Labuan Credit Token Business License

- The Labuan Credit Token Business is gaining steady popularity. This has led to a rise of Labuan Credit Token Business License. Over the past few years, as digital finance continues to grow, Labuan has become a preferred jurisdiction for fintech business owners wanting to issue credit tokens, this has led to more and more people opting to register company in Labuan. This license is governed by the Labuan Financial Services Authority (Labuan FSA), and allows businesses to issue tokens that represent credit, debt, and financial obligations. This regulatory structure offers clarity, credibility, and legal recognition for tokenized lending, credit issuance, as well as blockchain-based debt instruments without making any compromises on tax efficiency and international reputation.

- A Labuan Credit Token License enables the issuance of credit tokens to borrowers or even investors. These tokens showcase digital debt obligations, peer-to-peer lending, microloans, and other credit-based instruments. Operators can issue, trade, redeem, and even manage these tokens in adherence with the Labuan FSA’s guidelines.

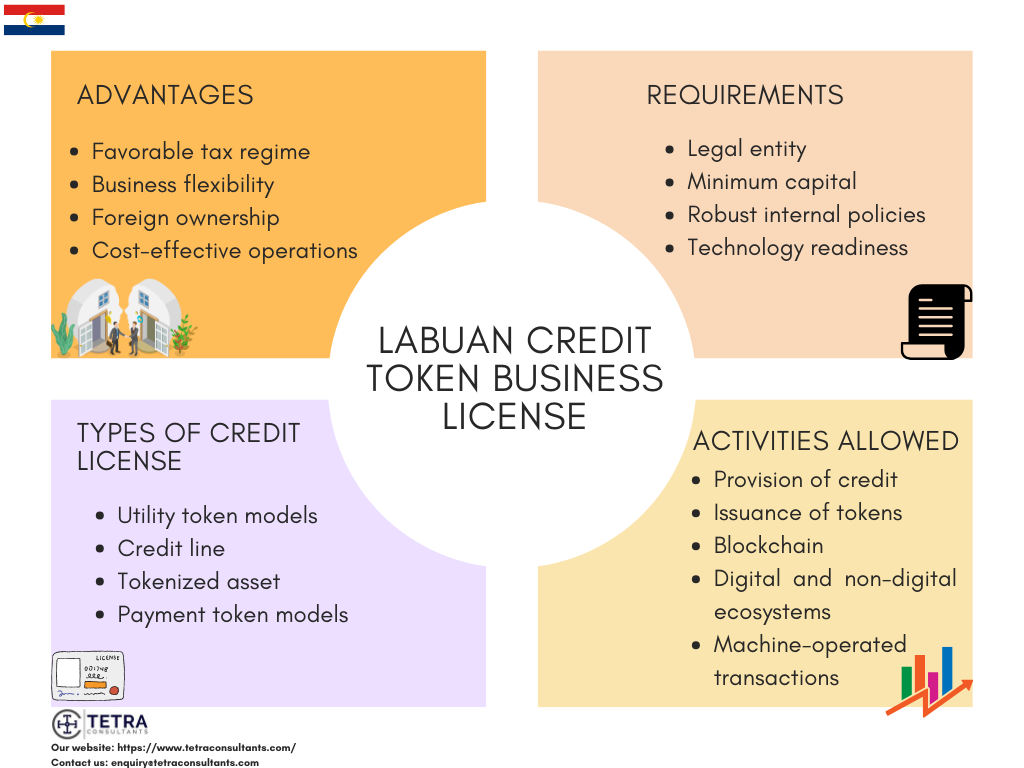

Advantages of obtaining a Labuan Credit Token Business

- Establishing a Labuan Credit Token license provides several benefits, especially for companies operating in the space of digital finance and blockchain sectors. Here are some of the main advantages of a Labuan Credit Token Business:

Favourable tax regime

- Only 3% of the corporate tax is levied on trading profits, which makes it highly attractive when compared to other jurisdictions. There are no taxes on capital gains or even on inheritance, which further reduces the tax burden. The tax exemptions also help businesses to minimize their operational costs.

Business flexibility

- Companies can also transact in various currencies without any restrictions, which facilitates international operations. Tokens can also be used for real estate investments, goods and services, and more. However, it is a given that these tokens are not used in-game currencies or cryptocurrencies.

Foreign ownership

- Foreign investors can now fully own a Labuan Credit Token Business without any need for a local Malaysian partner, thus providing greater control and flexibility.

Cost-effective operations

- In Labuan, licensing and operational costs are affordable when compared to those of other financial centres. A two-year, renewable multiple-entry working visa is easily available for foreign staff and directors.

Timeline to get the Labuan Credit Token Business

- With the assistance of Tetra Consultants, launching a Labuan Credit Token Business usually takes around 4 to 6 months, from the time all due diligence documents are received. Upon receiving the documents, our experts will register your Labuan company within 2 weeks. During this period, our team will also start preparing all the needed documents for the license application, which includes a comprehensive business plan and AML/CFT policy. Simultaneously, we will also help in recruiting two local employees, a principal officer and a compliance officer, along with sourcing a physical office address, following the Labuan FSA requirements. After the incorporation, preparation of documents, recruitment, and office setup, we will submit the credit token license application to the Labuan FSA. On average, the Labuan FSA usually takes 4 to 6 months to evaluate the application and issue the certificate. Once the license is secured, we will move forward by opening a corporate bank account for your Labuan Credit Token Business license, which usually takes an additional 3 to 4 weeks.

Regulatory authority of Labuan Credit Token Business

- The Labuan Credit Token Business is supervised and regulated by the Labuan Financial Services Authority (Labuan FSA). This statutory body is responsible for the regulation, licensing, as well as ongoing supervision of all the credit token businesses operating in the Labuan International Business and Financial Centre (Labuan IBFC).

- Labuan FSA ensures that the licenses adhere to all the relevant laws, guidelines, and regulations. This also consists of ongoing reporting requirements, fit and proper evaluation of directors, main offices, as well as enforcement of operational standards. The authority also issues detailed guidelines that cover the conduct of credit token business, capital requirements, risk management, as well as reporting obligations. Non-compliance usually leads to administrative penalties and other enforcement actions.

Types of Credit Token Models

- Credit token models consist of a myriad of structures and mechanisms for issuing, utilizing, and managing tokens that showcase credit or value within a business ecosystem. These models are mainly used in fintech, blockchain, and digital finance. These models are:

Utility token models

- These models provide access to a product, service, or even platform features. The most common uses of utility token models are loyalty programs, platform credits, and prepaid services. This license is issued under a regulated framework as part of non-securities, allowing its owners to participate in digital ecosystems.

Credit line

- This license allows customers to easily access a revolving line of credit using tokens. Tokens display an available credit balance that can be easily spent and repaid, similar to a credit card, but are often managed digitally. Credit line is mainly used in retail, B2B platforms, and e-commerce to facilitate flexible purchasing.

Tokenized asset

- Tokenized assets represent fractional ownership or claim on assets such as real estate or carbon credits. It also enables small-scale investment and a rise in liquidity through the means of tokenization. In Labuan, Initial Coin Offerings (ICOs), as well as other franchising models, can use credit tokens to showcase participation in projects or asset pools.

Payment token models

- These tokens act as a medium of exchange for goods and services, and can be used for direct payments, peer-to-peer transfers, or even as a substitute for cash within a closed ecosystem. For instance, digital vouchers, prepaid cards, or specific merchant cards.

Activities allowed under the Labuan Credit Token Business

- Here are the activities permitted under a Labuan Credit Token Business:

Provision of credit

- Upon presentation of the token, the issuer supplies cash, products, or services to the customer on credit, either directly or through a third party. For instance, the customer uses this token to get goods from a merchant, and then the issuer pays the merchant, while the customer settles the payments with the issuer on a later date.

Machine-operated transactions

- Token can also be used to operate machines such as vending machines or kiosks, offered by the issuer or third parties, with the issuer responsible for the settlement of the payment.

Digital and non-digital ecosystems

- Tokens can also be issued and managed through the medium of digital and non-digital means, allowing participation in the ecosystem of digital assets for uses like purchasing goods, services, and real estate investments.

Issuance of tokens

- Tokens can be issued in multiple forms, like cheques, vouchers, booklets, coupons, cards, and stamps to customers.

Blockchain and tokenization

- Tokens can also be used to establish and operate blockchain-based platforms to easily facilitate the use of digital assets and credit tokens.

Step-by-step process of getting a Labuan Credit Token Business

- Setting up a Labuan Credit Token Business consists of various regulatory steps. Tetra Consultants handles each stage with accurate precision, making sure you fulfil all legal, operational, as well as technical requirements.

Step 1- Preliminary consultation and planning

- The first step is to evaluate your business model and token structure. Our team recommends the best licensing approach and corporate setup and determines whether your proposed activities qualify under the Labuan FSA’s credit token guidelines.

Step 2- Company incorporation in Labuan

- In order to apply for the license, you should have a registered company in Labuan. At Tetra Consultants we provide offshore company incorporation, where our team will help you to reserve your preferred company name, prepare and file incorporation documents with Labuan FSA. Appoint a resident secretary and registered office, as well as ensure compliance with the Labuan Companies Act 1990.

Step 3- Preparing the business plan and policies

- Your application should include a robust business plan as well as a compliance framework. Our team will draft a comprehensive business plan, which also includes financial projections. We also offer legal drafting services, and our experts will prepare AML/CFT policy documents, personalized to credit token operations, and outline your IT systems, customer onboarding procedure, risk management, as well as data.

Step 4- Submission of license application to Labuan FSA

- Once the documents are ready, our team will submit your license application to the Labuan FSA. Tetra Consultants will compile and review all your documents to avoid any errors, submit the complete application package to the Labuan FSA, and liaise with regulators as well as respond to additional queries that arise.

Step 5- Approval and issuance of license

- After reviewing your license application, you will get your Labuan Credit Token Business license. Throughout this entire procedure, our team will follow up with the regulatory authorities to clarify and resolve any regulatory feedback and help you in meeting any final conditions as well as capital requirements before the issuance of the license.

Step 6- Open a corporate bank account for the Labuan Credit Token Business license

- After the issuance of the license, Tetra Consultants will provide you with corporate bank account opening services, and our team will open a corporate bank account for your business.

Step 7- Post licensing support and compliance

- Getting a Labuan Credit Token Business requires ongoing regulatory compliance. Our team at Tetra Consultants will handle all the annual license renewals as well as statutory filings. Maintain your accounting as well as audited financials, offer resident director, and registered office services. Our experts will also advise you on any legal changes or updated reporting standards, ensuring that your business is adhering to the updated regulations

Documents needed for the Labuan Credit Token Business

To apply for a Labuan Credit Token Business License, these documents will be required:

- Form LFB-OFB and LFB-OFB/1

- Certificate of Incorporation

- Corporate structure chart

- Memorandum and Articles of Association

- Bank statements

- Certificate of deposit

- Business plan:

- Outlining the description of the credit token model and its use case

- Risk management and compliance framework

- Operational processes and technology overview

- Target market and strategy

- Financial projections for the next three years

- Curriculum Vitae of directors and key personnel

- Certified true copies of passports and proof of address of all directors and shareholders

- Fit and proper declarations for all the directors, controllers, and principal officers, showcasing their relevant experience in their fields

- AML/CFT policies

- Security and IT infrastructure plan

- Proof of office in Labuan

- Employment contracts

- Whitepaper/ information sheet that discloses:

- General information about the license

- Risks, rights, and obligations

- Token operations and technology

- Redemption and operational details

- Disclaimer statement as needed by Labuan FSA

- Auditor’s appointment letter

Requirements for the Labuan Credit Token Business

In order to operate a Labuan Credit Token Business, applicants should adhere to regulatory and operational requirements as set up by the Labuan FSA. Here are some main requirements:

- Paid-up capital unimpaired by losses of at least RM1,000,000 or its equivalent in any foreign currency throughout its operations. Furthermore, Labuan FSA has the right to increase the required paid-up capital depending on the business’ nature, scale, complexity and diversity of their business activities. The capital should be paid fully before the license is issued. Furthermore, the evidence of capital should also be provided, usually through bank statements or certificates of deposit.

- Applicants must incorporate a Labuan company under the Labuan Companies Act 1990. The company should also have a registered office in Labuan and appoint a resident company secretary.

- The company should have at least two local employees, preferably serving as the Principal Officer and the Compliance Officer.

- A physical office premise is mandatory.

- All shareholders, key personnel, and directors should fulfil the fit and proper criteria, which include no criminal or bankruptcy record. They should have relevant financial and technical expertise and a sound reputation.

- The business should have a detailed and thoroughly documented:

- Business plan

- IT and cybersecurity practices

- Risk management framework

- AML/CFT policies

- Compliance procedures

- The company should also have an approved Labuan auditor to perform all the annual financial audits as well as regulatory reporting.

- The company should also adhere to Labuan’s AML/CFT requirements, submit annual returns on time, and maintain proper records of all the token transactions done.

- Lastly, if you are operating a token-based platform, you need to ensure:

- A clear technical infrastructure for token issuance, redemption, and tracking.

- Appropriate measures for protecting sensitive data and solidifying strong cybersecurity.

- Access to or the development of a digital wallet system or an integrated payment gateway.

Common challenges of a Labuan Credit Token Business

- Operating a Labuan Credit Token Business provides multiple challenges, several of which arise from the changing regulatory landscape. Here are some of the most common challenges:

Regulatory complexity

- Businesses should adhere to a wide set of laws, guidelines, and rules issued by the Labuan FSA. This also consists of ongoing updates and circulars; non-compliance can usually result in administrative penalties or enforcement actions. At Tetra Consultants our team will clearly explain you the laws, and regulations to be followed and take care of it on your behalf.

AML/CFT policies

- Strong anti-money laundering (AML), and counter-financing of terrorism policies are needed, which also consist of due diligence, monitoring of transactions, and reporting of suspicious activities. Failure to do so will lead to heavy fines. At Tetra Consultants our experts will draft AML/CFT policies in adherence to the strong regulatory framework of Labuan.

Hiring qualified employees

- The requirement to hire a local principal officer and compliance office is usually difficult to fulfil, especially for foreign-owned companies that are not familiar with the local talent pool. Ensuring that these personnel meet “git and proper” standards and also understand the credit token landscape is significant. Our experts will help you in meeting the key personnel related requirements to ensure a smooth company incorporation.

Bank account opening

- Despite the regulatory approval, opening a corporate bank account in Labuan for crypto-related businesses is usually quite challenging. Most of the time, financial institutions conduct strong due diligence on fintech models, especially those that involve tokenized credit, which can also increase timelines or limit banking options. At Tetra Consultants, we also offer corporate bank account opening services allowing you to successfully pass the due diligence checks and conduct seamless transactions.

Cost of getting a Labuan Credit Token Business

- The overall cost of setting up and operating a Labuan Credit Token Business differs on the basis of the complexity of your business operations, the scope of licensing, as well as the supporting services needed. These also include company incorporation, license application, ongoing compliance, recruitment of local employees, along with corporate bank account opening. At Tetra Consultants, our major focus is on transparency. in our breakdown of our total costs, there are no hidden fees or surprises. Our pricing is structured to offer you full clarity as well as value across each and every stage from initial planning to the post-licensing support.

Looking to obtain the Labuan Credit Token Business

- Setting up a Labuan Credit Token Business is mainly a strategic move, especially for fintech business owners and blockchain innovators wanting to issue tokenized credit products in a heavily regulated and stable environment. However, it is often difficult to navigate through the licensing procedure, fulfilling all the regulatory requirements, and ensuring long-term compliance is complex without the correct guidance.

- This is where Tetra Consultants steps in. With more than a decade of experience in offshore licensing, fintech structuring, as well as regulatory advisory, our team provides expertise in launching and managing Labuan-licensed entities. We also provide end-to-end support, from the registration of the company and preparing documents to getting license approval, as well as post-licensing compliance.

- Here is why you should choose us:

- Deep understanding of the tokenized finance and credit-based business models.

- One-stop solution that covers your HR, legal, tax, and banking requirements.

- Proven track record in obtaining Labuan FSA approval.

- Transparency and competitive pricing, with no hidden fees involved.

- Contact us, and our team will get back to you in 24 hours.

FAQs

Who needs this license?

How long does it take to secure the license?

What is a Labuan Credit Token Business license?

Can I open a bank account for my token business?

What are the annual obligations of this license?

Accounting & Tax

Company Incorporation

New Economic Substance

Employment Pass

Credit Token Business License

Cryptocurrency Exchange License

Compliance Officer Services

Fund Management License

Insurance Broker

Investment Bank License

Securities License

Money Broking License

Payment System Operator License