Labuan Insurance Broker

- In the present scenario, the Labuan Global Insurance Broker License is the most sought-after license. Labuan is an international business and financial hub located in Malaysia, which has slowly started to grow into a preferred jurisdiction for insurance and other financial activities. Labuan has become an attractive destination because of its favorable regulatory framework, competitive tax regime, and international reputation, leading to a rise in the number of businesses wanting to engage in insurance-related services

- Through the Labuan Global Insurance Broker License business can operate as mediators between insurers, clients, as well as reinsurers while also providing a broad range of broking and advisory services. In Labuan, companies operating as Labuan insurance brokers are controlled by the Labuan Services and Securities Act 2010 (LFSSA). At Tetra Consultants, we will help you obtain the Labuan Global Insurance Broker License. Our team manages the entire application process and also provides post-regulatory services to ensure that your business easily survives in the regulatory landscape of Labuan.

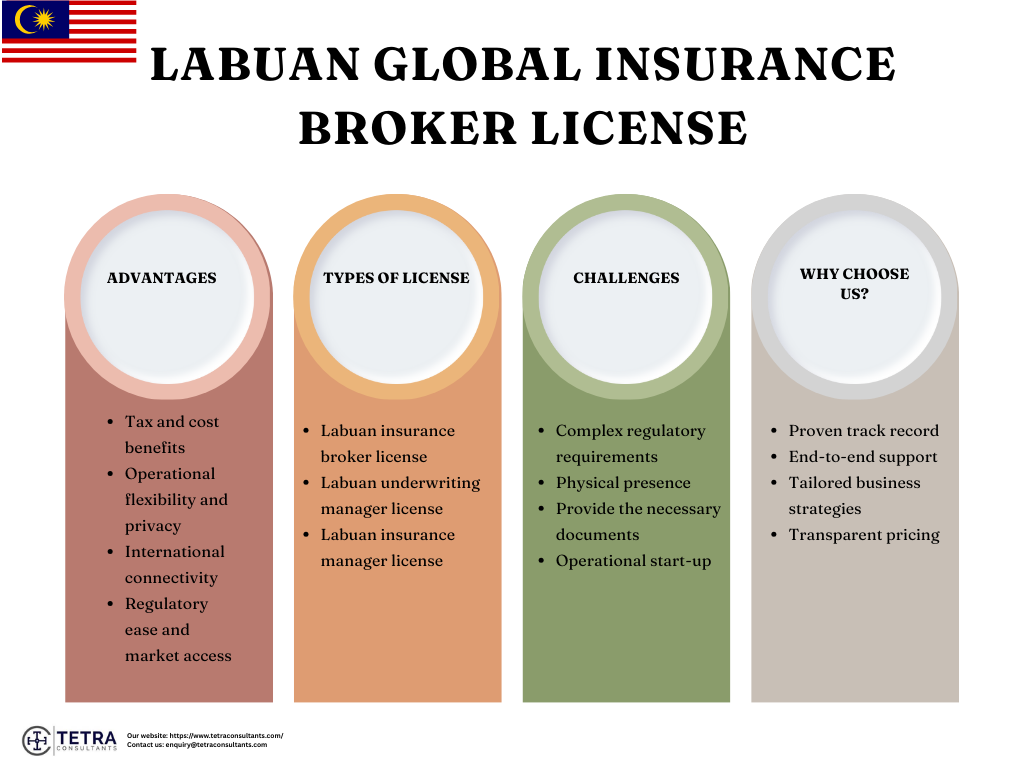

Advantages of Labuan Global Insurance Broker License

- A Labuan Global Insurance Broker License offers major advantages to businesses, these are:

Tax and cost benefits

- In Labuan, insurance entities enjoy a low corporate tax rate, which is 3% of the audited profits. Businesses also get tax exemptions on specific income streams and even the director’s fees. Furthermore, there are no withholding, stamp, import, or even sales taxes, which further reduces the overall operation costs of insurance business entities. The licensing as well as annual fees are comparatively low when compared to those in Hong Kong, Singapore, or even mainland Malaysia. This has increased the number of businesses who want to register company in Labuan.

Operational flexibility and privacy

- In Labuan, the company formation and licensing processes are straightforward with practical capital requirements as well as manageable local presence regulations. The privacy framework of Labuan ensures confidentiality as well as data protection, which is an attractive quality that international brokers look for. Brokers also benefit from the business models’ flexibility as well as scope, such as direct, reinsurance, and life, which allows them to provide customized solutions for the diverse markets.

International connectivity

- Labuan has maintained relationships with more than 70 tax treaty partners, which facilitates cross-border operations and reduces the risk of double taxation for international business activities. The strategic location of Labuan ensures easy access to the Asian markets and seamless connectivity between Eastern as well as Western markets. The ecosystem also supports a broad range of insurance and risk management activities by reputable intermediaries, auditors, banks, and service professionals.

Regulatory ease and market access

- Licensing under the Labuan FSA creates a regulated and internationally recognized status that offers regulatory flexibility for innovation and adaptability. Brokers are allowed to arrange both direct and reinsurance business, handle domestic and international clients, and also establish takaful, which is Islamic insurance broking windows without needing a separate license. The regulatory framework of Labuan strictly follows the standards set by the global bodies such as the Organisation for Economic Co-operation and Development (OECD), Financial Action Task Force (FATF), and Asia/Pacific Group on Money Laundering (APG), to ensure compliance and credibility of international transactions.

Types of Labuan Insurance Broker License

- There are 3 types of Labuan Global Insurance Broker License that are issued by the Labuan FSA, these are:

Labuan insurance broker license

- This license allows brokers to arrange general, life, and annuities business for prospective and existing clients. The brokers owning this license can also conduct financial planning activities, except for the high-net-worth individuals. Lastly, taking up direct Malaysian risks is prohibited under this license.

Labuan underwriting manager license

- This license grants the license holder the authority to perform underwriting functions and also administer business for Labuan insurers. With this license, the licenses can also handle portfolio management and distribute the administrative duties that support the underwriting activities of the insurance companies.

Labuan insurance manager license

- With this license, the licensee can easily offer management or administrative-related services to Labuan insurance companies. However, this license does not consist of any underwriting services and is solely focused on operational and managerial support for the insurance entities.

Costs and timeline for getting the Labuan Global Insurance Broker License

- After 2 weeks of receiving the required due diligence documents, Tetra Consultants will register with your company, and our team will start preparing necessary documents like the business plan and AML/CFT policies. During this time, our team will help in hiring two local employees, including the principal officer, and getting a physical office in Labuan. Once these important steps are completed, we will then submit your licensing application to the Labuan FSA. The authority may ask for additional clarifications and changes to documents, which usually takes around 4 to 6 months, after which you will get your license certificate. After the license is used, our team will then move ahead to open your corporate bank account, which takes an extra 3 to 4 weeks.

- The overall cost of getting a Labuan Global Insurance Broker License is based on your business model and the services you are opting for. You will also need to consider expenses that are related to company incorporation, government fees, and employee recruitment. At Tetra Consultants, we follow a transparent fee structure and no hidden fee policy, so during the initial consultation, our team provides you detailed cost breakdown to ensure that we are on the same page, and you know exactly what services you are paying for.

Regulatory authority for Labuan Global Insurance Broker License

- The regulatory authority responsible for the Labuan Global Insurance Broker License is the Labuan Financial Services Authority (Labuan FSA).

- This authority is responsible for overseeing, regulating, and implementing legislation for the insurance brokers, as well as other financial services providers within the Labuan International Business and Financial Centre (Labuan IBFC). Lastly, Labuan FSA also sets guidelines, capital adequacy frameworks, and compliance standards that should be followed by all the Labuan insurance brokers.

Activities allowed under the Labuan Global Insurance Broker License

Financial advisor and planning

- The license permits licensees to participate in insurance-related financial planning services and management consultants for insurance portfolios.

Fee-based management services

- Brokers owning this license can also earn income through the brokerage fees, management fees for extra services like risk evaluation, claims consultancy, and account administration, along with investment or interest income-related activities.

Arranging insurance and reinsurance

- Brokers are allowed to arrange and facilitate both general as well as business and reinsurance transactions doe their clients located within Labuan, Malaysia, and foreign insurers and reinsurers.

Claims and premium handling

- Brokers can also collect premiums on behalf of the insurers and reinsurers. Brokers are also permitted to distribute claims recoveries to clients, as well as manage the flow of funds between the clients and reinsurers as part of their brokering activities.

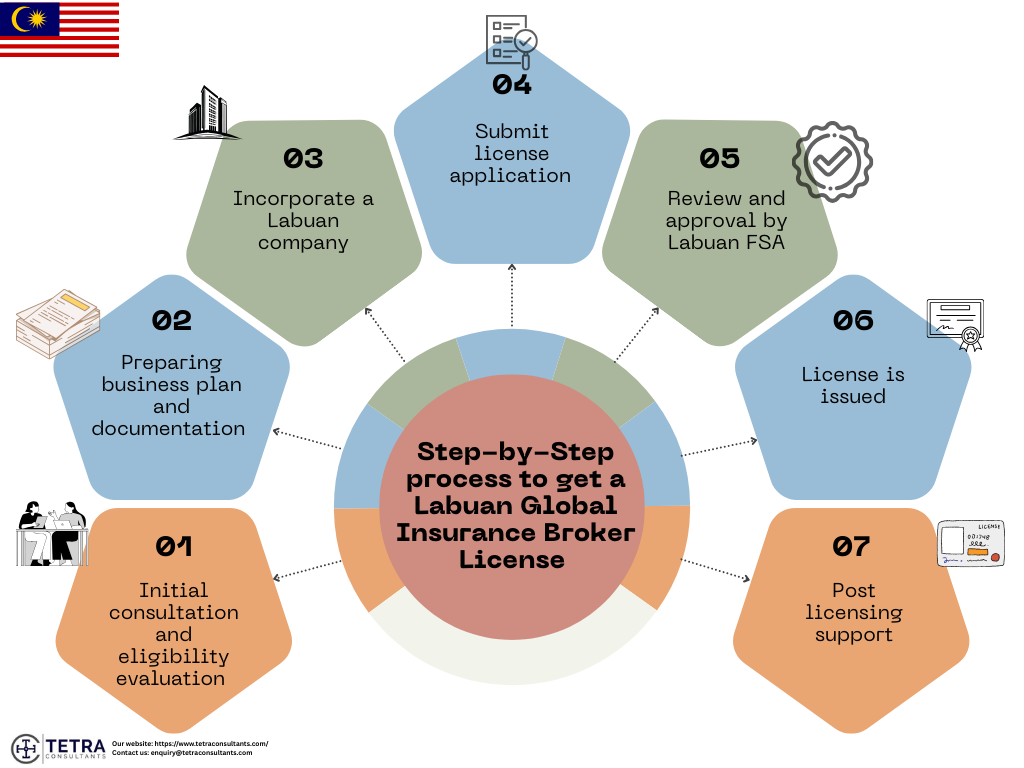

Step-by-step process to get a Labuan Global Insurance Broker License

Step 1- Initial consultation

- Our team conducts an initial consultation to understand your business goals and licensing requirements. We also evaluate whether your business model is eligible for the Labuan Global Insurance Broker License.

Step 2- Preparing business plan and documentation

- Our team then moves ahead and drafts a detailed business plan with financial predictions and a compliance framework. Tetra Consultants also drafts Anti-money laundering and Counter-financing of terrorism policies, which are compulsory under the Labuan regulations. We also collect shareholders, directors, as well as key personnel due diligence documents.

Step 3- Incorporate a Labuan company

- Before applying for the license, Tetra Consultants ensures that a Labuan company is incorporated. Our team handles the incorporation process, drafts Memorandum and Articles of Association, provides a registered office address, and appoints local officers.

Step 4- Submit license application

- After the company is incorporated, Tetra Consultants then moves ahead with the license application with the Labun FSA. Our team ensures that the application form is filed with all the necessary documents to avoid any delays.

Step 5- Review and approval by Labuan FSA

- Labuan FSA will then review your application, and they may ask for additional queries. Tetra Consultants communicates with the Labuan FSA on your behalf and responds to additional queries to ensure that there are no delays.

Step 6- License is issued

- After the successful review, the license is issued. Now your business can easily carry out brokerage and advisory services.

Step 7- Post licensing support

- After getting the license, companies should fulfill ongoing obligations, appoint auditors, prepare annual statements, and file taxes. Tetra Consultants will help you open a local corporate bank account and ensure that your business is complying with the Labuan FSA’s regulations.

Common challenges and how we can help

Complex regulatory requirements

- Most of the businesses find it difficult to understand the regulations set up by the Labuan FSA. For new applicants, it is an overwhelming task to align their business models with the licensing conditions set up by the Labun FSA, which leads them to make mistakes and inaccuracies. At Tetra Consultants, our team offers clear guidance on the requirements and explains all the regulatory regulations in simple terms to ensure that your business is adhering to the Labuan FSA standards.

Physical presence

- Businesses also struggle with establishing a physical office in Labuan and hiring local staff. Foreign businesses that are not well-versed in the local environment of Labuan find it difficult to hire quality staff. At Tetra Consultants, our team will help you set up a physical office and hire local staff.

Operational start-up

- Hiring fit and proper directors, while understanding local customs and business practices, is a difficult task for new businesses. Companies also find it difficult to set up a corporate bank account in Labuan due to the strict background checks conducted by Labuan banks. At Tetra Consultants, we provide nominee director and shareholder service, and corporate bank account opening services. Our team provides you with a local director or principal officer. We will also open a corporate bank account for your business, reducing your administrative burden.

Provide the necessary documents

- Businesses often fail to include necessary documents while submitting the application, which leads to delays and errors. At Tetra Consultants, our team ensures that all the necessary documents are submitted to the Labun FSA in the correct order to avoid any delays.

Requirements for Labuan Global Insurance Broker License

- Maintain a minimum paid-up capital or minimum working funds of at least RM 300,000 or equivalent to any foreign currency in a Labuan bank account.

- The applicant should be a Labuan company or a foreign company that is registered under the Labuan Companies Act 1990. The applicant should be a member of the Labuan International Insurance Association.

- The company should have a registered operational office in Labuan and appoint a licensed Labuan insurance manager.

- The company must have 1 local Principal Officer or director of a Labuan insurance broker.

- The company should have at least one residential director or secretary in Labuan, and the individuals in control of directors and principal roles should be fit and proper and should have suitable insurance experience.

Documents needed for Labuan Global Insurance Broker License

- Completed application for (Form LIB)

- Certified copy of the certificate of incorporation

- Certified copy of the relevant business license

- Certified board resolution approving the licensing application

- A detailed business plan for the next three years

- Letter of guarantee/undertaking from corporate shareholders or the parent company

- Details of shareholders

- Fit and proper declarations, such as resumes and declarations of directors, shareholders, and senior officers, confirming good character

- Audited financial statements for the last three years

- Risk management and internal control policies (to be provided upon getting the license)

- Declaration of the accuracy and completeness of the information submitted

- Frameworks for AML/CFT compliance and KYC policies

How can Tetra Consultants help with the Labuan Global Insurance Broker License?

- In order to apply for the Labuan Global Insurance Broker License, the applicant will have to carefully prepare the application, with detailed documentation, and conduct ongoing compliance with the rules set by the Labuan FSA. Most of the businesses find it difficult to draft a detailed business plan, prepare AML/CFT manuals, or meet the capital and governance requirements. This is where Tetra Consultants steps in. Our team ensures that you fulfill all the regulatory obligations while saving time and resources. Here is how we can help:

- Proven track record- At Tetra Consultants, we have successfully helped our global clients in getting insurance and financial licenses across various jurisdictions, including Labuan.

- End-to-end support- After getting the license, we continue to support your business with risk advisory, expansion strategies, and taxation advice.

- Tailored business strategies- Our team creates business plans, compliance frameworks, and corporate structures based on your specific business goals.

Looking to obtain the Labuan Global Insurance Broker License

- If you want to establish an insurance brokerage company in a well-known global jurisdiction, then the Labuan Global Insurance Broker License is a good solution. The friendly business environment, worldwide reputation, and streamlined regulatory framework of Labuan offer your company credibility as well as flexibility to serve regional and international markets. However, navigating the application process and communicating with the Labuan FSA is a tough task for most businesses. At Tetra Consultants, our team will handle the incorporation process, documentation, and communicate with the FSA on your behalf. Our main focus is to relieve you of your administrative burdens, so that you can focus on your core business operations.

- Contact us, and our team will get back to you within 24 hours.

FAQs

What are the minimum capital requirements for this license?

Can foreign investors fully own an insurance brokerage company in Labuan?

Do I have to maintain a physical office in Labuan?

Who regulates insurance brokers in Labuan?

Accounting & Tax

Company Incorporation

New Economic Substance

Employment Pass

Compliance Officer Services

Credit Token Business License

Cryptocurrency Exchange License

Fund Management License

Insurance Broker License

Investment Bank License

Money Broking License

Payment System Operator License

Securities License