Singapore Digital Token Service Provider (DTSP) License application

- The Singapore Digital Token Service Provider (DTSP) License regime has recently emerged as one of the strongest and most widely respected regulatory frameworks for digital asset businesses. Through the Monetary Authority of Singapore, the jurisdiction has positioned itself as a trusted international hub in the areas of fintech, blockchain, and digital token innovation, while also maintaining strict regulatory oversight.

- For business owners and global fintech teams wanting to register company in Singapore and work in the space of digital assets, getting the appropriate digital payment license in Singapore has become a critical step. MAS has recently clarified that only firms with strong governance, sound risk management, and genuine economic substance will be considered for approval in Singapore. The regulatory expectations have become increasingly stringent; professional guidance is necessary to easily navigate through the application process of the Singapore DTSP License. At Tetra Consultants, we support our clients with an end-to-end licensing of digital payment token service Singapore, in order to ensure regulatory alignment, correct documentation, and a smooth negotiation process with the MAS.

What is Singapore Digital Token Service Provider (DTSP) License?

- The Singapore Digital Token Service Provider (DTSP) License controls cryptocurrency-related services under the Monetary Authority of Singapore. The license falls under the Payment Services Act 2019 (PS Act), which requires providers of digital payment token services such as exchanges, custody, or transmission, to get a license to operate legally. Businesses that want to provide digital token-related services from Singapore, whether they are serving local or international customers, are now subject to the licensing requirements under the Financial Services and Markets Act 2022 (FSMA).

- With the introduction of the Digital Token Service Provider (DTSP) regime under the FSMA, MAS has expanded the regulatory coverage in order to include entities operating from Singapore, even if they serve customers who are living overseas. This will ensure that the Singapore-based business operations do not pose any reputational or regulatory risks to the global financial system. The Singapore DTSP License is hence not just a registration formality but an effective compliance framework created to protect financial stability, prevent money laundering, and protect market integrity.

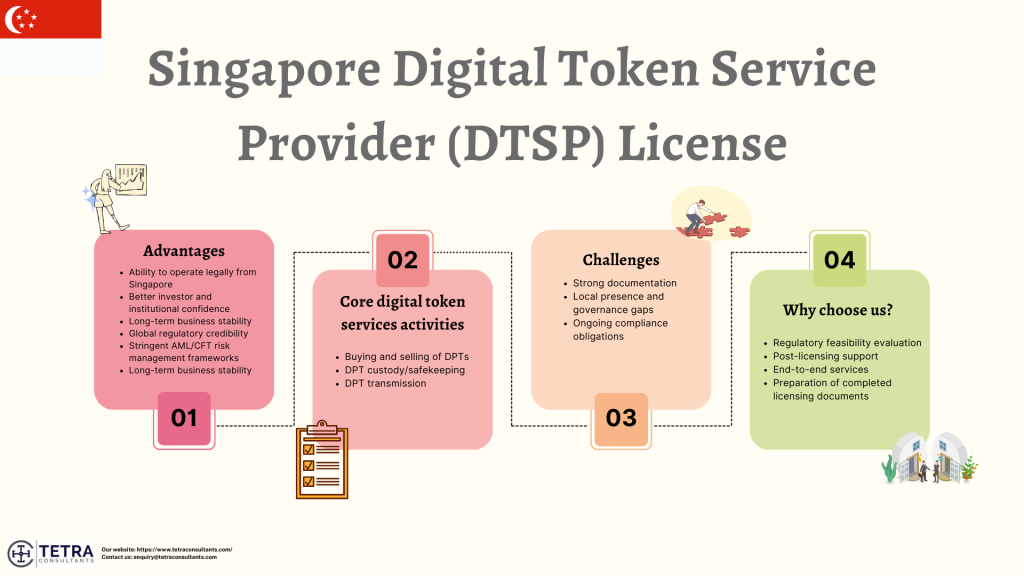

Advantages of getting a Singapore Digital Token Service Provider (DTSP) License

- Getting a Singapore Digital Token Service Provider (DTSP) License provides major strategic, regulatory, and commercial benefits for businesses that are operating in the fields of digital assets and blockchain technology. The regulatory framework of Singapore is created to balance out innovation with financial stability, which makes the licenses highly valued globally:

Ability to operate legally from Singapore

- MAS has clarified that entities operating from the jurisdiction and providing digital payment token services to international customers, should get a license under the DTSP regime. Getting the Singapore Digital Token Service Provider (DTSP) License makes sure that operations stay lawful and future-proof.

Better investor and institutional confidence

- Investors and institutional clients mainly prefer working with the regulated entities. A Singapore DTSP License showcases long-term commitment, risk dissociation, and regulatory readiness, which makes fundraising and strategic partnerships easy.

Stringent AML/CFT risk management frameworks

- The licensing procedure requires applicants to incorporate stronger AML/CFT controls, governance structures, as well as internal policies. While these requirements are demanding, incorporating them improves operational resilience and protects businesses from financial crime risks.

Long-term business stability

- In order to protect the financial reputation of Singapore, MAS has stated that it will strengthen DTSP approvals. Getting a license will position your business among a select group of compliant operators, which supports long-term growth and regulatory stability.

Global regulatory credibility

- A Singapore DTSP License is issued by the Monetary Authority of Singapore, and is considered to be one of the most respected financial regulatory authorities globally. Holding this license showcases strong governance, transparency, and regulatory compliance, which improves trust among investors, partners, and counterparties.

Better access to banking and financial services

- Licensed serviced providers are effectively positioned to open operational as well as segregated bank accounts. Bank and financial institutions are significantly more receptive to the licensed business entities because of reduced compliance as well as reputational risks.

Timeline for obtaining a Singapore Digital Token Service Provider (DTSP) License

- The timeline for getting a Singapore Digital Token Service Provider (DTSP) License usually spans over multiple months and follows a structured regulatory process. Tetra Consultants incorporates your Singapore company within one week, during which a nominee director is hired only for registration purposes, and is intended to be replaced within six months. At the same time, our team begins the recruitment process for the local Executive Director and local Compliance officer (management level), which usually takes around three weeks. Once your company is incorporated, we prepare the required documentation for the MAS DTSP License, and the first draft is usually completed within one week. Our team then gets a legal opinion from a MAS-approved law firm regarding the activities of the proposed digital payment token service Singapore, fall within the regulated scope, which usually takes three to four weeks on the basis of business complexity.

- After submission, the MAS reviews the application and may conduct interviews with the management personnel or the Compliance Officer. If all the regulatory requirements are met, then the Singapore Digital Token Service Provider (DTSP) License is usually approved within six to seven months. After this, Tetra Consultants helps you with opening operational and segregated bank accounts, which usually takes six to eight weeks.

Main regulatory authorities for the Singapore Digital Token Service Provider (DTSP) License

- The Monetary Authority of Singapore (MAS) serves as the main regulatory authority for DTSP License. MAS also oversees licensing, compliance, and also the enforcement of regulations under the Payment Services Act 2019.

- MAS issues licenses as the Standard Payment Institution (SPI) or Major Payment Institution (MPI) on the basis of transaction volumes, enforces AML/CFT requirements, and mandates the segregation of customer assets. The authority also conducts regular audits, approves applications, and updates guidelines such as PS-G02 for public DPT services and PS-G03 for customer protection.

- Furthermore, MAS also collaborates with the Commercial Affairs Department (CAD) for investigations into unlicensed business activities or fraud. No other standalone authority exists, all the DPT regulation centralizes under the payment frameworks of DPT.

Activities allowed under the Singapore Digital Token Service Provider (DTSP) License

- MAS DTSP License authorizes specific regulated activities that are related to cryptocurrencies and similar tokens, which are being used as payment tokens. Here are the main activities allowed under this license type:

Core digital token services:

- Buying and selling of DPTs– The businesses can participate in the execution of trades of digital payment tokens such as cryptocurrencies, such as Bitcoin, for fiat or other DPTs on behalf of the customers.

- DPT custody/safekeeping- Businesses can provide custodial wallet services, secure storage, and manage their clients’ DPT holdings, with compulsory asset segregation.

- DPT transmission- Businesses can facilitate transfers of DPTs between users or accounts; this consists of processing payments or settlements using the DPTs.

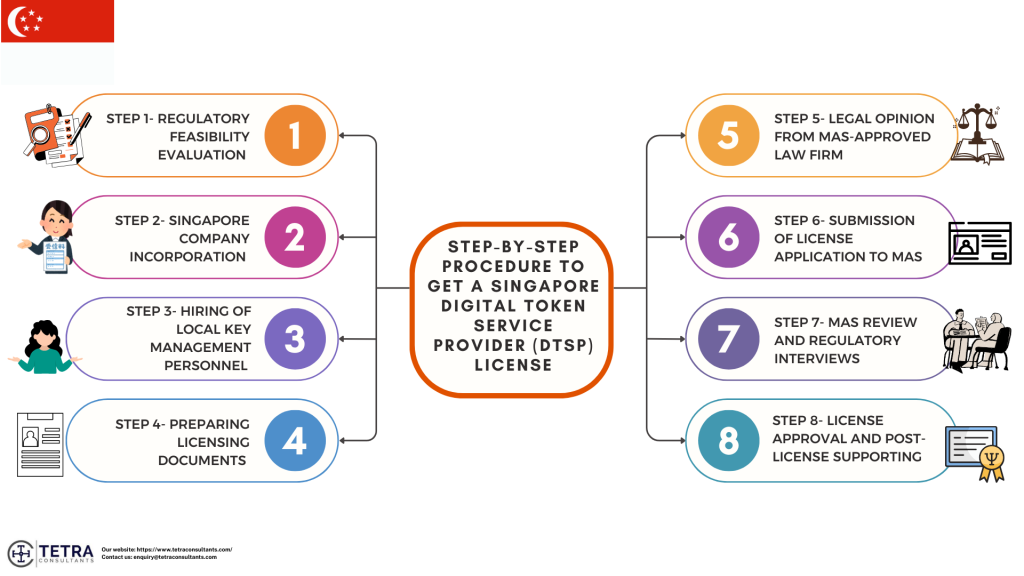

Step-by-Step procedure to get a Singapore Digital Token Service Provider (DTSP) License

Step 1- Regulatory feasibility evaluation

- Tetra Consultants start by conducting a detailed evaluation of the proposed business model to understand whether the planned activities fall under the Singapore Digital Token Service Provider (DTSP) License regime. This consists of assessing the nature of digital tokens, target markets, and service offerings under the MAS DTSP guidelines.

Step 2- Singapore company incorporation

- We help with the incorporation of a Singapore business entity, which includes the appointment of a nominee director for the initial setup procedure. The nominee director is used only for the company incorporation, with a structured plan to transition to a permanent local director within six months.

Step 3- Hiring of local key management personnel

- Our team then begins the recruitment process to hire a qualified local Executive Director and local Compliance Officer (management level) who fulfills the fit and proper requirements set up by the MAS. Tetra Consultants will ensure that individuals possess relevant regulatory and industry experience.

Step 4- Preparing licensing documents

- Our team then prepares all the mandatory documents that are needed for the MAS DTSP License. This includes all the business plan, AML/CFT framework, risk management policies, internal controls, governance structure, and compliance manuals.

Step 5- Legal opinion from MAS-approved law firm

- Our team then coordinates with the MAS-approved law firm to get a formal legal opinion in order to confirm whether the proposed digital payment token service Singapore activities are controlled and fall within the DTSP licensing framework.

Step 6- Submission of license application to MAS

- Once the documents and legal opinions are finalized, Tetra Consultants then submits a completed and well-secured Singapore Digital Token Service Provider (DTSP) License application to the MAS.

Step 7- MAS review and regulatory interviews

- MAS may assign a case officer, and request clarifications or an interview with key management personnel or the Compliance Officer. Our team will provide regulatory guidance and interview preparation in order to ensure readiness.

Step 8- License approval and post-license supporting

- Upon getting the approval, the license will be issued. Tetra Consultants will then help you with post-licensing requirements, this includes the opening of operational and segregated bank accounts, and ongoing compliance advisory.

Documents needed for Singapore Digital Token Service Provider (DTSP) License

- In order to get a DTSP License in Singapore, the MAS usually expects a detailed application. The exact checklist of this license is set out in MAS Form 1 and related guidance. Applicants will have to prepare these documents:

Corporate and ownership documents

- Certificate of incorporation, constitution, and present business profile/company extract

- Board resolution approving the application, and hiring key officers (CEO, compliance officer, MLRO, and director)

- Detailed shareholding chart that shows ultimate beneficial owners, controllers, and any group structure. This also includes percentages and justification of each entity

Business plan and operations

- Detailed business plan that describes all the services such as (DPT exchange, custody, transfer), along with target customers, jurisdictions served, and channel of distribution

- Organizational chart (group-level and entity-level) showing reporting lines, risk management, IT/security, internal audit, and compliance function

- Detailed description of business model (revenue streams, counterparties, fee structure, and on/off-ramp arrangements)

AML/CFT, and sanctions documentation

- Full AML/CFT policy and processes, that are aligned with the MAS notices (such as CDD, EDD for high-risk customers, ongoing monitoring, PEP handling)

- Customer risk evaluation methods and enterprise-wide risk evaluation, which covers products, geography, delivery channels, and types of customers

- Processes for STR filing, transaction monitoring rules and scenarios, name screening setup, and record-keeping standards

Financial and capital documents

- The latest audited financial statement of the applicant for the past three years

- Financial projections along with capital adequacy evaluation that covers at least 3 years, along with assumptions regarding transaction volumes and DPT float

- Evidence of fulfilling the capital requirements, such as bank statements, capital injection documents, and shareholder funding arrangements.

Governance, fit and proper

- Fit and proper declarations along with detailed CVs for directors, CEO, key executives, compliance officer, shareholders, and MLRO

- Board and management governance framework, which consists of committees, meeting frequency, risk and compliance oversight, along with conflict-of-interest policy

- Internal policies regarding fitness and propriety, remuneration (where relevant), and handling of conflicts of interest, related-party transactions, and whistleblowing

Technology, cybersecurity, and DPT-specific attachments

- Overview of technology architecture, and IT operations documentation (systems, APIs, security zones, key vendors, and hosting)

- DPT-specific technology evaluation questionnaire, and supporting documents (wallet design, private key management, segregation of client assets, backup and recovery)

- Framework of cybersecurity and policies (access control, encryption, key management, and incident response)

Risk management and compliance frameworks

- An enterprise-wide risk evaluation framework, which includes risk taxonomy and limits

- Compliance manual that covers monitoring, internal controls, regulatory reporting, and remediation processes

- Outsourcing policies and registers with copies of material outsourcing agreements (such as cloud, KYC providers, and custodians) and oversight mechanisms

Regulatory forms and declarations

- Completed MAS application form (Form 1 – Application for a DTSP License)

- Relevant declaration, confirmation, and checklist that is embedded in the form (such as no disqualifying events, consent to checks, and accuracy of information)

- Any legal opinions required (such as token classification, group regulatory evaluation) and external auditor confirmations where MAS expects them

Requirements for a Singapore Digital Token Service Provider (DTSP) License

- In order to get a Singapore Digital Token Service Provider (DTSP) License, applicants are required to fulfill the regulatory, governance, financial, and operational requirements that is prescribed by the Monetary Authority of Singapore (MAS), under the Financial Services and Markets Act 2022, and related DTSP regulations:

- The applicant should be a Singapore-incorporated company or a Singapore branch of a foreign corporation, subject to MAS evaluation

- The applicant is expected to hire appropriate locally based senior management, which will consist of

- At least one executive or non-executive director who is ordinarily resident in Singapore, and

- An executive director or senior officer holding a valid employment pass, wherever applicable

- The applicant will have to maintain a permanent place of business or a registered office in Singapore, where all the books, records, and regulatory information will be properly maintained

- The applicant should showcase adequate staffing arrangements in order to handle regulatory communications, customer inquiries, and complaints

- The minimum base capital is S$250,000 along with an annual license fee of S$10,000 regardless of business size. There is no application fee

- The applicant will have to submit forward-looking financial projections, along with evidence of the ability to meet the ongoing solvency and liquidity expectations

- All controllers, directors, senior management, and key officers should satisfy the fit and proper criteria of MAS. This includes integrity, competence, and financial soundness

- The board and senior management should exercise effective oversight, with clearly defined responsibilities for compliance, risk management, and AML/CFT

- The applicant will have to establish a strong AML/CFT framework that is aligned with the applicable MAS notices (including FSM-N27), incorporating:

- Risk-based customer due diligence (CDD) and enhanced due diligence (EDD)

- Ongoing transaction monitoring

- Timely suspicious transaction reporting

- Sanctions and adverse media screening

- Adequate technology risk management and cybersecurity controls, this includes access controls, incident response procedures, penetration testing, system resilience, and recovery planning

- The applicant will have to show the adoption of customer protection measures, this includes appropriate disclosure of risks that is associated with digital payment tokens and safeguards in order to prevent misuse of customer assets

- A legal opinion from a Singapore-based law firm that is experienced in MAS-regulated financial services, evaluating the business model, and confirms the regulatory status of the proposed digital token services

- Compliance with ongoing regulatory reporting obligations to MAS, which includes finance, compliance, and operational reporting

- Maintenance of an internal audit function or an independent review mechanism to periodically evaluate the effectiveness of the key controls, especially AML/CFT and technology risk

- Prompt notification to the MAS regarding material changes (business model, control changes, key officers, and cyber incidents), and continued compliance to all guidelines on DPT positions, and conduct

Common challenges in obtaining Singapore Digital Token Service Provider (DTSP) License

Strong documentation

- MAS demands an endless list of documents and submissions, which consists of legal opinion on token classification, independent auditor reports on AML/CFT controls, a detailed 3-year business plan with revenue models, and risk evaluations. If you submit incomplete or misaligned packages, it will trigger multiple revision rounds, delaying approvals for months.

- At Tetra Consultants, our team will collect all the documents, this includes indexed folders, explanatory memos, a financial model stress-tested for DPT volatility, and Singapore lawyer opinions.

Local presence and governance gaps

- MAS has made it compulsory for the business to have a Singapore-resident director, physical office, and robust board oversight, which is a challenge for foreign firms. Providing “fitness and propriety” for controllers and key personnel is usually a difficult task for foreign entrepreneurs.

- At Tetra Consultants, our team assists you in hiring a local executive director and ensures that all the key personnel are fulfilling the “fit and proper” criteria set by the MAS to ensure that the application process is going smoothly.

Ongoing compliance obligations

- MAS has stringent compliance obligations that the business has to follow. This includes regulatory reporting, which consists of financial, transaction, and compliance-related information. Regular maintenance of internal audit or equivalent independent review of the key controls, especially AML/CFT and technology.

- At Tetra Consultants, we provide regulatory compliance consulting and corporate bank account opening services in order to ensure that your business is fulfilling all the compliance obligations and is easily surviving in the strong regulatory environment of Singapore.

Cost of getting a Singapore Digital Token Service Provider (DTSP) License

- The cost of getting a Singapore Digital Token Service Provider (DTSP) License differs on the basis of the nature and complexity of the proposed digital token business activities. The regulatory scope needed, and the level of compliance infrastructure needed by the MAS, also impact the costs. The major cost components usually include Singapore company registration, nominee director arrangements, recruitment of a qualified local executive director and compliance officer (management level), and preparation of detailed compliance and AML/CFT documentation. At Tetra Consultants, our team clearly communicates all the costs to you during the initial consultation, so that you know for exactly what services you are paying for.

How can Tetra Consultants help with Singapore Digital Token Service Provider (DTSP) License

- Tetra Consultants provides end-to-end professional assistance for businesses looking to get a Singapore Digital Token Service Provider (DTSP) License. Our team ensures full compliance with the MAS and DTSP regulatory framework. This is why our global clients choose us:

- Regulatory feasibility evaluation– Our team evaluates whether the proposed activities fall within the MAS licensing requirements

- Preparation of completed licensing documents– Our team prepares all the documents that are needed by the MAS. This includes business plan, risk management frameworks, internal control, and AML/CFT policies

- Post-licensing support- Our team provides post-licensing support, which includes assistance with opening corporate bank accounts and ongoing compliance advisory

- End-to-end services- From company incorporation to post-license compliance obligations, our team helps you at every step

Looking to obtain Singapore Digital Token Service Provider (DTSP) License

- If you are looking to get a Singapore Digital Token Service Provider (DTSP) License, then it is necessary to work with a regulatory advisor who will understand both the commercial realities of the digital asset business and the strict expectations of the MAS. The licensing framework is created to give this license to only well-governed, well-capitalized, and compliant entities, which makes the need for professional support even more significant. At Tetra Consultants, we offer end-to-end support to help you get this license, from evaluating business feasibility and company set-up to regulatory engagement and post-license compliance. Our team helps your business to secure this license effectively while also creating a strong foundation for long-term success and sustainable operations in Singapore.

- Contact us, and our team will get back to you within 24 hours.

FAQ

What is a Singapore Digital Token Service Provider (DTSP) License?

At Tetra Consultants, how long does it take to get this license?

What are the main requirements imposed by the MAS for this license?

If I live abroad, can I still apply for this license?

How can Tetra Consultants help with the licensing process?

Incorporation Process

Nominee Director Services

Bank Account Opening

Singapore Shelf Company

Common Types

Singapore Family Office

Singapore Foundation

Singapore Trust

Compliance Officer Services

Cryptocurrency Company

Digital Token Service Provider License

Payment Institution License

Immigration Services

Individual Tax Filing Services

Recruitment Services

Accounting & Tax

Annual Filing Requirements

Singapore Yacht Registration

Successful Case Study