Compliance officer for Singapore Payment Institution License

- The Singapore Payment Institution License compliance officer is critical in ensuring payment service providers are compliant with the strict regulatory requirements of the Monetary Authority of Singapore (MAS). As Singapore continues to establish itself as a premier destination for cross-border payments, we are seeing a definite demand for compliance professionals. Right now, there are over 200 active Major Payment Institution (MPI) license holders and 15 Standard Payment Institution (SPI) license holders, of which 93% of MPI licensees are licensed for cross-border money transfer activity.

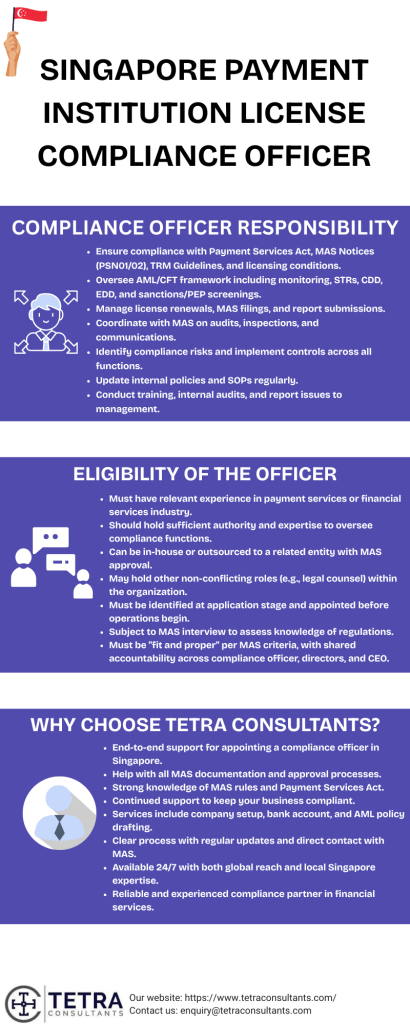

- Some of the responsibilities of compliance officers include implementing AML (anti-money laundering) initiatives, continual regulatory reporting obligations, and ensuring that all activities fall within the parameters of the Payment Services Act. In order to register company in Singapore for obtaining a Singapore Payment Institution License, strict requirements must be adhered by organizations, including company registration in Singapore, local directorship and initial minimum capitalization. For this reason, businesses interested in registering company in Singapore and enhancing their presence in these exciting payments environment need to focus on strong compliance leadership to help manage the many changing regulations.

Benefits of appointing Singapore Payment Institution License compliance officer

Ensures regulatory compliance

- A compliance officer provides payment institutions with the right mechanism, culture, or tone at the top from the outset to consistently meet the requirements expected by the Monetary Authority of Singapore (MAS). This includes overseeing the entire process of staying current with changing regulations, enforcing the Payment Services Act, and ensuring that every aspect of the organization is compliant with regulations, all of which mitigate the business risk potential for fines and infractions.

Strengthens Anti-Money Laundering (AML) controls

- Building and maintaining a sufficient AML and counter-terrorism financing (CTF) framework is just one of the responsibilities of a compliance officer. With functions involving the monitoring of transaction activity and reporting suspicious activity, the compliance officer also safeguards the institution from being used for nefarious purposes and instills the company’s reputation for integrity.

Facilitates smooth licensing and renewals

- Designating a compliance officer benefits obtaining and maintaining a Singapore Payment Institution License. A compliance officer will ensure that any papers, reporting and internal controls requested by MAS are compliant and to expectations. This can facilitate an easier process for license application approval and timely renewal.

Instills confidence with stakeholders

- Having a qualified compliance officer signals to clients, partners, and regulators that the company is committed to ethical business practices, thereby helping to develop trust that is vitally important when attracting institutional clients and partners in the heavily regulated payments industry.

Mitigates operational risks

- Compliance officers will identify, assess, and mitigate risks of non-compliance, fraud, and operational failures. Because compliance officers act proactively to help prevent regulatory violations, financial loss and reputational damage, and ensure business continuity and resilience.

Facilitates business growth

- Having a compliance officer enables companies to safely and confidently pursue new products, services, and markets, knowing regulatory requirements are taken care of. This is especially critical for companies registering company in Singapore and looking to grow operations regionally or internationally.

Improves corporate governance

- The compliance officer fosters a culture of accountability and transparency within the organization. Improving corporate governance and ensuring compliance with best practices in alignment with expectations of Singapore Payment Institution License holders.

Who should appoint Singapore Payment Institution License compliance officer?

- It is the responsibility of the payment service provider requesting or renewing a Singapore Payment Institution License from the Monetary Authority of Singapore (MAS) to appoint a compliance officer. This includes both Standard and Major Payment Institution License holders. The appointment must be at the management level and the compliance officer must have adequate expertise and authority to oversee all compliance functions in the organization. The MAS regards the compliance officer as having a very important oversight role which is evident in the licensing and ongoing compliance requirements.

- Following is the list of entities needed to apply for Singapore payment institution license:

Licensing applicants’ obligations

- Every licensed applicant (Singapore Payment Institution License), regardless of if they were applying for a standard or major license, must appoint a compliance officer. This appointment must take place at the application stage and/or before any activities commence. The applicant must show MAS that compliance oversight is in place to manage their regulatory obligations from day one, which can be handled by Tetra Consultants through regulatory compliance consulting.

Direct appoint by the applicant company

- The applicant company bears the responsibility of hiring a compliance officer who has the appropriate skills and authority to oversee compliance issues. The process of direct appointment means that compliance is an organizational function, not something that is left to an external party or a relevant third party.

Supervision in outsourced situations

- If compliance functions are earned through a holding company or relevant overseas entity, the applicant company still must appoint a compliance officer or person responsible. This is to ensure that there is an appropriate, identifiable local connection and accountability mechanism, as well as to identify someone with whom the Monetary Authority of Singapore can communicate locally who understands the Singapore regulatory environment.

Eligibility for Singapore Payment Institution License compliance officer

- The compliance officer must be appropriately qualified to have sufficient experience and authority to supervise the applicant’s compliance function.

- The person should have relevant experience in the operation of a payment services business or in a relevant capacity within the financial services industry.

- The compliance function can either be acted on by a specific appointment in-house compliance officer or be outsourced to a related entity that has an independent and dedicated compliance function (with permission from MAS).

- The compliance officer may also hold other non-conflicting roles in the organization, for example, in-house legal counsel, so long as there are no conflicts of interest.

- At the point of application, the compliance officer must have at least been identified but must be employed and appointed before the business commences operations.

- MAS may choose to interview the proposed compliance officer to determine if they have sufficient knowledge regarding MAS requirements and the Payment Services Act.

- The compliance officer must also be fit and proper in line with MAS Guidelines on Fit and Proper Criteria.

- The ultimate responsibility and accountability for compliance lies with the compliance officer, directors, and CEO.

- Compliance arrangements must also be appropriate to the nature, scale, and complexity of the business.

Singapore Payment Institution License compliance officer assistance

- All of our compliance officers are Certified Anti-Money Laundering Specialists (CAMS) and Certified Crypto Asset AFC Specialists (CCAS) with a minimum of 5 years of work experience and exposure to the finance system and/or fintech world. Our staff are very familiar with the Payment Services Act (PSA) and have a working understanding of the MAS regulatory expectations. We have your compliance function covered with specialist knowledge to manage a solid AML/CFT framework, monitor for regulatory risks, and fulfill any continuing obligations imposed by the Monetary Authority of Singapore (MAS).

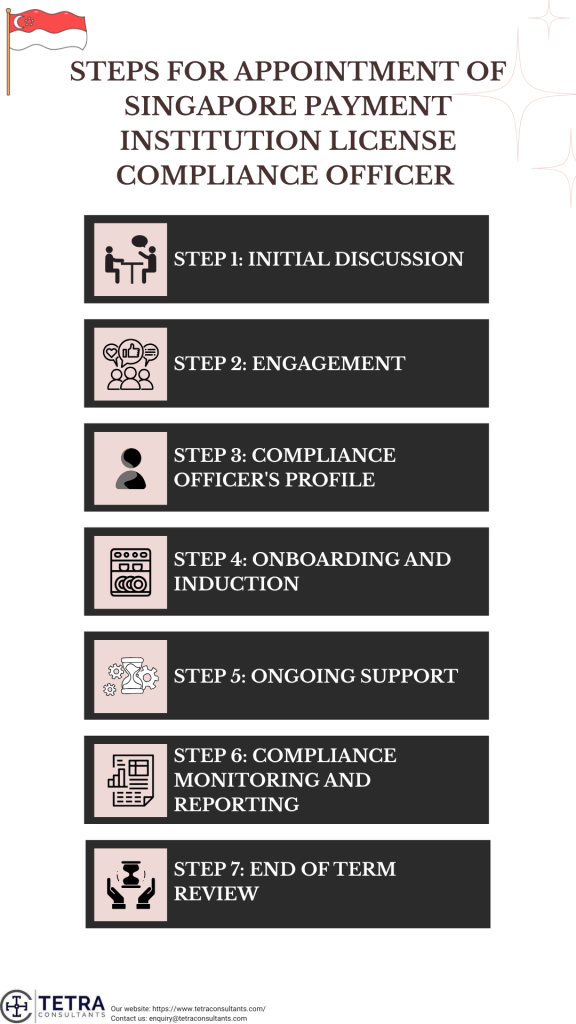

Steps for appointment of Singapore Payment Institution License compliance officer

Step 1: Initial discussion

- At Tetra Consultants, we start by having a conversation about your business model, regulatory obligations and the compliance issues you are experiencing as an applicant for a Singapore Payment Institution License. We will also discuss compliance officer’s daily operations, which could involve regulatory reporting obligations, risk assessment procedures, and internal controls. This is to ensure that the proposal provided to you is tailored to your operation and to ensure it meets MAS standards.

Step 2: Engagement

- Once you have decided to engage Tetra Consultants, we will send you an appointment letter that captures the terms of service, work scope and timeframes. Accompanying the letter will be an invoice to allow you to know how much the service will cost. This is to further define and clarify the service that will be provided to enable both parties to receive maximum benefits at the time of engagement.

Step 3: Compliance officer’s profile

- After engagement, we will provide CV with the compliance officer’s and state their current activities and prior activity and highlight areas of relevant qualifications, industry experience and experience with MAS’s Payment Services Act compliance obligations. You will have an opportunity at this stage to ascertain the compliance officer’s experience of suitability and to validate any assumptions with explanations or to questions that are answered with supplementary information.

Step 4: Onboarding and induction

- We organize a formal onboarding process where the compliance officer will be properly assessed with your company, including the operations, compliance policy frameworks, and regulatory obligations. The compliance officer will be linked to your internal teams and systems so that they have a strong understanding of your compliance expectations, including risk profile and compliance priorities. This stage is very important to ensure that the compliance officer can do their job effectively from the start.

Step 5: Ongoing support

- Throughout the engagement, the compliance officer is active in your company and regularly schedules meetings with you to assess compliance status, compliance with regulatory documentation, discussions on new regulation changes or developments, and identifying risks that may be rising. The compliance officer can also support the internal controls, assist with regulatory filings, and prepare for any MAS audits or regulatory inspections. Continuous support is a benefit for you to ensure compliance is being managed effectively as your business grows.

Step 6: Compliance monitoring and reporting

- We conduct regular audits of compliance for your business to identify any gaps in compliance or ideas for improvements. We can assist you in preparing your reports for MAS and submitting these in the relevant time frame to ensure that they are accurate and completed on time. Ongoing compliance monitoring can help with maintaining your license and provide an added layer of assurance of not breaching any regulations.

Step 7: End of term review

- At the conclusion of the appointment period, we will conduct a comprehensive review of service delivery and compliance parameters. During this conversation we will discuss any new elements in your business or regulatory environment and options to either cancel, renew, or modify our engagement. Our goal is to ensure your compliance support continues to be consistent with your future needs.

Services offered by Tetra Consultants for Singapore Payment Institution License compliance officer

- Ensure ongoing compliance with the Payment Services Act (PS Act) (including any licensing conditions related to the business).

- Incorporate any applicable MAS guidelines and circulars as they are issued, including the Technology Risk Management (TRM) Guidelines and AML/CFT Notices (e.g., MAS Notice PSN01 and PSN02).

- Coordinate with the Monetary Authority of Singapore (MAS) regarding regulatory issues, inspections, and notifications.

- Oversee the process of license renewals and changes, ensuring that all submissions are made in full, properly timed, and on time.

- Act as AML/CFT Compliance Officer, overseeing the implementation of the company’s AML/CFT framework in accordance with MAS Notice PSN01.

- Monitor CDD, EDD, and KYC processes to ensure customers are properly verified.

- Monitor customer transactions for suspicious transactions, including filing Suspicious Transaction Reports (STRs) where required.

- Conduct regular sanctions screening and politically exposed persons (PEP) screening, along with ongoing customer monitoring.

- Identify and assess the regulatory and operational risks associated with the company’s products and services, including geographical exposure.

- Work with other departments to design and implement appropriate controls to mitigate compliance- and business-related risks.

- Maintain all internal policies on a regular basis to accommodate changes to regulations and the business.

- Develop and maintain standard operating procedures (SOPs) to assist with compliance on a daily basis as well as internal controls.

- Conduct regular training sessions for employees for any relevant regulatory compliance issues; for example, ethics, AML/CFT and data privacy.

- Ensure that all key personnel understand their compliance duties as required by the regulatory framework.

- Coordinate and respond to any MAS audits, inspections or requests for information, and ensure that all responses are accurate and on time.

- Conduct internal compliance reviews and audits to identify weaknesses or gaps in existing controls.

- Report compliance issues to senior management or the Board and provide ongoing updates on remediation progress.

- Prepare and submit all regulatory returns including transaction volume reporting, AML compliance, statutory disclosures, and others.

- Monitoring compliance risks associated with third-party or outsourced service providers.

- Ensuring compliance with MAS Outsourcing Guidelines (for example, due diligence, monitoring, contractual safeguards, etc.).

Cost for appointment of Singapore Payment Institution License compliance officer

- As Tetra Consultants, when we are facilitating the appointment of a compliance officer for your Singapore Payment Institution License, there may be a number of fees associated with this process; for example, professional recruitment fees for sourcing and vetting compliance officers, administrative fees for preparing and submitting the required application and documentation to the Monetary Authority of Singapore (MAS) for the appointment of the compliance officer, and costs for preparing or amending compliance policies and manuals in order to meet the regulatory requirements. There can also be fees for conducting background checks, preparing employment contracts, and if applicable, obtaining an Employment Pass for foreign candidates. Then there are ongoing communication costs with MAS and preparing any further requirements that may be requested, to ensure your Singapore Payment Institution License compliance officer appointment is seamless and compliant.

Why choose Tetra Consultants?

When you choose Tetra Consultants to appoint your Singapore Payment Institution License compliance officer, you can be assured of a hassle-free, professional process from start to finish. With our knowledge of the industry, comprehensive position and service package, and our experience and track record on regulatory compliance, we are a trusted partner for companies entering one of the most exciting payments markets in the world.

End-to-end service coverage

- Tetra Consultants applies a management approach to the whole process: preparing, recruiting, identifying and finally, preparing and submitting all of the documentation required to MAS. On an ongoing basis, we also provide support with compliance frameworks to ensure your business stays fully in-line with regulatory compliance throughout the local business structure.

Expertise in regulator knowledge

- Our team has experience and knowledge of the Payment Services Act and MAS requirements. We ensure our clients understand the regulatory details, as well as the common pitfalls to avoid compliance officer ‘fit and proper’ criteria to address the formality of license approval and operation.

Integrated business setup solutions

- In addition to appointing compliance officers, Tetra Consultants is a one-stop shop for registering your company in Singapore, corporate bank account opening and preparing business plans and AML policies. The integrated solutions take away headaches around administrative work and allow you to enter the Singapore market seamlessly.

Transparent and timely communication

- We provide clear timelines and commit to keeping you informed with regular updates from us and also contact MAS on your behalf. Our active project management gives you peace of mind that items are being worked on in a timely manner, ensuring your application and compliance officer appointment gets processed accurately and efficiently.

Global experience and local expertise

- We are headquartered here in Singapore and have clients from around the world, so Tetra Consultants offers a global viewpoint and local expertise. We are available 24 hours, 7 days a week, and we maintain very high standards of service. This approach makes us the partner of choice for businesses seeking certified compliance solutions in Singapore’s regulated financial services industry.

Looking to appoint Singapore Payment Institution License compliance officer

- Engaging Tetra Consultants as your Singapore Payment Institution License compliance officer makes the entire process smoother and fully compliant at every touchpoint. We offer a comprehensive service yield from company set-up and hiring the appropriate compliance officers to prepare compliance documents and ongoing liaison with the authorities.

- Tetra Consultants has extensive experience in Singapore’s regulatory climate, which is unique to the region, and we have continuously supported international clients. This supports an efficient and open process to fulfill the requirements of MAS. With Tetra Consultants addressing your compliance requirements, you can be more relaxed knowing you are engaging someone who will protect your interests and the longevity of your success inside the competitive payments market in Singapore.

- Contact us to know more about Singapore Payment Institution License compliance officer and our team will revert in 24 hours.

FAQ

Who must appoint a compliance officer?

When should the compliance officer be appointed?

What qualifications must the compliance officer possess?

What are compliance officer's primary duties?

Does MAS approve the appointment?

What are the consequences if a compliance officer for a Singapore Payment Institution fails to do their job?

How does MAS determine the suitability of compliance officers?

Can a compliance function be supported by a holding company or overseas entity?

Are there any compliance arrangements which must also be addressed in addition to the appointment of a compliance officer?

Are “management level” and “senior management” used interchangeably in this context?

Incorporation Process

Nominee Director Services

Bank Account Opening

Singapore Shelf Company

Common Types

Singapore Family Office

Singapore Foundation

Singapore Trust

Compliance Officer Services

Cryptocurrency Company

Digital Token Service Provider License

Payment Institution License

Immigration Services

Individual Tax Filing Services

Recruitment Services

Accounting & Tax

Annual Filing Requirements

Singapore Yacht Registration

Successful Case Study