Register company in Dubai

To register company in Dubai is hassle-free if you know-how. With Tetra Consultants at the wheel, you will be able to dedicate your time and resources to other more important business channels.

With our lean-and-mean mentality, you can rely on our team of experts to provide you a seamless experience throughout the whole process of your business registration in Dubai. Our ultimate goal is for your company in Dubai to be operationally ready within the stipulated time frame.

Our service package includes everything you will require to set up business in Dubai:

- Offshore company registration in Dubai with Registrar of Companies

- Registered agent and registered address

- Corporate bank account opening

- Annual accounting and tax services

How long to register company in Dubai and open a corporate bank account?

- Prior to the start of the engagement, it is essential for you to understand the process of offshore company registration in UAE (United Arab Emirates). There are many different types of entities and our team of experts will explain which suits your business best.

- Tetra Consultants will complete the process to register company in Dubai within 3 weeks. After receiving the required due diligence documents of the directors and shareholders, Tetra Consultants will search for the availability of your preferred company name and prepare the required incorporation documents.

- Throughout the setup process, you will not be required to travel to Dubai.

- After Tetra Consultants has set up your Dubai offshore company, you can expect to receive the documents of your new company including certificate of formation, memorandum & articles of association as well as the register of directors and shareholders.

- Within 4 weeks upon company registration, Tetra Consultants will open a corporate bank account either a local or international reputable bank.

- Consequently, you can expect your company to be fully operational and be able to issue invoices within 7 weeks upon engaging Tetra Consultants.

- If you are keen to know more about setting up a business in Dubai, Tetra Consultants has prepared a step-by-step explanation of all steps required.

What is an Offshore Company in UAE?

An offshore company is an entity that is legally registered outside the country where your main business operation is conducted. For example, if you are a foreigner registering a company in UAE, this entity will be known as a UAE offshore company as you are not physically present in the UAE. Most UAE offshore companies are not allowed to conduct business within the UAE.

The United Arab Emirates is one of the most popular jurisdictions for foreign investors to set up offshore entities. This is due to the ease of doing business as well as the attractive tax regime. From 1st December 2020, UAE has abolished the requirement for companies to have Emirati shareholders, allowing 100% ownership for foreign investors.

Popular among many entrepreneurs, Dubai offshore business setup allows foreign entrepreneurs to enjoy tax efficiency and cost-effectiveness. With this corporate structure, foreign entrepreneurs can venture into the Middle East without administrative obligations. In essence, it is a wholly-owned limited liability company that is exempted from tax and any annual accounting filings.

This business structure is commonly used among business owners to engage in international trading, real estate as well as registering copyright and patents.

Types of Dubai Offshore Companies to consider when registering company in Dubai

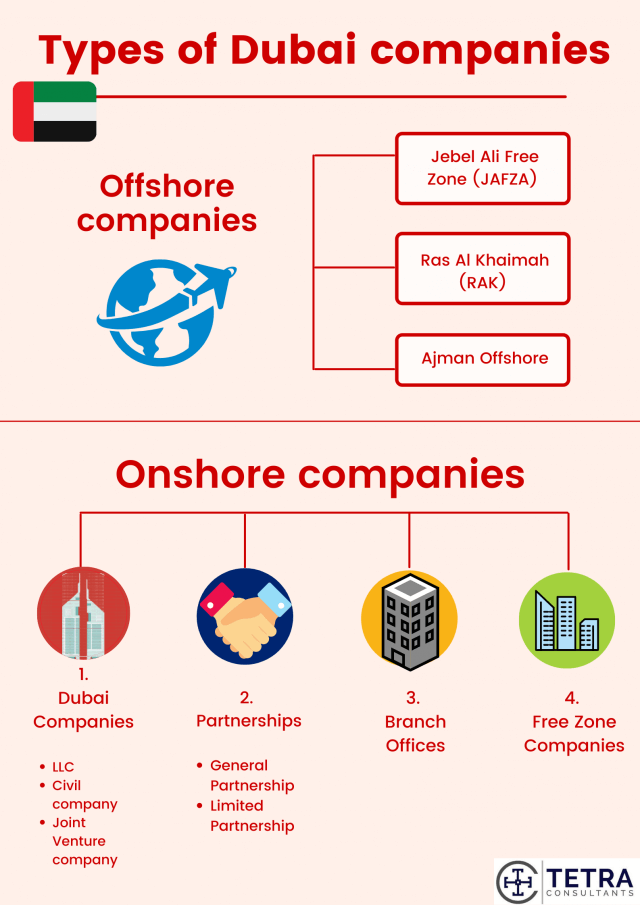

Before you proceed to register company in Dubai, it is essential to understand the different types available. The three main jurisdictions are the Ras Al Khaimah (RAK), Jebel Ali Free Zone (JAFZA) and Ajman Offshore. With the promise of being a tax-free jurisdiction, companies are not subjected to any income tax or corporate tax and can enjoy 100% foreign ownership.

Jebel Ali Free Zone (JAFZA) Offshore Company

- A Jebel Ali Free Zone (JAFZA) offshore company can be set up with minimal requirements. You are required to appoint one director and one shareholder of any nationalities. In addition, there are no minimum capital requirements register company in Dubai JAFZA and you are allowed to open a local UAE corporate bank account.

- If you are familiar with offshore structures, a JAFZA offshore company is the equivalent of an International Business Company (IBC) in the British Virgin Islands (BVI) or the Cayman Islands.

- With its origins as early as 1985, the Jebel Ali Free Zone (JAFZA) is an industrial area surrounding one of the world’s biggest shipping ports. International companies located there can benefit from residing in a free zone.

- Jebel Ali is located at a strategic location as it is near Abu Dhabi, which is the capital of the UAE. Al Maktoum International Airport, which was opened on 27 June 2010, allows access to both freight and passenger traffic.

- Registering a JAFZA offshore company in Dubai is one of the most popular options when setting up business in the UAE. Jebel Ali offshore company formation allows 100% foreign ownership, exemption from import duties, exemption from corporate taxes and 100% repatriation of capital and profits.

- According to Jafza Offshore Companies Regulations 2018, a JAFZA offshore company is prohibited from carrying out these activities: insurance, banking, financial, media, publishing, advertising, movie production, gambling, casino, real estate, military and education.

- Tetra Consultants will provide the full-service package of JAZA offshore company formation including registered agent, registered address and business bank account opening.

Ras Al Khaimah (RAK) Offshore Company

- Known for its highest level of industrialization in the UAE, Ras Al Khaimah (RAK) is reputed for a business-friendly investment environment and low costs. A RAK offshore company requires only one shareholder and one director. No minimum share capital is required to register company in Dubai RAK and you are allowed to open a business bank account with a local UAE bank.

- RAK offshore company formation also comes with a multitude of benefits. While offshore companies are generally prohibited from conducting business with a UAE resident, an exception is made in this case. A RAK offshore company can hold the shares of both free zone and onshore companies.

- The RAK offshore authority is also known as RAK International Corporate Centre (RAK ICC). It is a Corporate Registry operating in Ras Al Khaimah, United Arab Emirates. This entity is regulated under Ras Al Khaimah Free Trade Zone Authority International Companies Regulations 2006.

- Tetra Consultants will be your one-stop solution for you to register company in Dubai RAK. Our services include company formation within the mainland as well as within the free zones in Dubai, registered agent, registered address and business bank account opening.

Which structure should you choose to register company in Dubai?

- When determining between the jurisdictions, it is important to consider several factors.

- If you are looking for a cost-efficient business setup in Dubai, Tetra Consultants will recommend you consider RAK offshore incorporation.

- In the event you are planning to expand your trade business internationally or own a property in Dubai, you may wish to consider incorporating a JAFZA offshore company.

Benefits of choosing to register company in Dubai

- There are plenty of benefits of setting up an offshore company in Dubai. Despite having zero corporate taxes, Dubai is not labelled as a tax haven unlike Cayman Islands or British Virgin Islands. By setting up a Dubai offshore company, you are able to open corporate bank accounts with reputable international banks. This will increase the trust given by your customers and suppliers.

- The stable and business-friendly legal system that Dubai houses are something you can expect to benefit from. By registering an offshore company in Dubai, you will have access to a flexible regulatory regime that would also mean that conducting business operations can be made easier.

- Additionally, Dubai is also home to many Intellectual Property laws that will serve as tools to protect your assets. With tax neutrality on international earnings and access to global funding, doing business through this offshore entity can also mean reaping greater financial rewards.

- Although, one thing to note, setting up an offshore business in Dubai will not entitle you to carry any business activities with a UAE resident or within the physical premises of the UAE. Thus, if you are looking to expand into the UAE, a Dubai offshore company may not be the one.

Offshore Company vs Free Zone Company

- With many similar benefits, a Dubai offshore company is often mistaken as a Dubai Free Zone Company.

- Foreign ownership is not a problem with either of the company. With 100% foreign ownership, both Dubai offshore and Dubai Free Zone companies can be owned by a foreigner without association to a local contact. Despite its similarities, there are still some distinct differences that you have to consider before setting up either of which.

- Free Zones in Dubai are primarily created to attract companies who are in the business of trade and export. On the other hand, an offshore company is used as holding companies or asset companies for other organizations. While it continues to enjoy ownership benefits that a Free Zone company gets as well, it is not a direct substitute.

- The biggest distinction comes in anonymity. An offshore company’s details are kept anonymous and cannot be found on the Public Record. Yet, a Free Zone company’s information is available upon request. The Dubai offshore company can open a bank account in Dubai and invest internationally, it can also purchase land in Dubai. Unlike a Dubai Free Zone company, no minimum capital threshold is expected of an offshore company.

- Nonetheless, both business entities do come with their limitations. While an offshore company cannot rent any physical office space in the UAE, a Free Zone company is not allowed to trade directly with the UAE local market.

- A Free Zone company can only undertake local businesses through locally appointed distributors. Yet, businessmen opening offshore companies are not granted with a residency visa. This may make traveling in and out of the UAE troublesome.

Types of Dubai Onshore Companies to consider for registering company in Dubai

- Dubai is home to a myriad of business forms that include companies, partnerships, branch offices and free zone companies. Before the start of the engagement, Tetra Consultants will fully understand your business before recommending the most optimum business entity in Dubai.

- Some considerations we take into account include the type of business activity, tax obligations and nationalities of shareholders and directors. Our consultants will also offer more information on the requirements imposed to set up these entities.

#1: Dubai Companies

Limited Liability Company (LLC)

- For a Dubai Limited Liability Company (LLC), directors will not be personally liable for any debts or obligations incurred by the business. They will only be liable up to a specified amount of liability insurance declared. Dubai LLCs provide different classes of members that come with specific rights, powers and duties.

- The requirements to set up a limited liability company in Dubai differ when registering in Dubai vis-à-vis in one of its free zones. If registered in Dubai, the company must have at least two shareholders and at least one if set up in a Dubai free zone.

- A Dubai LLC is not mandated to have a minimum amount of share capital, while in a free zone, this would depend on its respective authority. In both Dubai and the free zone, a registered address and a local bank account are required. Tetra Consultants can assist you in obtaining a local registered agent and setting up a local bank account.

Civil Company

- Promising greater liberty, a Dubai civil company offers 100% foreign ownership and full access to UAE’s local market. However, this also involves unlimited liability – whereby, investors can be personally liable.

- As an association, Dubai civil companies are established wherein professionals agree to carry out professional activities and be liable to third parties against payment of consideration.

- To set up a Dubai civil company, a Dubai Local Service Agent is required. However, these agents do not hold a stake in your company and primarily function to liaise with relevant governmental departments on your behalf.

- A super-quick and easy setup, the formation of a Dubai civil company also costs relatively low and does not require the payment of an upfront share capital. Unlike many other business forms, the civil company allows you to enjoy 100% foreign ownership.

Joint Venture Company

- With a Dubai joint venture company, foreign entrepreneurs can continually benefit from the association with a local company. Setting up a joint venture company also offers the same benefits as a limited liability company.

- To set up a Dubai joint venture, a local partner who holds 51% of the shares is required. Both parties have to register the agreement with the Department of Economic Development.

- While the structural differences between a joint venture company and a limited liability company may be minimal, you should still look out for several factors. When it comes to setting up a joint venture in Dubai, a license is not required. This makes setting up simpler. While there is a mandatory requirement in terms of local equity participation, profit and loss distribution can still be prescribed.

- In general, if you are collaborating on specific projects to opt for a joint venture company instead, Tetra Consultants recommends you to opt for a Dubai joint venture company instead.

#2: Partnerships

General Partnership

- Owned by two or more partners, a Dubai General Partnership does not extend limited liability. While the partners bear unlimited liability, they also enjoy the entirety of its profits. It is also a relationship that involves the management participation of all partners. However, unlike other business forms, this type of company can only be opened by UAE nationals and are not applicable to foreign investors.

Limited Partnership

- A separate legal entity, a Dubai Limited Partnership includes general partners as well as limited partners. General partners are distinguished from limited partners based on their liability to the debts and obligations of the company.

- A general partner remains fully liable while a limited partner is only liable up to a specified amount of liability insurance declared as well as their own wrongful acts. A limited partner typically holds no management participation benefit in the company.

- Contrastingly, only UAE nationals are allowed to be general partners. This holds a stark difference to many other countries.

#3: Branch Offices

- A Dubai branch office allows foreign entrepreneurs to own a licensed organization in another emerging economy. This new entity will still be fully owned by the parent company and will continue to operate under the same registered name and business activity.

- However, a Dubai branch is permitted to operate other additional activities for the sole purpose of marketing the organization’s main products and services.

- To set up a Dubai branch office, a national service agent is required. The agent can be an individual or a company, who will assist with the setup but will not own any rights to the company. The agent, however, has to be of UAE nationality.

- If you are looking to expand into the Middle East with the same product line, Tetra Consultants recommends you consider setting up a Dubai branch instead. This enables you to work with 100% foreign ownership, unlike other business entities.

#4: Free Zone Companies

- Establishing a business in the Dubai Free Zones is attractive to many businessmen. Dubai Free Zone companies are not subjected to any foreign ownership restrictions. They are also largely governed by an independent Free Zone Authority.

- One misconception to note is that a Free Zone company does not belong to the same umbrella consisting of offshore companies. While they do share many similar structural functions, they also have distinctive characteristics.

- Dubai Free Zone company formation allows you to 100% foreign ownership, repatriation of capital and profits without being subjected to corporate or personal income tax as well as the absence of currency restrictions. Even so, shareholders, directors and employees can still continue to benefit from residency visas given out.

- To register a Dubai Free Zone company, there must be two or more shareholders. A detailed business plan might be requested. If necessary, Tetra Consultants will assist you in developing the business plan. Upon company formation in Dubai, operating license and leasing agreements have to be prepared.

- If you are looking to sell products in the UAE, this business form might not be suitable. This is so as a UAE official agent will be necessary for the future to help you gain an operating business license in Dubai. Alternatively, you may have to set up a joint venture. This may lead to additional expenses incurred.

How to register a company in Dubai?

In order to register your business in Dubai, you must follow these steps:

Step 1: Choosing a suitable business structure

- The Dubai government offers various forms of business structures including the following:

-

- Sole Proprietorship

-

- Partnership

-

- Limited Liability Company

-

- Free Zone Company

-

- Offshore Company

-

- Branch Office

-

- Representative Office

-

- Others

- Our team at Tetra Consultants will first understand your business model, requirements, and objectives before recommending a suitable business structure for you.

Step 2: Meeting all the pre-registration requirements

- Tetra Consultants will check for the availability of your preferred business name and reserve the same with the Dubai Department of Economic Development (DED).

- We will then inform you about the documents you will be required to prepare and help you do the same. Some of these documents include the following:

-

- Article of Incorporation

-

- Proof of address

-

- Financial statements, if required

-

- Personal information of directors and shareholders

Step 3: Registering your business

- Once all the pre-registration steps are completed, Tetra Consultants will submit the documents along with the application form to the Dubai Department of Economic Development (DED).

- Once the DED grants the approval, we will collect the Certificate of Incorporation, Memorandum and Articles of Association, and other incorporation documents on your behalf and then courier it to your preferred address.

Step 4: Opening a corporate bank account

- Tetra Consultants will leverage our extensive banking network to open a corporate bank account for your newly incorporated business.

Step 5: Meeting all the post-registration requirements

- Tetra Consultants will obtain a suitable business license for your business, depending on your business activities and location.

- We will also register your business with the Federal Authority to obtain a VAT number which is needed to conduct business in Dubai.

- Moreover, if needed, we will also apply for suitable work visas.

Step 6: Staying Compliant

- After the incorporation process, Tetra Consultants will continue to ensure that your business remains compliant with the government regulations.

- We will assist you in preparing financial statements, filing for tax returns, and more in a timely manner.

Why register company in Dubai?

A gateway to the Middle Eastern and North African countries, many business owners choose to proceed with company formation in Dubai. Its growing economy, strong infrastructure and low tax rates have attracted many to set up business in Dubai. If you are similarly looking to expand into Dubai, you came to the right place. Besides the economic benefits, you can also enjoy a wide variety of other benefits.

Before you proceed with Dubai company registration, it is important to understand the business landscape of the jurisdiction. This is to ensure that your newly established entity will be able to safely and legally conduct business while striving towards your long-term business goals.

Political reasons to register company in Dubai

- With a strong political climate, Dubai is also home to a business-friendly government that welcomes and promotes business development.

- According to the 2018 IMD Dubai Competitiveness Report, Dubai is ranked 7th in global efficiency and tax system. This means that based on economic performance, the efficiency of the business environment and infrastructure, Dubai has succeeded in many countries such as Singapore, Switzerland and all European Union countries except Iceland.

- According to the leading anti-corruption group, Transparency International, Dubai has been criticized as a “money laundering paradise”. Its lax restrictions have also led to its present reputation with money laundering.

Economic reasons

- Companies registered in Dubai are not subjected to income or corporate tax if structured properly. With no trade barrier quotas or foreign exchange controls imposed, profits earned may be repatriated. This makes Dubai attractive to many investors.

- Known for its abundance of oil, Dubai companies can benefit from the access to government-subsidized low-cost energy sources. As such, the cost of production is comparably lower to other countries. If you operate an energy-intensive business, Tetra Consultants recommends you to consider setting up their corporate homes in Dubai to enjoy greater monetary benefits.

- If you are looking to register a Dubai limited liability company, you may not be exempted from tax payment.

- External support is mandated to validate your business. This includes additional filing from your home country that will possibly require more resources – time and money.

Social

- Committed to maintaining a safe city, Dubai is known for its low crime rate and enhanced security system. This makes doing business in Dubai safe.

- Classified as the number one country with the best quality of life in the Middle East, investors can also benefit from a high quality of life and living conditions.

- If you are looking for a residency visa, incorporating in Dubai will earn you a UAE Residency Visa. This allows expatriates to lease apartments, own properties and travel freely within the UAE.

Technology

- Ranked 27th in the Digital Competitiveness Ranking, Dubai company registration allows you to enjoy a strong physical technological infrastructure.

Legal

- With a target of topping the World Bank’s annual ease of doing business ranking in 2021, the UAE is working on a series of reforms currently. This includes adopting measures to improve legislation.

- Free zones made available by Dubai are increasingly popular for its tax-free and low-cost benefits. However, each zone operates on different rules and regulations. As such, when deciding to operate in the free zone, it is also important to get acquainted with the respective rules. This could be complex if you are looking to operate in multiple free zones.

- Dubai’s free zone laws can be complicated. Particularly, companies are not allowed to establish a branch office in the free zone. As such, if you are looking to promote your parent company and affiliate a local business to it, you may have to rethink about your Dubai corporate home.

Environmental

- Fueled primarily on oil, Dubai is otherwise known as the world’s most improbable green city. However, this has started to change since 2006 – with the beginnings of a new housing development (Sustainable City) that recycles and produces more energy than it consumes.

- Driverless metro trains can also be found in the city, making significant reductions in its environmental footprint.

Find out more about how to register company in Dubai

Contact us to find out more about how to register company in Dubai. Our team of experts will revert within the next 24 hours.

FAQ

Can an offshore company buy property in Dubai?

- Yes, JAFZA and RAKA offshore companies are allowed to buy properties in Dubai. However, you are required to meet certain requirements.

How can I register my offshore company in Dubai?

- See this webpage to find out more about the process.

What business activities are allowed in Dubai?

- In general, Dubai welcomes a myriad of business activities to its shore. Nonetheless, with standards of legislation and local customs that are based on Islamic laws, there are some exceptions to the case. The activities which are prohibited or restricted can be divided into several categories – food, gambling, goods and services as well as illegal trade and activities.

How much does it cost to register a company in Dubai?

- This depends on the exact services required from Tetra Consultants. Our fees are inclusive of government fees and all fees will be clearly stated in our engagement letter prior to the start of the engagement. Tetra Consultants believes in transparency with our valued clients and there are no hidden fees.

How long do I have to wait to start operations with my Dubai offshore company?

- On average, it will take 3 weeks to complete company formation and another 4 weeks for corporate bank account opening.

Do I have to travel to Dubai to register company in Dubai and open corporate bank account?

- No travel is required. Tetra Consultants will complete the company incorporation remotely, without the need to travel.

Can I obtain UAE residency visa by registering a Dubai offshore company?

- Unfortunately, you are required to register a UAE free zone company or onshore company.

Can my Dubai offshore company sign lease agreements for an office space?

- No, you are not allowed to do so.