Money Exchange License in UAE

- The United Arab Emirates (UAE) has become one of the leading financial hubs of the Middle East. It offers a strong and controlled environment for businesses handling currency exchange and remittance services. Getting a Money Exchange License in the UAE enables investors and business owners to legally participate in money transfer, currency exchange, and other financial transactions under the supervision of the Central Bank of the UAE (CBUAE). Furthermore, the percentage of individuals opting to register company in Dubai has also increased. The increasing expat population of the UAE, and its role as a worldwide business center, has led to an increase in demand for licensed money exchange companies. However, in order to operate in this sector, companies will have to fulfill strict compliance regulations. This guide outlines everything that you need to understand about the Money Exchange License in UAE, and how Tetra Consultants can help you with the application process and obtaining this license.

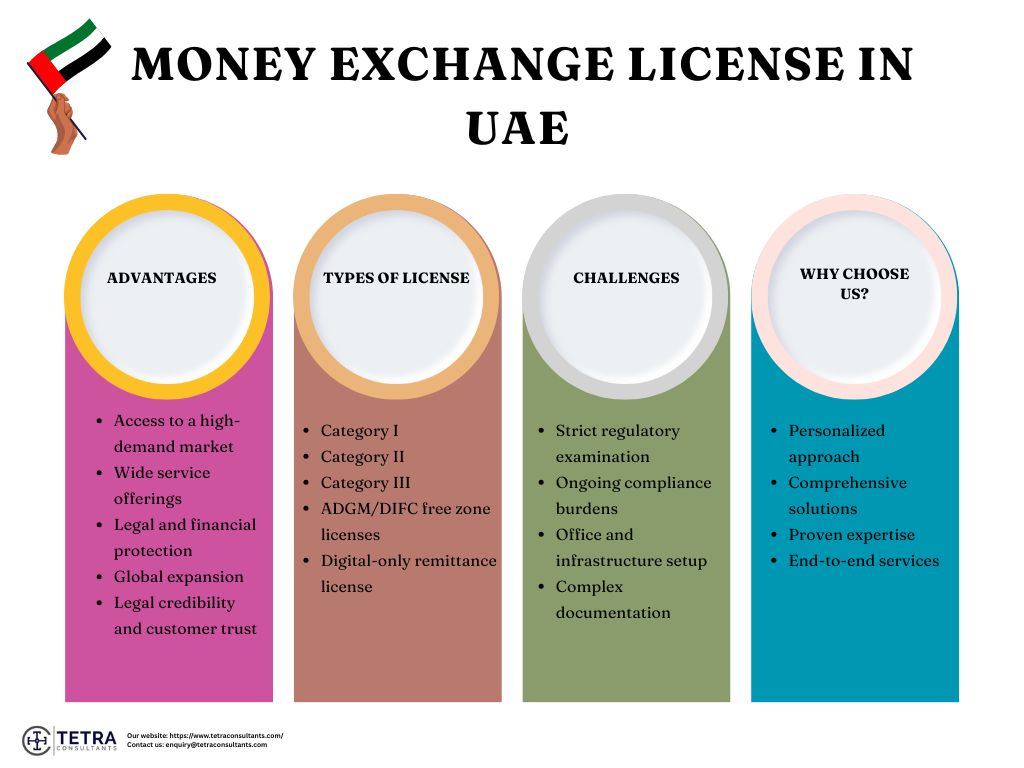

Advantages of the Money Exchange License in UAE

- The Money Exchange License in UAE offers regulated businesses with major advantages such as:

Access to a high-demand market

- UAE has a large expatriate population along with a robust tourism sector, and a pivotal geographic role, which makes it a popular currency exchange hub. This has resulted in strong and ongoing demand for licensed money exchange services.

Wide service offerings

- A money exchange license allows a business to legally offer a variety of services that go beyond the currency exchange. This consists of cross-border remittances, payment of wages through the medium of the wage protection system, and, with correct licensing, you can also issue prepaid cards.

Legal and financial protection

- Operating a business with a valid license reduces legal risks, offers protection against strict regulatory penalties, and also ensures the continuity of a business. Whereas when a business operates without any license, it leads to account freezes, heavy fines, and business closures.

Legal credibility and customer trust

- If a business has a UAE-issued license, it shows compliance with strict regulatory as well as anti-money laundering requirements, which makes the business credible and trustworthy to customers, international partners, and financial institutions.

Global expansion

- With legal access to global financial markets, license holders actually benefit from a rise in business opportunities, a competitive reputation, as well as the ability to form strategic international partnerships, especially as the UAE continues to liberalize ownership rules and encourage foreign investment.

Types of Money Exchange License in UAE

- The UAE provides multiple types of money exchange licenses; each license allows specific services and is controlled by different authorities. These are the three main categories under the Central Bank of the UAE:

Central bank mainland license categories

- Category I- This is for foreign currency exchange services only.

- Category II- This license category is for both foreign currency exchange and remittance, which is a money transfer service.

- Category III- This category is foreign currency exchange, remittance, and wage payment, which is linked to the UAE wage protection system.

Digital-only and free zone licenses

- ADGM/DIFC free zone licenses- This license is for those companies that are based in Abu Dhabi Global Market or Dubai International Financial Centre, which allows flexible licensing for fintech and traditional remittance models. These models usually have lower capital thresholds and with the regulatory sandbox access.

- Digital-only remittance license- This license grants permission for online remittance businesses with 100% foreign ownership and no physical outlets. Digital-only licenses are subject to advanced e-KYC and AML requirements.

Costs and timeline for getting the Money Exchange License in UAE

- Within 2 weeks of getting all the necessary due diligence documents, Tetra Consultants will proceed to register your company, and our team will provide company secretary and local registered address services. Once you travel to Dubai, our team will help you get a visa and an Emirates ID within another 2 weeks. During this duration, Tetra Consultants will also prepare all the AML/CFT documentation, get a local office, a local director, and an AML/CFT compliance office as per the requirements of the Central Bank. Once this step is completed, our team will submit a money exchange license application to the Central Bank of the UAE. The regulatory review and approval procedure usually takes approximately 9 to 12 months. After you get your Emirates ID, Tetra Consultants will help in opening a UAE corporate bank account within the following 4 weeks, during which your physical presence will be needed in Dubai to complete onboarding.

- The costs of getting a Money Exchange License in UAE, can differ based on your business model and the services you require. At Tetra Consultants, we have a transparent and upfront pricing policy. Our team will clearly explain to you the fee structure during the initial consultation. There are no hidden charges or unexpected costs, so you are able to prepare your budget accordingly.

Regulatory authority for the Money Exchange License in UAE

- The regulatory authority responsible for the Money Exchange License in UAE is the Central Bank of the UAE (CBUAE). This body is responsible for issuing licenses, supervising compliance, setting up operating standards, implementing anti-money laundering (AML) and counter-terrorism financing (CFT) regulations, conducting ongoing inspections, and lastly ensuring that only credible as well as financially stable companies operate in this sector. All applicants will have to go through strict due diligence, fit and proper checks, and follow compliance requirements as per the Decretal Federal Law No. (14) of 2018, along with the CBUAE’s specific exchange business regulations.

- The free zone entities, such as DIFC and ADGM, are governed by the Dubai Financial Services Authority (DFSA) or the Abu Dhabi Global Market’s Financial Services Regulatory Authority (FSRA), respectively. However, retail currency exchange and money transfer businesses still require CBUAE oversight. Lastly, all the statutory requirements, minimum capital requirements, and fit and proper tests are implemented by the Central Bank.

Activities allowed under the Money Exchange License in UAE

- The activities permitted under a Money Exchange License in UAE are clearly defined by the Central Bank. A licensed money exchange company can conduct these activities:

Remittance services

- Businesses can execute local international money transfer, which also consists of person-to-person or business-to-business transfer of funds.

Cash handling and settlement

- Businesses can participate in secure handling, processing, and settlement of cash as part of their main exchange and remittance activities.

Wage payment services

- Businesses can disburse employee salaries under the Wage Protection System of the UAE. This activity is permitted under Category C or full-service licenses.

Currency exchange

- Purchasing and selling foreign currencies for businesses and individuals.

Issuance of stored value and prepaid cards

- This activity is subject to the approval of the Central Bank. Money exchange companies in the UAE, upon getting approval, can also provide prepaid card solutions to their customers.

Other services

- On getting prior approval from the regulatory authority, some businesses can also provide limited payment products or collaborate with payment services providers to offer additional solutions.

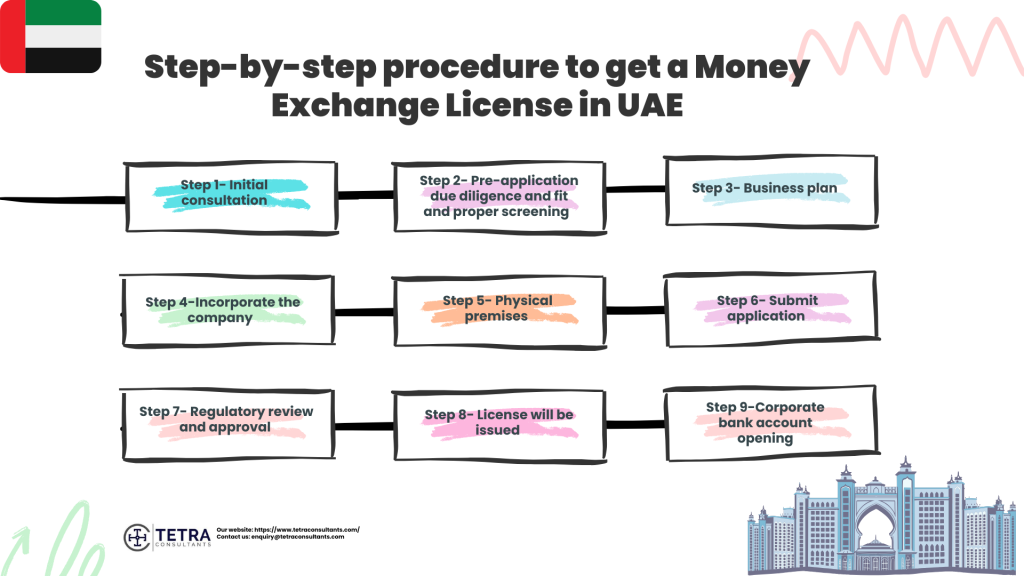

Step-by-step procedure to get a Money Exchange License in UAE

Step 1- Initial consultation

- Tetra Consultants conducts an initial consultation, in which we evaluate your business model and determine which category of Central Bank license is the best fit as per your plan.

Step 2- Pre-application due diligence and fit and proper screening

- To get a Money Exchange license in UAE, business owners, directors, and senior managers will have to get a “fit and proper” check. At Tetra Consultants, we prepare a precise “fit and proper” list of documents that will be needed by the Central Bank. Our team also advises on the composition of the board and senior management composition in order to meet Central Bank expectations.

Step 3- Business plan

- The Central Bank needs a detailed business plan and evidence of robust governance, risk management, internal controls, and AML/CFT controls as part of the license submission. Our team drafts a detailed business plan, AML/CFT policies, organizational chart, and roles and responsibilities.

Step 4- Incorporate the company

- Tetra Consultants will now incorporate a company for your business. Our team will prepare and file the incorporation documents with the appropriate UAE authority.

Step 5- Physical premises

- A registered physical office is needed to get full approval from the CBUAE. Our team will help you to locate a physical office and prepare lease agreements and supporting documents for submission.

Step 6- Submit application

- Our team will then prepare and submit your license application, along with a list of supporting documents, to the CBUAE.

Step 7- Regulatory review and approval

- The Central Bank will conduct an effective review of your documents, along with your business plan and financial standing. Tetra Consultants will address any additional queries to ensure that there are no delays.

Step 8- License will be issued

- Once everything gets approved, the Central Bank will issue a Money Exchange License in UAE, which will allow your business to participate in exchange and remittance activities.

Step 9- Corporate bank account opening

- After getting the Money Exchange License in UAE, Tetra Consultants will help you with corporate bank account opening, which is a mandatory step.

Documents required for the Money Exchange License in UAE

- A detailed business plan that outlines the range of your services, along with an operational plan, market analysis, and AML/CFT framework

- Clean criminal record certificates of all shareholders, key personnel, and directors

- Audited or certified financial statements showcasing strong financial standing

- An organizational chart that details reporting lines, segregation of duties, and compliance roles

- Certificate bank statement showing that the required capital is deposited in a UAE bank (AED 2 million for FX, AED 5 million for FX+ remittance, and AED 10 million for full services exchange)

- Notarized passport copies, CVs, and proof of residency status of shareholders and directors

- Fit and proper declarations of senior management and control persons

- Proof of office lease

- IT infrastructure plan for monitoring transactions, data protection, customer onboarding, and cybersecurity

- Written AML/CFT, KYC, risk management, and business continuity manuals and frameworks

- Proof of payment of the Central Bank and licensing fees

- Declaration of ultimate beneficial ownership (UBO)

- Application form of the Central Bank

- Board resolutions and shareholder agreements

- Letter of undertaking/guarantee for ongoing compliance and capital maintenance

Requirements for the Money Exchange License in UAE

- Capital should be deposited in a local UAE bank, and a proof of supply to the Central Bank during licensing

- Minimum paid-up capital is between AED 2 million to AED 10 million, on the basis of category.

- AED 2 million for exchange businesses that deal with currency only that is Category III

- AED 5 million for exchange businesses to provide remittance services which is Category II

- AED 10 million is for companies, providing both services, which also includes the Wage Protection System (WPS) and comes under Category I

- The minimum paid-up capital for a digital-only remittance license is AED 25 million

- A physical office in the UAE is mandatory

- Businesses should have a local director and a local AML/CFT officer

Common challenges and how we can help

- Common challenges in getting a Money Exchange License in UAE are:

Strict regulatory examination

- The CBUAE conducts thorough background checks, and fit-and-proper evaluations on shareholders and main employees. The regulatory body also reviews AML/CFT policies, which further delays the approval of the license. Our team at Tetra Consultants helps you with preparing strong AML/CFT policies based on your business model to ensure that they easily pass the strict checks conducted by CBUAE.

Ongoing compliance burdens

- Businesses find it difficult to fulfill post-licensing obligations, which consist of regular AML reporting, audits, maintaining capital adequacy, as well as periodic inspections. This raises a need for continuous compliance efforts. At Tetra Consultants, we provide regulatory compliance consulting services to ensure that your business easily survives in the complicated regulatory framework of the UAE.

Office and infrastructure setup

- Offshore businesses find it tough to establish compliant, secure office premises, internal controls, and IT systems that meet the Central Bank standards, which is a resource-intensive and time-consuming task. At Tetra Consultants, our team will help you with office leasing and ensure that it meets all the regulatory standards.

Complex documentation

- Applicants will have to prepare a detailed business plan, IT infrastructure plans, proof of capital deposit, detailed ownership and management structures, and AML policies. Most of the time, it gets very difficult for applicants to prepare these documents, which leads to delays. At Tetra Consultants, our team prepares all the necessary documents to ensure that there are no barriers to your application process.

How can Tetra Consultants help with the Money Exchange License in UAE?

- Getting a Money Exchange License in UAE is a difficult process that needs an effective understanding of local rules and regulations, financial compliance, as well as Central Bank guidelines. At Tetra Consultants, our team provides end-to-end services to make sure that your licensing journey is easy, transparent, and efficient. Here is why our clients choose us:

- Personalized approach– We understand that the business model of every client is unique, and we provide personalized strategies to easily align with your business objectives.

- Proven expertise– Our global experience in financial licensing enables us to easily navigate through the complex UAE regulatory frameworks.

- Comprehensive solutions– From company incorporation to advisory, our team will handle all your business aspects under one roof.

Looking to obtain a Money Exchange License in UAE

- Setting up a Money Exchange License in UAE provides major potential for growth, considering the booming financial sector of the country. However, the procedure of getting this license is difficult and requires a detailed understanding of the standards set up by the Central Bank. This is where Tetra Consultants comes in; our team will streamline this entire process and focus on what truly matters.

- Contact us, and our team will get back to you in 24 hours.

FAQs

What is a money exchange license in UAE?

Is a physical office needed to apply for this license?

Can foreign applicants apply for this license in UAE?

Does this license permit digital or online remittance services?