Lithuania company registration

To register company in Lithuania is straightforward if you know the exact steps required. With Tetra Consultants at the wheel, you will be able to dedicate your time and resources to other more important business channels.

With our lean-and-mean mentality, you can rely on our team of experts to provide you a seamless experience throughout the whole process of Lithuania company registration. Our ultimate goal is for your Lithuania company to be operationally ready within the stipulated time frame.

Our service package for Lithuania company registration includes everything you will require to set up business in Lithuania:

- Lithuania company registration with State Enterprise Centre of Registers

- Local company secretary and registered address

- Opening local or international corporate bank account

- Annual accounting and tax services

The biggest of the Baltic states, Lithuania is also widely proclaimed for its economic powerhouse reputation. With a stable and strong economy, the country’s business-friendly environment encourages foreign investors to set up their company in Lithuania. Backed by its low labour cost, low taxation rate and low inflation rate, it is no wonder why foreign investors are drawn to Lithuania.

When can I expect to start business?

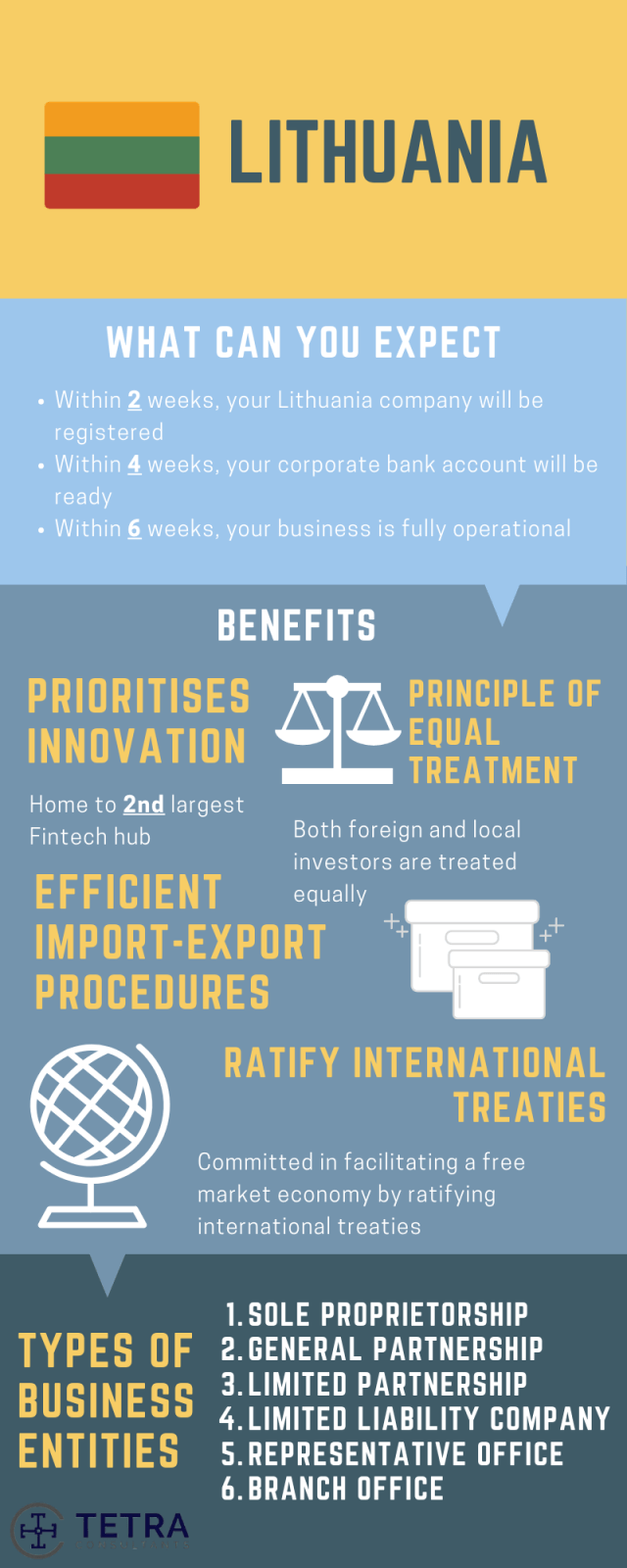

Tetra Consultants will complete the process to register company in Lithuania within 2 weeks. After receiving due diligence documents of the directors and shareholders, our team will search for the availability of your preferred company name and prepare all required incorporation documents.

Throughout the process to register company in Lithuania, you will not be required to travel overseas.

After Tetra Consultants has completed Lithuania company registration, you can expect to receive the documents of your new company including the certificate of formation, Memorandum and Articles of Association as well as register of directors and shareholders.

Within 4 weeks upon registering your Lithuania company, we will open a corporate bank account with either a local or international reputable bank.

As such, you can expect your company to be fully operational and ready for business within 6 weeks from engaging Tetra Consultants. See this webpage for a step-by-step guide on how to register company in Lithuania.

What types of companies are there?

There are many types of business structures in Lithuania. Prior to Lithuania company formation, it is important to consider various factors that include but are not limited to the availability of personal liability protection, tax ramifications, ownership and management flexibility as well as compliance requirements.

Each business entity will come with its distinctive features. Before proceeding to register the Lithuania company, Tetra Consultants will fully understand your business before recommending the most optimum business entity in Lithuania.

Some considerations we take into account include the type of business activity, tax obligations and nationalities of shareholders and directors. Tetra Consultants will also offer more information on the requirements imposed to set up these entities.

Individual Enterprise (IĮ)

- This is an entity made up of only 1 sole owner who is a natural person, similar to a sole proprietorship in other jurisdictions. There is no specified minimum initial capital amount prescribed. The owner will be held personally liable for the company, and this entity is governed under the local Civil Code.

Limited Liability Company (AB or UAB)

- The most popular corporate structure, a Lithuania limited liability company is viewed as a separate legal entity from its owner. Under which, in any event of a winding-up, you will not be personally liable for all debts and obligations incurred by your Lithuania limited liability company. Generally, there are 2 subsets within a limited liability company structure – a public limited liability company or Akcinė Bendrovė (AB) and a private limited company or Uždaroji Akcinė Bendrovė (UAB).

- A corporate vehicle for medium or large enterprises, a Lithuania public limited company can be formed with a minimum registered capital of €40,000. There are no restrictions as to the residency of the owner. However, the public limited company should form a management body of minimally 3 directors.

- Alternatively, a Lithuania private limited liability company can be formed. Similar to a public limited company, the only distinguishing property when it comes to a private limited liability company is that shares are not allowed to be listed for trading freely on the stock market.

- When establishing a Lithuania private limited liability company, a minimum requirement of €2,500 must be met in terms of registered capital. There are no restrictions as to the residency of the owner. Annual audits will only be imposed if the turnover of your private limited liability company exceeds €1.4 million.

General Partnership (TŪB)

- A general partnership in Lithuania is also known as a Tikroji ùkine bendrija (TŪB). Jointly shared between two or more partners, general partners and the business are seen as one and the same by the law. In the case of a winding up, the general partners can be personally liable for all debts and obligations incurred by the business. There is no minimum capital requirement imposed by the government. Generally, even a verbal agreement can be used to form a partnership.

- Partnerships are viewed as a separate legal entity in Lithuania and are taxed separately as the same rates as companies. To register a general partnership, it is also required that the partnership agreement is notarized. Unlike other jurisdictions, general partnerships in Lithuania are required to audit their financial statements.

Limited Partnership (KŪB)

- With shared characteristics of both a limited liability company and a general partnership, a limited partnership, also known as a Komanditiné ùkiné bendrija (KŪB), includes both the general and limited partners. General partners are owners entitled to manage the company.

- As such, general partners also bear unlimited liability for the company’s debts and obligations. Meanwhile, limited partners are not entitled to manage the company. Their liability only extends to the amount of their investment.

- Partnerships are viewed as a separate legal entity in Lithuania and are taxed separately as the same rates as companies. To register a limited partnership, it is also required that the partnership agreement is notarized. Unlike other jurisdictions, limited partnerships in Lithuania are required to audit their financial statements.

Small Partnership (MB)

- A Small Partnership, also known as a Mažasis Beisbolas (MB), can have up to 10 members but needs only 1 member to be set up. As its name suggests, it is a type of partnership for small business owners, with limited liability as the partners are not held personally liable to the company by law. There are no minimum share capital requirements prescribed by the official regulations, and instead partners determine the specific amounts to be contributed.

Branch Office

- To expand your growing business, you may consider setting up a branch office. A branch office is viewed as an extension to its foreign parent company. To set up a branch office, you will minimally require a manager who is currently residing in Lithuania. The manager or corporate agent will be representative for the branch when it comes to liaising with other external parties.

- For all liabilities incurred by your Lithuania branch office, they will be held responsible against the foreign parent company instead. The branch office is permitted to perform or conduct trade activities as per set out or predetermined by its foreign company. A branch office will have to meet a minimum paid-up capital of €1.

Representative Office

- Prior to expanding your business, you may want to explore the market in Lithuania. A representative office will allow you to test the market and promote your parent company. The exception to a representative office, you will not be permitted to operate any business or trade activities. All debts and obligations incurred by the representative office will be held liable against its parent company.

Agricultural Company (ŽŪB)

- This structure is suitable for businesses set up in the agricultural industry. A Lithuania Agricultural Company can have any number of members but at least 2 are needed to set up. There is no minimum share capital specified and members are not personally liable under the law.

How to carry out Lithuania company registration?

The key steps to Lithuania company registration are as follows:

Step 1: Choosing a suitable business structure

- There are a variety of corporate structures available in Lithuania for you to choose from. These include the Individual Enterprise (IĮ), Limited Liability Company (AB or UAB), General Partnership (TŪB), Limited Partnership (KŪB), Small Partnership (MB), Branch Office, Representative Office and Agricultural Company (ŽŪB). Foreign business owners most commonly pick the Limited Liability company due to its easy and minimal incorporation requirements and reduced liability for stakeholders.

- Tetra Consultants will first seek to fully understand your intended business goals, activities, needs and context, before recommending the most optimum structure for your company.

Step 2: Reserving the company name

- Before proceeding with Lithuania company registration, you will have to pick your preferred name for your company. Tetra Consultants will then reserve this with the Lithuania Register of Legal Entities, through the application form JAR-5. The name can be held for up to half a year and will need a reservation fee of around EUR 16.

Step 3: Preparing supporting documents required for Lithuania company registration

- Next, Tetra Consultants will assist you to prepare the necessary documents for incorporation and meet the prerequisites for registration.

- You will need a general manager for your company as well as a legal address in Lithuania. While you are not mandated to operate your business activities at that address, this requirement will persist for your registration needs. As such, Tetra Consultants will provide you with a local registered address as required for Lithuania company registration.

- You will also need to provide some necessary KYC documents before registration can be carried out. Some of these documents include the names of directors, company’s resolution and identification proof.

- We will then proceed to assist you with preparing the documents needed for incorporation, including the Article of Incorporation, Business Plan, Company Constitution and personal information of directors and shareholders. Generally, the Articles of Association will have to be translated into the Lithuanian language. As such, we will appoint a reputable translator to do so.

- Tetra Consultants will then assist you to carry out notarisation of the founding documents at the office of a registered notary, which is necessary before submitting them for official incorporation. Notarisation fees can range from EUR 70 to 290, varying according to the amount of share capital.

Step 4: Filing for registration with the Register of Legal Entities

- After the above steps have been completed, Tetra Consultants will then submit the necessary incorporation documents to the Lithuania Register of Legal Entities for processing and approval. A registration fee of around EUR 57 is needed, and the processing of your application will typically take around 3 business days.

- After receiving approval, Tetra Consultants will courier the Certificate of Incorporation, Memorandum and Articles of Association and other corporate documents to your preferred address.

- We will also assist in translating the incorporation documents into English so that you can review and verify the documents.

Step 5: Opening a corporate bank account

- After registration, Tetra Consultants will assist you in opening a corporate bank account. Our team has established partnerships with multiple reputable banks in Lithuania. We will present your business to each relationship manager and compliance team. Some of the international reputable banks we work with include Citadele Bank, Danske Bank and Nordea Bank. By engaging our services, you can leverage on our full portfolio of banking partners.

- Typically, a corporate bank account opening will take roughly 4 weeks. In most cases, the directors and shareholders are not required to travel. However, if travel is required, we will have a representative accompany you to the bank meeting. Alternatively, our team will negotiate with the banks to conduct a conference call instead or to request for a waiver.

- While nominee directors are not necessary for the setup of your company, you may still require one to set up your bank account. If necessary, we will provide you with a suitable, fit and proper nominee director.

- The bank meeting may also be conducted in Lithuanian. In such cases, our team will also send a representative to attend the meeting so that any potential communication barrier can be overcome.

- Once your account has been successfully opened, Tetra Consultants will courier the internet banking token and access codes to your preferred address.

Step 6: Staying compliant with tax and accounting requirements

- Following the setup of your new Lithuania corporate home, Tetra Consultants will continue to provide you with the necessary accounting and tax services to ensure that you can continue to legally conduct business while staying compliant with regulatory obligations.

- Once the Certificate of Incorporation has been acquired, our team will follow up in obtaining a Value Added Tax Number with the Ministry of Finance.

- Our team of dedicated consultants will timely prepare your firm’s financial statements, corporate tax returns and manage bookkeeping on your behalf.

- Generally, corporate income tax is charged at 15%.

- All financial statements have to be drafted and submitted in Lithuanian. As such, our team will review and translate your records into Lithuanian before submission.

- Our team of dedicated consultants will continue to clarify any doubts you may have with regards to your company’s obligations

Pros and cons of Lithuania company registration

Before you advance to Lithuania company registration, it is important to understand the business landscape of the jurisdiction. This is to ensure that your newly established entity will be able to safely and legally conduct business while striving toward your long-term business goals.

Political

- According to Transparency International’s Corruption Perceptions Index, Lithuania is ranked 35th among 180 countries when it comes to the degree of public sector corruption. This suggests that Lithuania is a relatively corrupt-free country.

- The 2019 elections swung in Gitanas Nausėda who Is a European Union supporter, suggesting Lithuanian shift in opinion towards European Union.

- Lithuania government is committed to facilitating a free-market economy liberal business environment through the ratification of various international treaties and enacting pro-business policies.

Economic

- According to the 2020 Index of Economic Freedom, Lithuania is ranked the 16th freest among other countries suggesting the efficiency of its policies.

- As a member of the World Trade Organisation, Lithuania is committed to working with other countries to develop its economy. This can be seen in the country’s ratification of many international treaties related to the promotion and mutual protection of investments.

- Lithuania has legislated laws to protect investors’ rights and interests. This is such that, under Lithuania’s laws, foreign investors are protected legally in the event where their rights were violated.

Social

- The official language in Lithuania is Lithuanian. However, according to the EF English Proficiency Index of 2019, Lithuania is ranked 21st among 100 countries. This suggests that while Lithuania’s official language may be Lithuanian, English is still a widely spoken language.

- According to the 2019 Crime & Safety Report published by Overseas Security Advisory Council, Lithuania is labelled moderate risk when it comes to crime threats with organised crime being the biggest threat.

- According to Eurostat, an estimated 28.3% of Lithuania’s population are at risk of poverty or social exclusion.

Technological

- A highly advanced country, to facilitate import or export procedures and facilitate faster customs clearance, Lithuania implemented the New Computerised Transit System.

- Lithuania is home to the fastest-growing startup ecosystems, clinching it a 2nd position as the largest Fintech hub in Europe.

- According to the World Bank’s 2019 Global Competitiveness Report, Lithuania is ranked the 1st in the European Union when it comes to the degree of University-business collaborations in Research & Development efforts.

Legal

- Lithuania has an extensive and robust legal framework implemented to manage investment disputes. This is such that investment disputes between foreign investors and the Republic of Lithuania are managed separately by the courts of the Republic of Lithuania, international arbitration institutions.

- Meanwhile, cross-disputes between foreign investors can be managed and directly addressed by the International Centre for Settlement of Investment Disputes.

- Lithuania practices the principle of equal treatment as established by subjected both Lithuanian and foreign investors to equal and fair business conditions accorded by the Law on Investment.

- Under Lithuania’s Law on Investments, foreign investors are equally and freely given access to all sectors of the economy except for activities in state security and defence.

Environmental

- The Lithuania government has been advancing its efforts in protecting the environment. The Environmental Impact Assessment introduced aims to provide a process that will duly check and review whether projects with significant impact on the environment are assessed before allowed.

- The Republic of Lithuania has ratified 21 multilateral environmental agreements to showcase its commitment to combatting environmental problems.

- According to the European Commission Representation in Lithuania, over 61% of Lithuanians reckoned that the growing volume of waste produced by the country is a key issue.

Looking to register company in Lithuania?

- Tetra Consultants will be your one-stop solution for Lithuania company registration. Our services include company formation, registered agent, registered address and business bank account opening.

- Contact us to find out more about how to register company in Lithuania. Our team of experts will revert within the next 24 hours.

FAQ

How much does it cost to register a company in Lithuania?

- The engagement fee depends on the services you require from Tetra Consultants. Prior to each engagement, our team will fully understand your business needs and inform you of the exact services you require.

- Tetra Consultants’ fees include government fees such as business name reservation charges, company registration fees and tax registration costs.

How do I register a company in Lithuania?

- To register a company in Lithuania, we have simplified the process as follows: 1.) Select a Suitable Business Structure; 2.) Reservation of Your Company Name; 3.) Preparation of Supporting Documents; 4.) Filing for registration with the Register of Legal Entities; 5.) Opening a Corporate Bank Account; 6.) Compliance with Government Tax and Accounting Requirements.

- Throughout these processes, Tetra Consultants will guide you through each step–making this arduous process hassle-free for you!

Can a foreigner start a business in Lithuania?

- Yes! As long as they meet the minimum legal requirements, a foreigner can register their company in Lithuania.

What is the best business to start in Lithuania?

- The best business to start in Lithuania is subject to the nature of what you envision your company to be. However, Tetra Consultants will advise you with the optimum business entities that your company can embody, as to maximize the potential of your business..