Compliance officer services for Labuan Money Broking License

- Labuan Money Broking License compliance officer services are essential to guarantee that money broking operators stay within an established regulatory framework by Labuan Financial Services Authority (Labuan FSA). Among the five new money brokers that received licensing in 2024, the environment appears to grow in dynamism, as exhibited in the Labuan IBFC Market Report 2024. Moreover, companies incorporated and licensed with an entity in Labuan, located and connected to a strong economy that invests nearly half of the total financing volume of 47% into manufacturing, property and financial services industries.

- With Tetra Consultants, you will find it easy to get a Labuan Money Broking License as we will help you to register company in Labuan and have you complaint with all regulatory demands as stated in the law. We will have experienced compliance officer services to meet those obligations and ensure you automated continuous compliance with regulated AML/CFT standards and regulatory filings. Tetra Consultants is positioned to assist your business maximize the potential for sustained growth in this thriving financial ecosystem, empowering you with regulatory assurance.

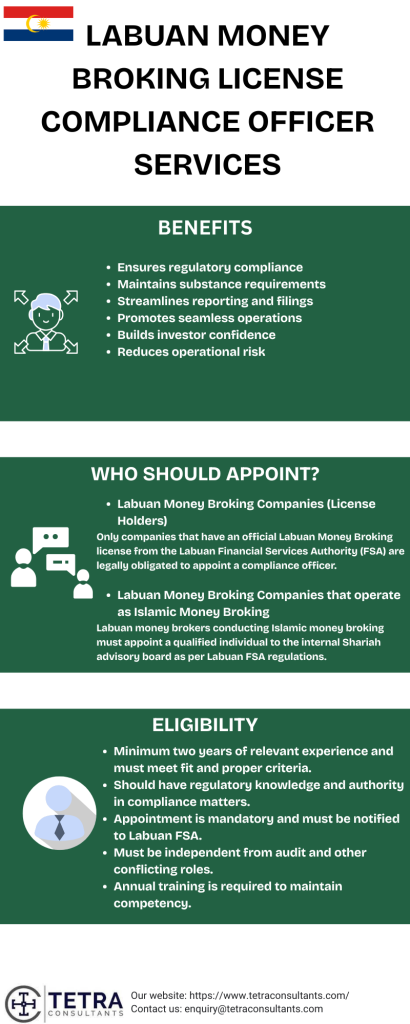

Benefits of Labuan Money Broking License compliance officer services

Ensures regulatory compliance

- The compliance officer will be responsible for ensuring the licensed money broking firm remains complaint with all Labuan Financial Service Authority (FSA) regulations including Anti-Money Laundering/Combating Financing of Terrorism (AML/CFT) requirements, thus avoiding any fines or license suspension.

Maintains substance requirements

- The compliance officer will be responsible for assisting the business in maintaining its substance requirements. This includes maintaining a registered office for the company, employing a minimum of two full-time local employees, and maintaining a minimum spend on mandatory local operating expenditures as is required under the Labuan Business Activity Tax Act to keep the tax incentives and the validity of the license.

Streamlines reporting and filings

- The compliance officer will be responsible for the many regulatory reports the company is required to produce each quarter, and to file the annual audited financial statements as well as other filings required by the Labuan FSA. This will include ensuring that everything is submitted in a timely manner and avoiding penalties or revocation from the Labuan FSA.

Promotes seamless operations

- A local compliance officer also promotes seamless communication with Labuan regulatory authorities and local stakeholders. This can ensure any ongoing updates or inspections from regulators or stakeholders are carried out as efficiently as possible.

Builds investor confidence

- A compliance officer demonstrates strong governance and operational integrity, instilling greater belief and trust in vested counterparties, potential investors, and financial institutions around the world, with Labuan as a registered offshore financial center.

Reduces operational risk

- Even though compliance officers manage the compliance program/plan, they also manage the internal controls and look out for any compliance risks. This ensures that any risks of non-compliance are identified and resolved early, maintaining the license and the image of the corporation in global competition.

Who should appoint Labuan Money Broking License compliance officer services?

Labuan Money Broking Companies (License Holders):

- Only companies that have an official Labuan Money Broking license from the Labuan Financial Services Authority (FSA) are legally obligated to appoint a compliance officer. This is part of the regulatory and operational obligations for the Labuan Money Broking License. The compliance officer is responsible for compliance with all regulatory obligations and AML/CFT requirements.

Labuan Money Broking Companies that operate as Islamic Money Broking:

- In addition to a compliance officer, Labuan money brokers conducting Islamic money broking activities will need to appoint an eligible person on the internal Shariah advisory board in accordance with Labuan FSA regulations.

Eligibility for Labuan Money Broking License compliance officer services

- A compliance officer must have at least two years of relevant financial experience, preferably in money broking or financial institution experience.

- Required to be a fit and proper person under Labuan Financial Services Authority (FSA) guidelines, which include good probity, personal integrity, competence, and financial soundness.

- Compliance officers must have sufficient knowledge, skill and experience to properly fulfil compliance responsibilities, understanding the business and regulatory environment.

- Should have sufficient seniority and authority to influence decisions regarding compliance and AML/CFT issues in the company.

- Legally, must be appointed and notified to the Labuan FSA by using the appropriate forms and formats according to regulatory requirements.

- The compliance officer may be simultaneously assigned in an AML/CFT compliance role, but subject to fulfilling all the regulatory and functional roles, while remaining independent of any internal audit responsibilities.

- If the compliance officer has any other job responsibilities, their ability to give adequate time and attention to the compliance role must not be affected, and independence in the role must be preserved.

- Appointment for compliance officer is only mandated for Labuan Money Broking License holders in accordance with Labuan FSA statutory obligations.

- Compliance officers must keep their knowledge up to date through relevant training at least once a year to remain competent and effective in their role.

Labuan Money Broking License compliance officer assistance

- All of our compliance officers are Certified Anti-Money Laundering Specialists (CAMS) and Certified Financial Crime Compliance practitioners, with a minimum of 5 years of practical experience in the financial services sector. Our officers have extensive technical knowledge of Labuan’s regulatory regime, including the Labuan Financial Services and Securities Act 2010 (LFSSA), the AML/CFT Guidelines issued by the Labuan FSA, and any applicable requirements pertaining to money broking activities.

- We will help ensure your Money Broking business in Labuan is fully compliant by establishing sound AML/CFT systems, managing regulatory reporting and liaising with the Labuan FSA, and ensuring you are managing the compliance function with professionals that have the highest commitment to upholding the regulatory integrity.

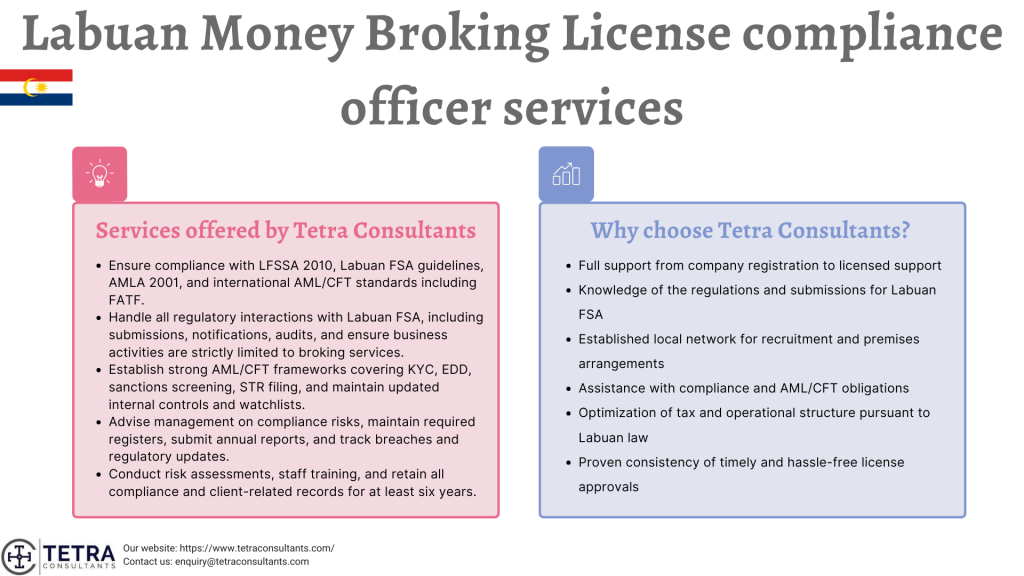

Services offered by Tetra Consultants Labuan Money Broking License compliance officer

- Ensure compliance with:

- LFSSA 2010

- Labuan FSA Guidelines on Money Broking Business

- Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act (AMLA), 2001

- Liaise with Labuan FSA for:

- Regulatory submissions (annual returns, license renewals, etc.)

- Notifications of material changes (directors, shareholders, business scope)

- Inspections, audits, inquire

- Ensure that the business activities are limited to broking services (i.e. arranging or coordinating trades between clients in the foreign exchange or money markets) and do not involve taking a principal position

- Robustly develop, implement, and maintain comprehensive AML/CFT policy and internal controls, with reference to:

- Labuan FSA’s AML Guidelines

- BNM’s relevant AML/CFT notices

- Monitor, oversee Customer Due Diligence (CDD/KYC), EDD and Ongoing Monitoring of clients.

- Carry out sanctions screening (UN, OFAC, EU) and maintain current watchlists.

- Report Suspicious Transaction Reports (STRs) to the Financial Intelligence and Enforcement Department (FIED) at BNM, through the appointed Money Laundering Reporting Officer (MLRO) (can be same person as CO).

- Provide written advice to the Board and Senior Management on compliance and regulatory risks.

- Maintain a compliance monitoring plan and report regularly to evaluate the effectiveness of internal systems and controls.

- Report on breaches of compliance with the policies, steps taken to address breaches and on regulatory developments.

- Prepare and submit on an annual basis:

- Annual compliance report to Labuan FSA.

- Any ad-hoc filings or notices (e.g. change of UBO, compliance incidents).

- Maintain compliance registers, including:

- Breach register.

- Training records.

- Regulatory correspondence.

- Conduct Risk Assessment:

- Enterprise-wide AML risk assessment (at least annually).

- Client-level / transaction-level risk assessment.

- Review internal processes regarding compliance with business continuity, outsourcing, and governance policies.

- Design and deliver AML/CFT and regulatory compliance training programs to all staff.

- Keep training records and evaluate effectiveness.

- Ensure all records are kept relating to:

- Client KYC/CDD.

- Transaction logs.

- STRs.

- Internal compliance decisions.

- Training and audits are kept for at least 6 years (Labuan FSA maintain).

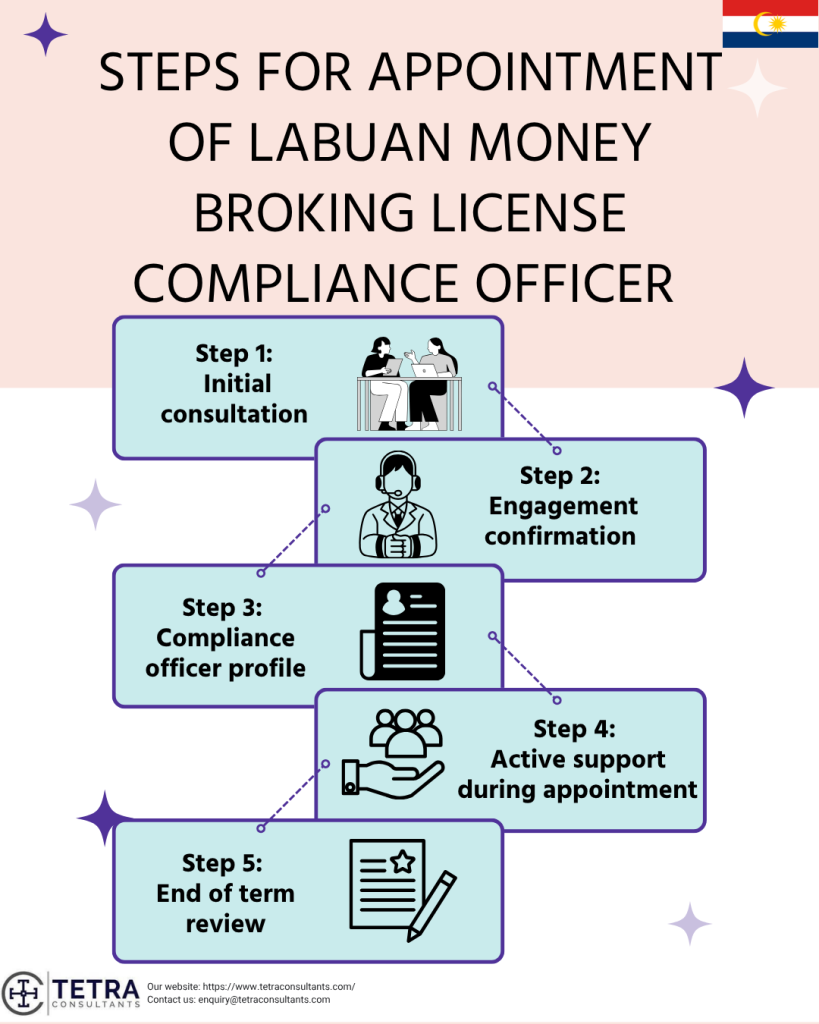

Steps for appointment of Labuan Money Broking License compliance officer

Step 1: Initial consultation

- We start with a consultation to understand your business structure, regulatory obligations under the Labuan Financial Services and Securities Act 2010, and the scope of support you want from the compliance officer. The compliance officer’s goal is to review your business model, internal policies, and reporting needs to align compliance engagement with your requirements.

Step 2: Engagement confirmation

- When we agree on the job scope and responsibilities, we will issue an appointment letter and services invoice. In the appointment letter, we will outline the duties of the compliance officer, the length of the engagement and deliverables for your engagement. This is to ensure a clear, mutual understanding in relation to the compliance engagement.

Step 3: Compliance officer profile

- Once confirmed, we will send you the professional profile (CV) of the proposed compliance officer. This is to allow you to understand their qualifications, certification (e.g. CAMS), and the relevant experience in overseeing AML/CFT compliance and working with Labuan financial regulations. You can request a short meeting with the compliance officer prior to formal confirmation.

Step 4: Active support during appointment

- Throughout the engagement, your compliance officer shall assist you with the risk-based AML/CFT framework implementing Labuan FSA requirements. We will continue to be a source of support whether remotely or in person through meetings, regulatory filings and audits, and as your business matures and your compliance obligations change.

Step 5: End of term review

- As we approach the end of the engagement term, we will complete a review of your overall compliance performance with regulations and with expectations. This is when you will decide to renew the appointment, revise scope, or go in-house for the compliance resources if you so choose.

Cost for Labuan Money Broking License compliance officer services

- When you hire a compliance officer for your Labuan Money Broking License with Tetra Consultants, it is key to have a full understanding of the services provided over the whole engagement. We can offer complete transparency starting from your initial consultation and through post licensing compliance support, to prevent surprises at any point in the process.

- Our compliance officers will provide advisory support tailored to your operations and associated with Labuan FSA regulations, provide support on day-to-day AML/CFT matters, advise you of current regulatory matters, and provide ongoing support for your internal compliance framework.

- We engage with your team to ensure compliance and audit readiness at all times. Each stage of the engagement is clearly defined so you can proceed with confidence knowing your regulatory obligations are with capable and experienced hands.

Why choose Tetra Consultants?

- There are many benefits in selecting Tetra Consultants for Labuan Money Broking License compliance officer services, including expertise, experience, and service level. Tetra Consultants is a one-stop shop from company registration in Labuan to obtaining the Labuan Money Broking License, help with corporate bank account opening, recruitment of qualified staff, and assistance with any economic substance requirements. Tetra Consultants has experienced staff and understands the unique complexities regarding regulatory processes in Labuan, to assist clients with navigating licensing processes in a smooth and efficient manner.

- Tetra Consultants keeps current and close communications with Labuan FSA, and manages the documents, compliance filings, and regulatory notifications, making certain that the business is operating at all times, avoiding all delays, frustrated communications, and compliance issues surrounding non-compliance. Tetra Consultants’ local presence and network allows them to recruit suitably qualified local staff to carry out the operations and opening of offices, both of which are important to meet the local substance rules.

- Tetra Consultants also provides compliance officer services customized for clients and engaging the clients in positive ways to help the client conform to its AML/CFT obligations while optimizing business optimization under Labuan’s favorable terms. Tetra Consultants provides expert advice to ensure compliance with usages of license conditions, and to keep the company in compliant standing continuously.

- Tetra Consultants is known for its end-to-end support, regulatory understanding, and ability to help clients navigate Labuan’s growing financial ecosystem with confidence.

- Full support from company registration to licensed support

- Knowledge of the regulations and submissions for Labuan FSA

- Established local network for recruitment and premises arrangements

- Assistance with compliance and AML/CFT obligations

- Optimization of tax and operational structure pursuant to Labuan law

- Proven consistency of timely and hassle-free license approvals

Looking to appoint Labuan Money Broking License compliance officer

- The Labuan Money Broking License compliance officer services are essential to ensure that licensed entities continue to meet the regulatory obligations as prescribed by the Labuan Financial Services Authority. A compliance officer is fundamental to monitoring and verifying compliance against the license conditions, including AML/CFT obligations, regulatory filings, and the substance requirement. By appointing a seasoned compliance officer, Tetra Consultants can not only ensure the Labuan Money Broking License is consistently maintained, but also support engagement with the regulator, device institutional integrity, and regulatory compliance consulting.

- With a strong compliance culture, companies can feel confident in taking advantage of Labuan’s robust financial ecosystem and pro-business regulatory environment as part of a sustainable growth approach. Ultimately, the compliance officer services are essential to protect the company’s reputation, manage regulatory risks, and harness business opportunities within Labuan’s vibrant offshore financial center.

- Contact us to know more about Labuan Money Broking License compliance officer services and we will revert in 24 hours.

FAQs

What does a compliance officer for the Labuan Money Broking License do?

Who must appoint a compliance officer?

What qualifications must compliance officers have?

Can the compliance officer function be outsourced?

What are the main compliance areas the compliance officer will be covering?

What are the benefits to the company of designating a compliance officer?

Is there ongoing training for compliance officers?

Accounting & Tax

Company Incorporation

Employment Pass

New Economic Substance

Compliance Officer Services

Credit Token Business License

Cryptocurrency Exchange License

Fund Management License

Insurance Broker License

Investment Bank License

Payment System Operator License

Money Broking License

Securities License