UAE Money Services Provider License

- The UAE Money Services Provider License has become one of the most sought-after financial licenses for businesses wanting to work in the dynamic financial ecosystem of the region. Over the years, the UAE has established itself as a global financial hub, providing robust infrastructure, favorable regulatory frameworks, and a supportive business environment. To open a business in UAE, you have to register company in Dubai. For businesses involved in currency exchange, payment processing, money remittance, and similar services, getting this license is important in order to operate legally and securely in the country.

- At Tetra Consultants, we help our international and local clients in applying for a money services provider license in UAE, while also ensuring full compliance with the money services provider regulation in UAE. Our team will handle every stage of the licensing process, from preparing documents and communicating with the regulatory authorities to post-licensing compliance, enabling you to focus on building your business.

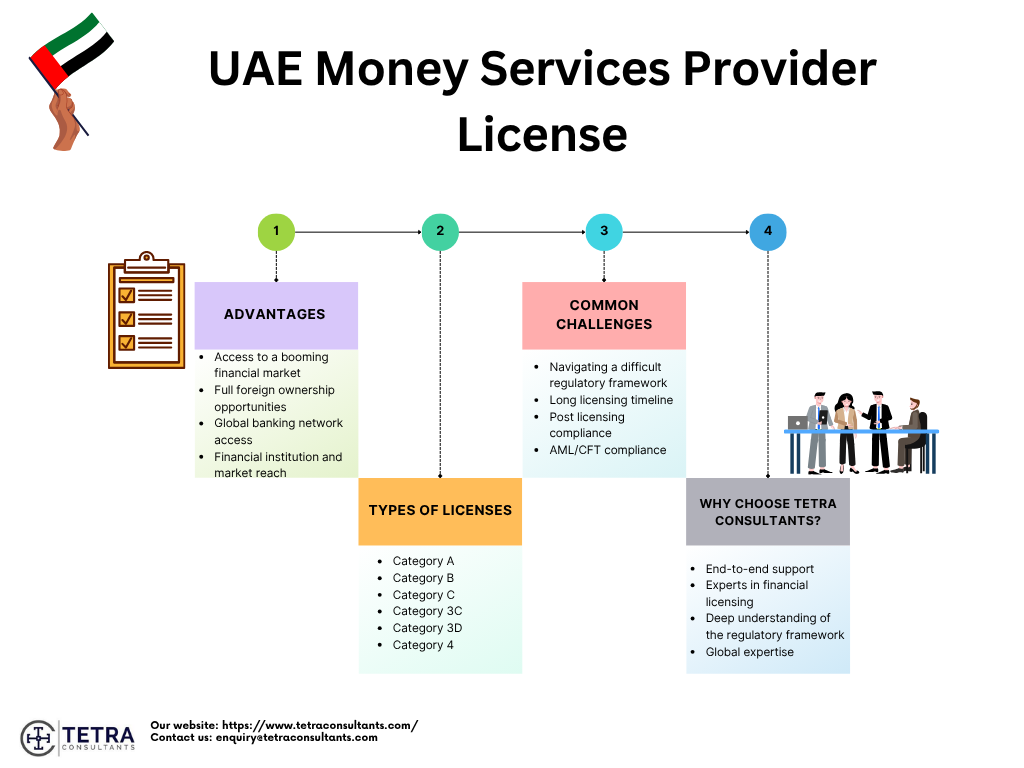

Advantages of the UAE Money Services Provider License

- The UAE Money Services Provider License provides multiple benefits that make the UAE an attractive choice for financial institutions and investors:

Access to a booming financial market

- If you are holding an MSB license, then you can easily operate in the rapidly growing fintech sector of Dubai. The strategic location and advanced financial infrastructure acts as positive points which will help you to easily expand your services and customer base in this region.

Full foreign ownership opportunities

- There are specific license set-ups within the Dubai International Financial Center (DIFC) free zone, which provide 100% foreign ownership. You do not need a local sponsor; this option provides you with flexibility and helps you attract international business investors.

Global banking network access

- If you are a licensed Money Services Provider (MSP), then you can easily connect with international banks. This will help you to facilitate cross-border transactions and expand global business opportunities.

Financial institution and market reach

- In Dubai, Money Services Providers usually serve underserved population groups, which consist of expatriates and businesses that require money transfer, fostering inclusion, as well as meeting the demands of the markets effectively. This is done by offering convenient, fast, and cost-effective services.

Regulatory credibility

- The credibility of a business is improved if it is licensed by regulatory bodies like the Central Bank of the UAE (CBUAE) or the Dubai Financial Services Authority (DFSA). Licensing helps to reassure clients and partners regarding the compliance of a business with anti-money laundering and know your customer regulations.

Types of UAE Money Services Provider License

- The UAE provides multiple types of Money Services Provider (MSP) licenses, mainly categorized under the regulatory frameworks of the Central Bank of the UAE (CBUAE), as well as the financial free zones like the Dubai International Financial Center (DIFC) as well as Abu Dhabi Global Market (ADGM). MSPs are structured in order to accommodate different levels of financial activities, operational models, and capital requirements.

UAE license categories:

- Under the Central Bank of the UAE, money exchange and remittance businesses are mainly classified into the three main categories on the basis of permitted activities:

- Category A- This category permits only foreign currency exchange services. This license is best for businesses that are mainly focused on currency conversion without any remittance or wage payment functions.

- Category B- This license allows foreign currency exchange as well as remittance operations. This allows for cross-border money transfers and is best for firms providing both exchange and money transfer services.

- Category C- This is one of the most comprehensive license categories, which covers foreign currency exchange, wage payments through the Wage Protection System (WPS), and remittance operations. This category is recommended to those businesses that want to establish a full operational scope in the UAE.

DIFC and ADGM licensing frameworks

- The financial free zones are regulated by the Dubai Financial Services Authority (DFSA), and the Financial Services Regulatory Authority (FSRA) of ADGM.

- Category 3C (DIFC/ADGM)- This category covers issuing stored value such as prepaid cards, e-money, as well as related digital wallet services. The minimum capital requirement for this category is $500,000 based on the combination of services.

- Category 3D (DIFC)- This category is for those businesses that provide or operate payment accounts, execute payment transactions, and issue payment instruments. The minimum capital requirement for this category is $200,000.

- Category 4 (DIFC)- This license permits arranging or advising on money services and offers money transmission services such as transferring funds without creating an account. The minimum capital requirement for this category is $140,000.

Costs and timeline for getting the UAE Money Services Provider License

- Once engaged, Tetra Consultants will conduct an initial consultation to determine the most suitable license type and legal structure based on your business model and UAE laws. We will also provide advice on compliance, governance, and regulatory expectations.

- At the same time, we will prepare a business plan and all AML/CFT documents, in line with CBUAE’s requirements. We will also assist you with sourcing local office, recruitment of local director, local AML/CFT officer, etc.

- Once above is completed, our team will submit a quality money services provider license application to CBUAE.

- Once the authorities complete their review, we will assist in obtaining final approvals and register your Dubai company.

- After your company is incorporated in the UAE, Tetra Consultants will then proceed to get your visa and Emirates ID, within 2 weeks of your arrival in Dubai. After getting your Emirates ID, our team will then help you open a corporate bank account, which usually takes an additional 4 weeks and needs your physical presence in Dubai. The complete process to get a UAE Money Services Provider License consists of regulatory submission, compliance reviews, and approval from the CBUAE, and usually takes around 3 to 5 months, depending on your business model as well as the timeline of regulatory.

- At Tetra Consultants, we have a transparent fee structure; the overall cost of getting a UAE Money Services Provider License is based on multiple factors. This consists of the choice of your jurisdiction (mainland, ADGM, or DIFC), the type of license, and if you require post-licensing services. During the initial consultation, our team communicates all the costs to you so that you know exactly what you are paying for.

Regulatory authority for the UAE Money Services Provider License

The regulatory authority for the UAE Money Services Provider (MSP) license is based on where the business is established, whether it is located on the mainland or within the financial free zones.

Mainland UAE

- The Central Bank of the United Arab Emirates (CBUAE) is the main regulatory that governs the licensing, supervision, and governance of the Money Services Providers (MSPs), and Payment Services Providers (PSPs) working on the mainland.

- The CBUAE enforces compliance along with the Federal Decree Law No. 14 of 2018, as well as related payment system regulations. It is mandatory for applicants to submit the detailed, financial, operational, and AML/CTF compliance documentation to the Licensing Division of the CBUAE.

Dubai International Financial Center (DIFC)

- For entities operating within the DIFC, regulation is controlled by the Dubai Financial Services Authority (DFSA). The DFSA is responsible for overseeing all the financial and ancillary services, which include money transmission, stored value issuance, as well as payment account operation. License categories also consist of Category 3C, 3D, and 4 based on the range of services. Furthermore, the DFSA also requires firms to get authorization under the DFSA rulebook, which ensures that AML/KYC, conduct, and prudential compliance.

Abu Dhabi Global Market (ADGM)

- Within the ADGM, licensing and supervision fall under the Financial Services Regulatory Authority (FSRA). The FSRA issues the Category 3C Money Services Business License, and covers payment instruments, stored value issuance, money transmission, as well as payment account operations. Firms will have to meet the minimum base capital requirement, which usually starts from USD 250,000 and AML/CTF obligations, and register with the UAE goAML platform for suspicious transaction reporting.

Activities allowed under the UAE Money Services Provider License

Mainland UAE

- Foreign currency exchange– Purchasing and selling foreign currencies, in branches and through digital channels.

- Wage protection system (WPS) operations– This includes disbursement of salaries to private sector employees through the authorized payment systems.

- Remittance services– This includes domestic as well as cross-border funds transfers through physical outlets and online platforms.

- Digital-only remittance services– This category was launched recently in 2025, which allows fintech companies to provide cross-border remittances completely, without any physical branches. Digital license holders can easily:

- Conduct cross-border remittance services through apps or online platforms

- Implement electronic KYC (e-KYC) and digital AML/CTF monitoring systems

- Offer foreign exchange as well as payment aggregation for customers

- However, digital license holders cannot issue wallets and payment accounts, or offer B2B treasury or merchant POS services without any separate authorization under the Stored Value Facility or PSP regulations.

DIFC (Dubai Financial Services Authority – DFSA)

- Operating or providing payment account- License holders are allowed to create and maintain accounts for executing transactions.

- Issuing stored value- License holders can engage in prepaid cards, e-money vouchers, and e-wallets.

- Issuing payment instruments– Cards, vouchers, and other instruments that initiate payments.

- Executing payment transaction– License holders can perform domestic and international transfers for clients.

- Arranging or advising on money services– License holders can act as intermediaries between service providers and clients or offer payment-related counseling services.

Step-by-step procedure to get the UAE Money Services Provider License

Step 1- Initial consultation

- Our team conducts an initial consultation to evaluate if your business model is qualified for a UAE Money Services Provider License. Tetra Consultants also helps to select the best jurisdiction for your business based on the activity. Our team will also provide advice on compliance, governance, and regulatory expectations.

Step 2- Prepare business plan and documents

- Tetra Consultants then creates a detailed business plan that outlines all the activities of your business, financial projections, and all AML/CFT documents in line with CBUAE’s requirements.

Step 3- Secure office

- Tetra Consultants help you lease physical premises based on the regulatory requirements. We will also assist you with the recruitment of a local director and a local AML/CFT officer.

Step 4- Minimum capital

- Based on the type of your license category and jurisdiction, Tetra Consultants helps you to figure out your minimum capital requirement. After submitting the capital, our team helps you get the bank confirmation statement.

Step 5- Submit license application

- Tetra Consultants then submits your detailed business license application, AML/CTF policies, and proof of capital to the CBUAE.

Step 6- Regulatory review

- The regulator now reviews the business license application, schedules an interview with the main personnel, and may request further documentation. Our team communicates directly with the regulator and provides you with information to ensure that we are all on the same page.

Step 7- In-principle approval

- After your application gets approval, you will get an in-principle approval that is subject to conditions.

Step 8- Establish a legal entity and name

- Our team then sets up a company and finalizes the legal structure (LLC for mainland, or a free zone entity for DIFC/ADGM) for your business. Tetra Consultants will register the business name while also ensuring that it fulfills all the local naming regulations.

Step 9- License is issued

- After getting the approval, the regulator issues the Money Services Provider License. Tetra Consultants help in filing regular reports and maintaining ongoing compliance to ensure that your business survives in the strict regulatory environment of UAE.

Step 10- Corporate bank account opening

- At Tetra Consultants, we provide corporate bank account opening services. Our team helps you open a bank account in a UAE bank.

Documents required for the UAE Money Services Provider License

- A letter of intent (LOI) or inquiry form that outlines the type of business, license category, corporate structure, and shareholder details

- An organizational structure chart showcases management hierarchy

- AML/CTF policies and procedures, which include KYC, monitoring transactions, and suspicious activity reporting

- Copies of incorporation certificates, Articles of Association, shareholder agreements, and leasing agreements for office premises

- Application fee payment evidence that confirms payment to the DFSA

- Contracts or agreements with the outsourced service providers, if applicable

- Regulatory business plan, which explains the business model, target markets, risk management and compliance frameworks, governance, finances, and internal controls

- Descriptions along with background checks of keyword personnel

- Financial projections and audited statements for existing firms

- Evidence of minimum capital

- Corporate governance documentation, such as internal control frameworks and compliance oversight mechanisms

- License application forms

Requirements for the UAE Money Services Provider License

Legal entity and license

- Applicants should be a legally incorporated company established in the UAE or a free zone (DIFC, ADGM)

- Entities in free zones are allowed to have 100% foreign ownership, but mainland entities will need a local sponsor for specific license categories.

- It is mandatory for businesses to apply under the appropriate licensing categories, like Category A, B, or C by CBUAE, or Category 3C, 3D, or 4 by DFSA.

Compliance and governance

- Businesses will have to comply with the AML, CTF, and KYC regulations, and also establish robust risk management protocols, compliance frameworks, along with strong cybersecurity measures.

- Directors, beneficial owners, and senior management will have to go through fit and proper tests. Furthermore, businesses should have a local compliance officer, a director, and an AML/CFT officer is mandatory.

Documentation and reporting

- Businesses should submit detailed application forms, corporate documents such as Memorandum and Articles of Association, business plans, compliance policies, organizational charts, and shareholders’ information.

- Lastly, regular reporting and transaction monitoring are compulsory in order to track any suspicious activity.

Capital requirements

- Central bank licenses have paid-up capital requirements from AED 2 million to AED 10 million based on the category of your license.

- DIFC license capital usually ranges from USD 140,000 to USD 500,000 on the basis of the scope. While the ADGM requires a minimum capital that typically starts at USD 250,000.

- Capital should be deposited in the UAE bank, and evidence should be provided.

Common challenges and how we can help

Navigating a difficult regulatory framework

- The money services provider regulation UAE has set out detailed rules on licensing, risk management, and AML/CFT obligations. Several foreign investors or new entrants find it difficult to understand and apply these regulations effectively, especially given regular updates issued by the Central Bank of the UAE.

- Our regulatory experts at Tetra Consultants conduct a detailed, comprehensive assessment of your business model in order to ensure it aligns with the money services provider regulation UAE.

Long licensing timeline

- The approval procedure for the UAE Money Services Provider License is long and usually takes months or a year. The timeline of this license can also be expanded if there are any errors in the submitted documents. Furthermore, delays are usually caused by unclear documentation and incomplete applications. At Tetra Consultants, our team maintains direct communication with the CBUAE officials, making sure that your application is on time and accurate. Our team also evaluates all your documents before submitting them to avoid any errors, which will further delay this process.

Post licensing compliance

- Once the license is issued, businesses will now have to follow the ongoing compliance requirements, like annual audits and transaction reports, along with renewal submissions. Non-compliance with the regulations will lead to fines or even suspicion. At Tetra Consultants, we offer regulatory compliance consulting services. Our team ensures that all your business matters are fulfilled under the Money Services Provider Regulation UAE. Furthermore, we ensure that your business is aligned with the ongoing amendments in the financial laws of the UAE.

AML/CFT compliance

- It is mandatory for financial service businesses in the UAE to have strong anti-money laundering (AML), and counter-financial terrorism (CFT) systems. Businesses that are applying for an MSP License UAE should hire a compliance officer, implement transaction monitoring systems, and regularly file for any suspicious transactions. At Tetra Consultants, our team helps in creating and implementing strong AML/CFT policies, along with risk-based frameworks, that are fully aligned with the Central Bank requirements of the UAE.

How can Tetra Consultants help with the UAE Money Services Provider License?

- Applying for the UAE Money Services Provider License is a difficult and time-consuming process. The financial landscape of the UAE has become more regulated under the Money Services Provider Regulation UAE, and this is why Tetra Consultants are here. At Tetra Consultations, we offer a wide range of services in order to help businesses apply for a Money Services Provider License in UAE. Here is why businesses choose us:

- End-to-end support- Our team handles all aspects of the licensing process, from preparing business plans and collecting documents to submitting the application.

- Experts in financial licensing- Our team is an expert in getting financial and all the payment-related licenses for various clients located across Singapore, Mauritius, Labuan, and the UAE.

- Deep understanding of the regulatory framework– Our team is an expert in understanding the financial regulatory environment of the UAE. This helps us to prepare applications that fulfill the present standards and reduces the risk of delays.

- Global expertise– Our team has worked in more than 50 jurisdictions, which allows us to bring our best practices to your MSP license UAE application.

Looking to obtain the UAE Money Services Provider License

- Getting the UAE Money Services Provider License is a significant step for any business that wants to establish itself in the growth-oriented economy of the UAE. The financial landscape of the UAE is secure and supports local and foreign entrepreneurs, which has led to a rise in money services providers. However, the licensing procedure to get a UAE Money Services Provider License is difficult to navigate. At Tetra Consultants, we simplify this difficult journey. Our team helps you get this license and ensures that there are no delays in the application process.

- Contact us, and our team will get back to you in 24 hours.

FAQs

Can a foreign investor apply for this license?

Can I operate across different Emirates with this license?

What is the minimum capital requirement for this license?

Who requires a UAE Money Services Provider License?