notifications of material changes (in shareholding, key employees, business activities)

- Ongoing compliance attestations

- Design and maintain the firms AML/CFT framework

- Implement and supervise:

- Customer Due Diligence (CDD/KYC)

- Enhanced Due Diligence (EDD) for higher-risk clients

- Ongoing monitoring of transactions

- Sanctions and PEP screening

- Work alongside or act as the MLRO (Money Laundering Reporting Officer) for suspicious transaction reporting to the Financial Intelligence Unit (FIU).

- Establish and update internal compliance policies & procedures.

- Monitor compliance with internal codes of conduct, business ethics, and conflict of interest policies.

- Maintain effective whistleblowing procedures and compliance escalation procedures.

- Provide feedback to the Board and Senior management on regulatory risk and compliance gaps.

- Establish and implement a compliance monitoring program that includes:

- Follow-up on licensing obligations

- Follow-up on AML/CFT controls

- Transaction reviews

- Record keeping requirements

- Conduct internal audits and reviews, identify gaps and deficiencies, and correct them.

- Design and ensure timely remediation of audit findings or FSC observations.

- Plan and deliver AML/CFT and compliance training to employees and directors on a regular basis.

- Keep an up-to-date training log, training material, and attendance records.

- Ensure staff are aware of and updated about any emerging risks or regulatory changes.

- Ensure the company is keeping:

- KYC records

- Transaction records

- Internal compliance reports

- STRs

- Board and committee minutes

- Ensure all records are kept for a minimum of 7 years (or longer if required)

- Conduct risk-based assessments of:

- Financial instruments and services that are offered (equities, CFDs, derivatives, etc.)

- Client profiles and client jurisdictions

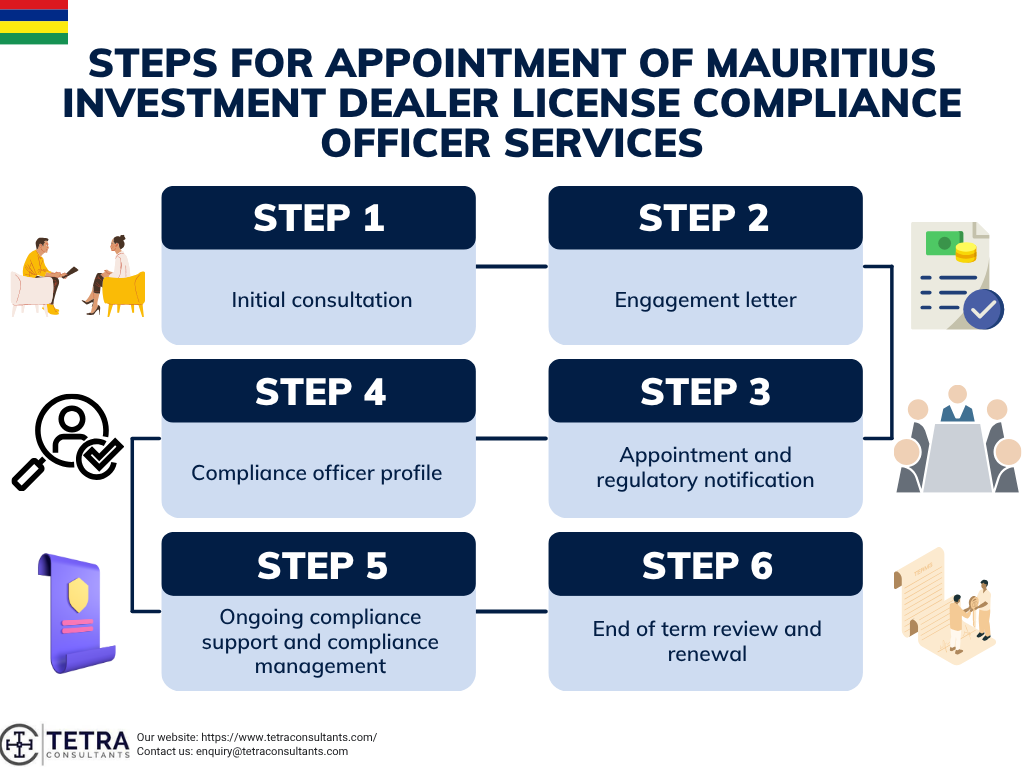

Steps for appointment of Mauritius Investment Dealer license compliance officer services

Step 1: Initial consultation

- Use the first call with the service provider e.g., Tetra Consultants to discuss your requirements and understanding of the tasks for the compliance officer. This allows you to describe your business obligations and requirements under the Mauritius Investment Dealer license.

Step 2: Engagement letter

- We will provide you with an appointment letter and an invoice once you have agreed and notified us of your intent to engage with our proposal. This will confirm the appointment of the compliance officer and terms of services.

Step 3: Compliance officer profile

- Once confirmation of the engagement is supplied, we will submit the CV and detailed profile of the proposed compliance officer for your consideration. This way you will have the opportunity to ensure the candidate meets the fit and proper test set by the FSC Mauritius in relation to qualifications, experience and competence in investment dealer compliance matters.

Step 4: Appointment and regulatory notification

- Following your acceptance, the compliance officer is formally appointed. The documentation submitted to the Financial Services Commission will include the compliance officer’s entire compliance due diligence (CDD) information and a competency declaration and will be part of licensing, or ongoing regulatory obligations.

Step 5: Ongoing compliance support and compliance management

- In all future engagements, the compliance officer provides continued regulatory compliance support, attendance at meetings, and oversight of risk management and AML/CFT policy implementation and compliance with all the conditions on the license. They are the regulator’s contact and continue to grow and modify your business.

Step 6: End of term review and renewal

- At the end of the term of appointment a review takes place to ensure that you want to continue with the compliance officer services. If you do, then terms are renewed otherwise arrangements are made for transition, or replacement in compliance with the obligations to the FSC.

Cost for Mauritius Investment Dealer license compliance officer services

- By using Tetra Consultants’ compliance officer service as part of your Mauritius Investment Dealer license, you receive transparent end-to-end regulatory support. Our compliance officers are CAMS-certified and knowledgeable in Mauritius AML/CFT regulations, as well as FSC guidelines, and we provide compliance advice that is tailored to your business model. Moreover, we assist you with day-to-day compliance functions to ensure staff follow internal controls and local requirements.

- We communicate any regulatory update and build relationships with your compliance officer to monitor growth and milestones. You can confidently assure your operations meet all internal and external expectations and maintain readiness for audits while actively monitoring the operating environment. With Tetra Consultants collaboration, you will know you are compliant with FSC rules, international standards are enacting change in your operations, and meeting client commitments. Our best practices demonstrate the actions to implement changes to your compliance obligations if required.

Why choose Tetra Consultants?

- When you engage Tetra Consultants for Mauritius Investment Dealer license compliance officer services, you are working with a trusted professional who is committed to the regulatory success and operational excellence of your business.

- From our first consultation, we take a personalized approach, recognizing that every business is different, therefore, our detailed compliance solutions will be developed to meet the exact requirements of the FSC. Tetra Consultants propose only qualified and experienced compliance officers and evaluate their professional standards and personal integrity before referring them to you.

- We will support you throughout our engagement to manage your AML/CFT frameworks, regulatory reporting, and risk management, keeping you compliant with all changing regulations. We will liaise internally with the authorities on your behalf and support you to remove as much of the activity’s relevance to your team is a part of our relationship with you.

- Reasons to engage Tetra Consultants:

- Compliance solutions personalized to your unique business.

- Access to seasoned compliance professionals with local knowledge and experience.

- Proactive regulatory tracking and reporting timelines.

- Value-based service extending integrity and confidentiality and placing clients front and foremost.

- Value-added service at every level from set up, through compliance, and renewal.

Looking to appoint Mauritius Investment Dealer license compliance officer services

- By utilizing Tetra Consultants compliance officer services for your Mauritius Investment Dealer license, you can rest assured that you will have a streamlined and dependable compliance experience that is specific to your business context. We go above and beyond to fulfill your compliance obligations, we do not just offer regulatory compliance consulting services, we are committed to finding ways to improve your business through compliance as we can provide consultative solutions that keep pace with changes in the interest of the industry while mitigating potential risks.

- With Tetra Consultants, you have a committed partner that will protect your business reputation, provide a mechanism for operational performance, and stability while supporting future growth. Our comprehensive approach means that your compliance needs will be met effectively, professionally, and with a valid comprehension of the Mauritius financial sector so that you can confidently focus on achieving your business objectives.

- Contact us to know more about Mauritius Investment Dealer license compliance officer services and our team will get back to you in 24 hours.

FAQs

Who is responsible for appointing a compliance officer at the time of Mauritius Investment Dealer licensing?

Who is responsible for appointing a compliance officer relating to Mauritius Investment Dealer licensing?

What are the qualifications for a compliance officer?

Can the compliance role be outsourced?

What are the compliance officer's key tasks?

Does the compliance officer need to reside in Mauritius?

How does Tetra Consultants assist in the appointment of a compliance officer?

What happens at the end of the compliance officer’s term of appointment?