Compliance officer services for Seychelles VASP

- Seychelles VASP license compliance officer services are essential for organizations seeking regulatory assurance and stability in one of the fastest emerging digital asset jurisdictions. Following a National Risk Assessment, in 2022, Seychelles identified high risks of money laundering and terrorist financing associated with virtual assets and put in place formalized compliance roles across the sector under the Virtual Asset Service Providers (VASP) Act of 2024. The VASP Act requires that all VASP licensees appoint a compliance officer to ensure there are robust anti-money laundering (AML) and counter-terrorist financing (CTF) systems from the beginning of their operations.

- The Financial Services Authority (FSA) requires companies to submit comprehensive AML and CTF policies and submit verifiable controls for ongoing compliance in order to secure Seychelles VASP License. The statistics confirm there has been a steady increase in new registrations, with approximately 133 new limited liability corporations registered in Seychelles in 2022. Register company in Seychelles continues to be a simple process which supports the Islands reputation as a hub for financial innovation.

- As Tetra Consultants, we assist clients on every finer detail of preparing documents, managing all regulatory submissions, and ensuring that every requirement is fulfilled as the compliance officer under the Seychelles VASP License. This expedites time-to-market and preserves institutional integrity.

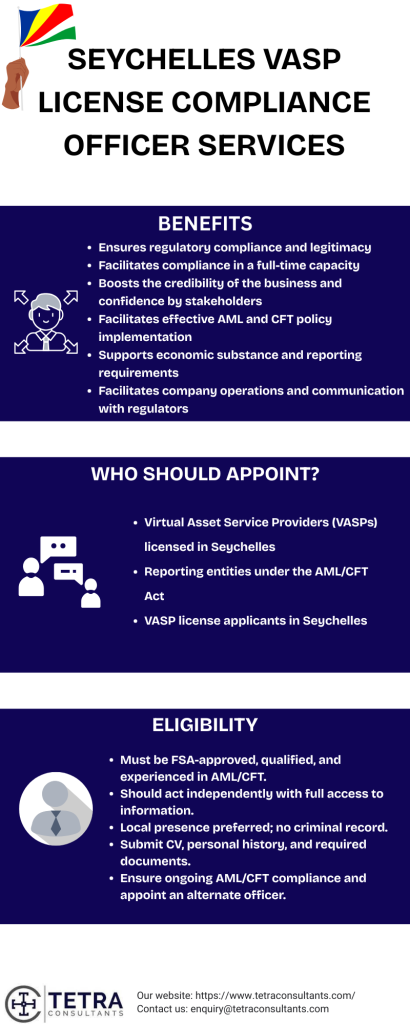

Benefits of appointing Seychelles VASP license compliance officer services

Ensures regulatory compliance and legitimacy

- Dedicated compliance officers help ensure the requisite strict adherence to the Seychelles VASP Act and AML/CFT regulations set forth by the Financial Services Authority (FSA). This compliance is essential in maintaining a legitimate virtual asset service provider to mitigate criminal and legal risks, as breaches can result in significant monetary penalties and/or suspension of licenses.

Facilitates compliance in a full-time capacity

- The regulatory framework in Seychelles states that a compliance officer must be a person employed full-time directly with the VASP and not contracted/outsourced. This ensures an ability to pay attention to compliance, be timely and in-depth in reporting, and to manage risks aligned with local and international regulations, laws, and standards.

Boosts the credibility of the business and confidence by stakeholders

- The existence of a compliance officer adds to the company’s credibility, signaling an objective cognizance of regulatory requirements, which is of great importance to clients, investors, and partners. This legitimacy is crucial for business planning and vision related to objective expansion and operation in global markets of virtual assets as a Seychelles VASP License holder.

Facilitates effective AML and CFT policy implementation

- A compliance officer is responsible for ensuring consistent delivery of Anti-Money Laundering (AML) and Counter Financing of Terrorism (CFT) policies along with client due diligence and record keeping obligations required by Seychelles VASP License.

Supports economic substance and reporting requirements

- The compliance officer is also responsible for ensuring the VASP has met all economic substance requirements such as maintaining a local office, holding regular meetings of the board of directors, and submitting annual returns within the deadlines stipulated in their contract with Seychelles VASP License. These are all important behaviors needed to uphold Seychelles VASP License.

Facilitates company operations and communication with regulators

- Ultimately, with the compliance officer managing the communications with regulators and maintaining compliance with all required documentation, this streamlines the time taken to complete day-to-day operations and ensures that all individual and company regulations and obligations are delivered on time and when required. This creates a pathway for those entities to register and operate seamlessly under the virtual asset regulatory regime in Seychelles.

Who should appoint Seychelles VASP license compliance officer services?

Virtual Asset Service Providers (VASPs) licensed in Seychelles

- Any company holding or applying for a Seychelles VASP License must appoint a Compliance officer. The Seychelles VASP license compliance officer signifies ensuring that the business is compliant with Seychelles’ VASP Act, Anti-Money Laundering (AML), and Counter Financing of Terrorism (CFT) regulations. The Seychelles VASP license compliance officer manages risk management, compliance and regulatory reporting, and internal controls to keep the virtual asset services integrity and legality.

Reporting entities under the AML/CFT Act

- Entities undertaking virtual asset activities will fall under Seychelles’ Anti-Money Laundering and Counter Financing of Terrorism Act and its regulations, these entities are obliged to appoint a compliance officer. The Seychelles VASP license compliance officer oversees the compliance programs, conducts due diligence, assesses suspicious transactions, and ensures all applicable laws and regulations concerning AML/CFT are adhered to in order to prevent any illicit activities involving financial transactions.

VASP license applicants in Seychelles

- The VASP must appoint a qualified Seychelles VASP license compliance officer to carry out the function while fulfilling a licensing requirement. The Seychelles VASP license compliance officer will demonstrate their understanding of regulatory requirements, will develop compliance policies, and submit applications to the Seychelles Financial Services Authority (FSA), all ensuring the applicant meets the licensing requirements quickly and effectively.

Eligibility for Seychelles VASP license compliance officer services

- Must be appointed and accepted by the Seychelles Financial Services Authority (FSA).

- Must meet fit and proper criteria and possess integrity, competence, and professional ethics.

- Must have relevant qualifications, such as a law, finance or business degree or other recognized qualifications in regard to AML/CFT (for example, CAMS, ICA).

- Must have relevant experience in compliance, AML/CFT or risk management (generally 3+ years) knowledge of the compliance regulations specific to Seychelles.

- Must act independently from business units and have access to all information related to the company without restrictions.

- Independence is required to act in a completely independent manner and remain out of operational activities that might create a conflict of interest.

- Strongly preferred to be a local resident or physically present in Seychelles.

- Must not have a criminal record, specifically for crimes of dishonesty or financial crime.

- Must provide the FSA with a questionnaire on personal history, Curriculum Vitae (CV), and supporting documentation for the appointment of compliance officer.

- Must participate on an ongoing basis as a compliance officer for AML/CFT including up-to-date compliance programs and training regularly.

- Provisions are made for the appointment of a named alternate compliance officer, regardless of risk management approach or size of staff.

- Can be a member of the board provided the independence requirements and regulatory requirements are adhered to.

Seychelles VASP license compliance officer assistance

- Our compliance officers are all Certified Anti-Money Laundering Specialists (CAMS) and Certified Crypto Asset AFC Specialists (CCAS), each with over 5 years’ experience in the crypto and financial services industry. Our team have comprehensive knowledge of the Seychelles Virtual Asset Service Providers Act, FIU guidance, and other regulatory requirements. Therefore, we ensure your VASP is entirely compliant with strong AML/CFT controls, reporting, and engagement with regulators. Your compliance function is with qualified professionals dedicated to upholding high standards.

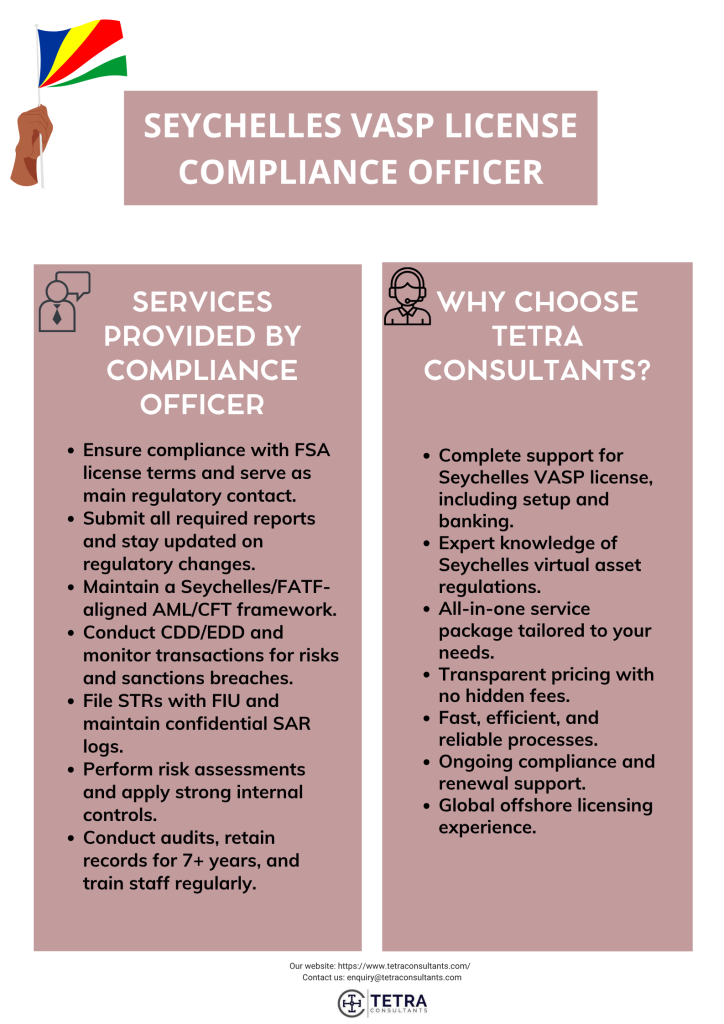

Services offered by Tetra Consultants Seychelles VASP license compliance officer services

- Ensure the organization is compliant with all the conditions attached to the VASP license issued by the FSA.

- Serve as the primary contact for the VASP for interactions with the FSA about regulatory matters.

- Conduct the preparation and submission of all statutory reports and filings (risk assessment reports, suspicious activity logs, annual compliance certifications, etc.).

- Track and maintain all legislative amendments and FSA updates.

- Establish, implement and keep current a Risk-Based AML/CFT framework permissive of Seychelles and FATF.

- Conduct Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) when on-boarding customers and when monitoring ongoing customer behavior.

- Monitor all fiat and virtual asset transactions to confirm there are no red flags (layering, mixing, sanction breaches, etc.).

- Ensure compliance with UN Security Council Sanctions and other sanctions regimes applicable in Seychelles.

- Act (or liaise with the designated MLRO) to review, investigate and submit Suspicious Transaction Reports (STRs) to the Financial Intelligence Unit (FIU).

- Remain aware of, complete, and maintain internal SAR logs and ensure confidentiality and legal protections are maintained.

- Coordination, support and assistance provided to FIU and FSA if available per the investigation.

- Conduct and maintain processing for a Business Risk Assessment (BRA) and maintain a Customer Risk Scoring System.

- Establish internal controls from a financial crime (money laundering, terrorism financing, sanctions breaches) a business can fit into to identify, isolate and mitigate risks.

- Organize regular independent AML/CFT audits, as mandated by the FSA.

- Keep current and secure copies of:

- KYC documents and verification procedures

- Transactions and blockchain logs

- Evidencing compliance monitoring activity

- All reports sent to FIU/FSA

- Compliance and risk management practices, ensuring your records are retained for no less than 7 years since they may be referred to when complying with Seychelles’ regulations.

- Provide regular training for employees on:

- AML/CFT responsibilities,

- Internal reporting procedures,

- Risk indicators concerning virtual assets

- Keep records of training attendance and materials used.

- Report on a regular basis to senior management, or the Board, in relation to:

- Compliance risks,

- Beaches detected,

- Emerging regulatory trends or FATF updates.

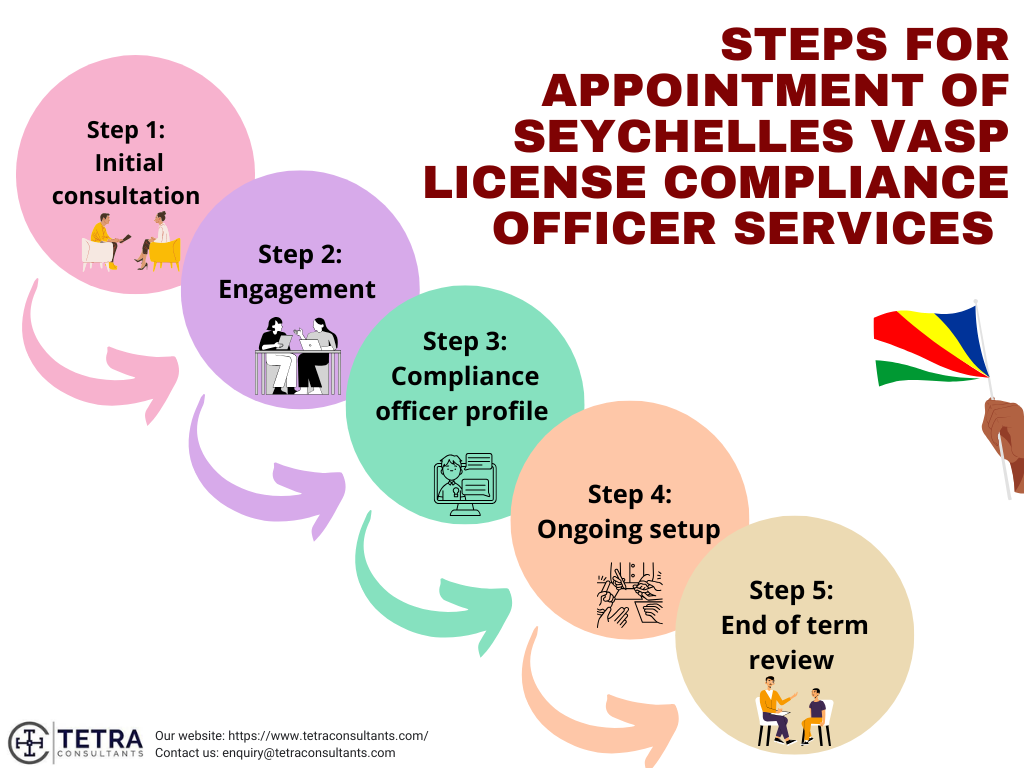

Steps for appointment of Seychelles VASP license compliance officer services

Step 1: Initial consultation

- We work with you to understand the specific compliance requirements of your organization and the anticipated area of responsibility for the compliance officer(s). This provides us with an opportunity to tailor a service proposal to your needs, both in terms of business objectives and regulatory requirements.

Step 2: Engagement

- Once you confirm the proposal, we will document the engagement with an appointment letter and an invoice. This will formalize the relationship, establish terms of the engagement, and allow us to begin the process of appointing a compliance officer straight away.

Step 3: Compliance officer profile

- Once the engagement is confirmed, we will distribute the full CV of your appointed compliance officer. This will allow you to understand their experience, qualifications and relevant experience so you can assess if the proposed candidate meets your requirements and the regulatory requirement in Seychelles.

Step 4: Ongoing setup

- During your term of engagement, our compliance officer will continue to be involved and available for meetings and consultation as needed. They will help you follow updates to regulations, streamline your compliance processes and support you in dealing with any emerging issues related to your Seychelles VASP license obligations.

Step 5: End of term review

- At the end of the term of engagement we will conduct a review and have a discussion regarding your satisfaction and business needs. This conversation will enable us to decide if we continue to assist you, if you require any adjustments, or whether we are to conclude compliance officer engagement in a seamless manner.

Cost for appointment of Seychelles VASP license compliance officer services

- When navigating the Seychelles VASP License regulatory landscape, various fees must be understood to ensure compliance. Aside from the application fees and annual license fees, which vary based on specific virtual asset activities (e.g. virtual asset wallet provision, exchange, broking, investing), there are additional costs related to obtaining a VASP License.

- These fees might include application fees for registration, and extra charges for various miscellaneous services (e.g. inspection of the register of the licensees, obtaining copies of licenses, fit and proper determinations). Knowing this, we have made it a priority with our clients to be fully transparent regarding every fee related to obtaining and maintaining your Seychelles VASP license compliance officer services.

- We breakdown the expected fees with full disclosure, leaving no fees undisclosed. Specifically, we explain the cost of each stage of the process including any approval or annual renewal of your Seychelles VASP License.

Why choose Tetra Consultants?

- By selecting Tetra Consultants, you receive a streamlined and inclusive process for the issuance, and management of your Seychelles VASP License. With experience in the complete range of Seychelles’ virtual asset regulations, Tetra Consultants supports its clients through the entire process of company formation, compliance officer appointment and contact, license application, and corporate bank account opening with transparency and efficiency. Tetra Consultants’ focus on transparency, no hidden fees and communication ensures that no costs will be hidden from clients, while our ongoing support will enable clients to continue acting in compliance with increasingly complex regulations.

- Reasons to choose Tetra Consultants:

- Fully inclusive services: Company formation, license application, corporate bank account opening, and many more services.

- Regulatory expertise: Specialized and in-depth knowledge of the Seychelles VASP laws and license categories.

- Transparency with fees: Clarity in all costs for all services and no hidden fees.

- Ongoing compliance help: Reaching out about regulatory and compliance updates and support with renewals.

- International operational experience: Proficiency with a broad range of services such as offshore financial licenses and offshore banking licenses will allow us to develop tailored solutions for your business growth.

Looking to appoint Seychelles VASP license compliance officer services

- Compliance for a Seychelles VASP License is very important, and Tetra Consultants can help you. A VASP in Seychelles must have a full-time compliance officer of senior level with proper fit and propriety criteria, has relevant experience (this is almost always 3+ years), and qualifications with degree in finance or CAMS certification. The Compliance officer will be critical of performing according to the AML/CFT rules laid out in legislation, along with best practice requirements.

- Tetra Consultants will facilitate this process that is extremely difficult as it helps carry out the time-consuming components of the Seychelles VASP Licensing process servicing offshore company incorporation, preparing documentation, seeking approvals, reporting to the Seychelle regulatory agencies, including the Central Bank of Seychelles. We help ensure clients are represented appropriately through the licensing and whole process and meet any obligations that makes the fit and propriety requirements for the compliance officer which keeps the VASP licensing and business functioning in Seychelles.

- Contact us to know more about Seychelles VASP license compliance officer services and we will revert in 24 hours.

FAQs

Who is required to appoint a compliance officer for the Seychelles VASP License?

Can the compliance officer be a member of the board?

What is the required qualification of compliance officer?

What are the main roles of compliance officers?

Are there any regulatory submissions with respect to the compliance officer?

What if VASP does not appoint a compliance officer?