Singapore individual tax filing services

- Singapore individual tax filing services refer to the professional help or solutions offered by third-party service providers, such as Tetra Consultants. These services are created to help individuals fulfill their personal income tax obligations. Furthermore, due to business-friendly atmosphere of Singapore, more and more individuals are opting to register company in Singapore.

- At Tetra Consultants, our team ensures that you fulfill your tax obligations on time. The Inland Revenue Authority of Singapore introduces strict deadlines as well as compliance requirements. Through this page, you will understand the benefits of individual tax filing services, types of services that Tetra Consultants offer, documents needed, common challenges, and how we can help, costs for the individual tax filing services, and our step-by-step process.

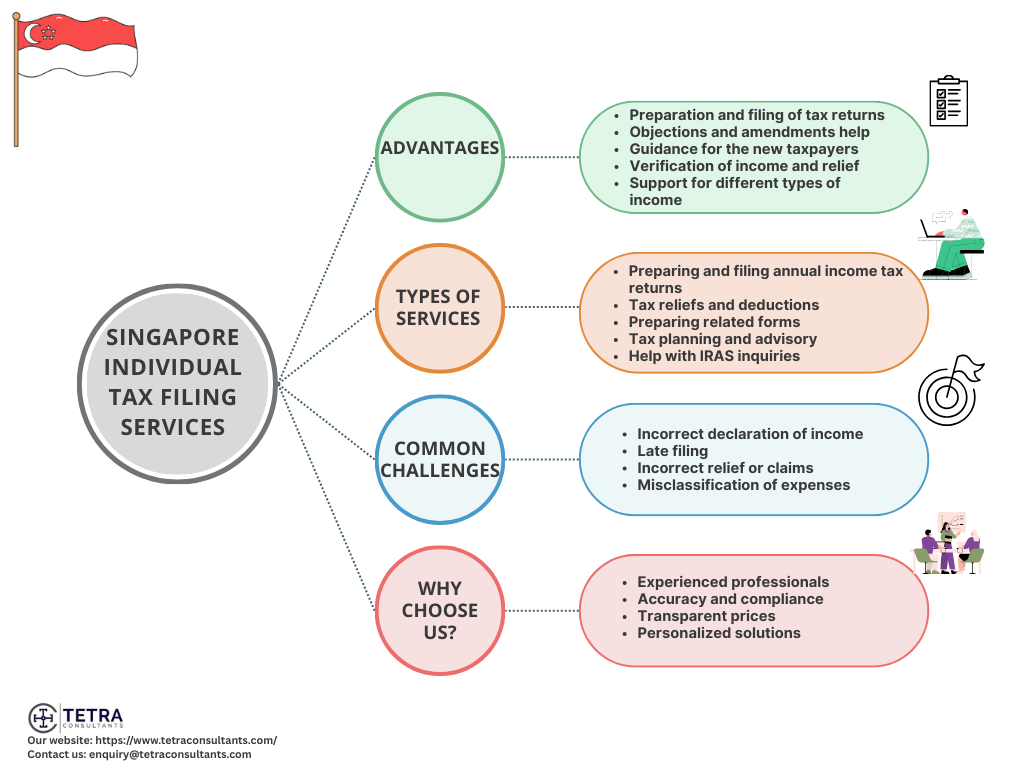

Advantages of individual tax filing services

- Singapore individual tax filing services refer to the help of professionals to help people file their personal income tax with the Inland Revenue Authority of Singapore (IRAS). These services usually consist of:

Preparation and filing of tax returns

- Tetra Consultants helps you to combine, arrange, and file annual tax returns by using accurate forms such as Form B1 for employed individuals, Form B for business owners or self-employed individuals, and Form M for non-residents of the country. The forms are filed through the IRAS myTax Portal.

Objections and amendments help

- Applicants often need help to dispute their Notice of Assessment (tax bill) or correct wrong information. Our team can help to file objections and amendments within the official deadlines.

Guidance for the new taxpayers

- At Tetra Consultants, our team also provides assistance and instructions to newly taxable individuals on how and when to file their taxes.

Verification of income and relief

- Our team at Tetra Consultants can also help you in checking allowable tax reliefs, like for dependents, Central Provident Fund (CPF) contributions on your income, in order to optimize your tax position.

Support for different types of income

- Our team handles complex returns, which include rental income, business income, and investment income, while also ensuring compliance and maximizing tax efficiency.

Who needs to file for personal income tax in Singapore?

- You need to file for personal income tax in Singapore if you fit under the following criteria:

- Your total annual income was more than S$22,000 in the previous calendar year.

- You get a notice in the form of a letter, email, form, or SMS from the IRAS, instructing you to file the income tax, even if your income is lower than S$22,000 or your employer participates in the Auto-Inclusion Scheme (AIS).

- You are a non-resident who derived income from Singapore, regardless of the amount.

- You have self-employment income with a net profit greater than S$6,000 in a year.

- However, it should be noted that individuals on the No-Filing Services (NFS) or Direct Notice of Assessment (D-NOA) do not need to file, but they should still verify the pre-filled information on the myTax Portal and update if there are any changes.

Services we offer for individual tax filing services

Preparing and filing annual income tax returns

- Our team at Tetra Consultants handles the compilation of your financial data, including your tax liability, and filing returns with the IRAS. We also include specific forms that are relevant to your income status to fully optimize your tax profile.

Extension requests and deadline management

- Our team is there to request extensions for deadlines and ensure on-time submission of the tax returns, to minimize the risk of penalties.

Tax reliefs and deductions

- Our experts carefully review your tax situation and ensure that all the applicable reliefs, like child, parent, or partner reliefs, along with deductible expenses such as business and rental property expenses, are included in your tax returns. This will, in return, reduce your tax bill.

Preparing related forms

- Tetra Consultants prepares supporting documents, which include employment-related forms such as IR8A and IR21, along with specialized schedules for unusual income types.

Tax planning and advisory

- At Tetra Consultants, our team offers strategic advice that provides our clients with tax relief, explains how to structure their income, and plans for their future taxes in order to get the most out of their taxable income.

Help with IRAS inquiries

- Our team handles all your queries, objections to Notice of Assessment, file amendments if there are any errors that are detected after the filing for your taxes, disclosures, and explains to you your previous tax mistakes.

Tax clearance and expatriate tax handling

- We help with the tax clearance process for professionals who are leaving Singapore and with expatriate tax matters.

Common challenges and how Tetra Consultants can help

Incorrect declaration of income

- Several individuals, especially the self-employed or those who have multiple sources of income, usually misclassify their income or omit various types of income, which leads to errors in their tax returns.

- At Tetra Consultants, our team clarifies and reports all forms of income accurately, which reduces errors and omissions. Our team is well-versed in the technical details of tax returns, which allows us to optimize your income.

Late filing

- Many individuals often overlook the deadlines or even assume that they do not need to file for tax returns, which leads to penalties and enforcement actions.

- At Tetra Consultants, our team reviews your income and then explains your tax return status to you. We also help individuals to file their taxes, to ensure that they do not pay heavy fines or have legal action taken against them.

Incorrect relief or claims

- Most of the time, it is a recurring problem if individuals file or claim personal reliefs and deductions if they do not meet qualifying conditions and fail to update new claims. Sometimes, taxpayers also assume that reliefs are carried over automatically from last year when manual updates are needed for changes.

- Tetra Consultants reviews the individual circumstances of our clients, and our team ensures that all the eligible reliefs and deductions claimed are made without breaching the IRAS rules, and guides clients on any new updates for changed reliefs.

Misclassification of expenses

- Some taxpayers also confuse personal expenses with their business deductions in order to make inappropriate claims for any non-deductible expense, which leads to disputes during audits. Our team at Tetra Consultants classifies all your expenses and puts them in different categories. This helps you to avoid making any false claims and optimize your income.

How to get started with individual tax filing services with Tetra Consultants

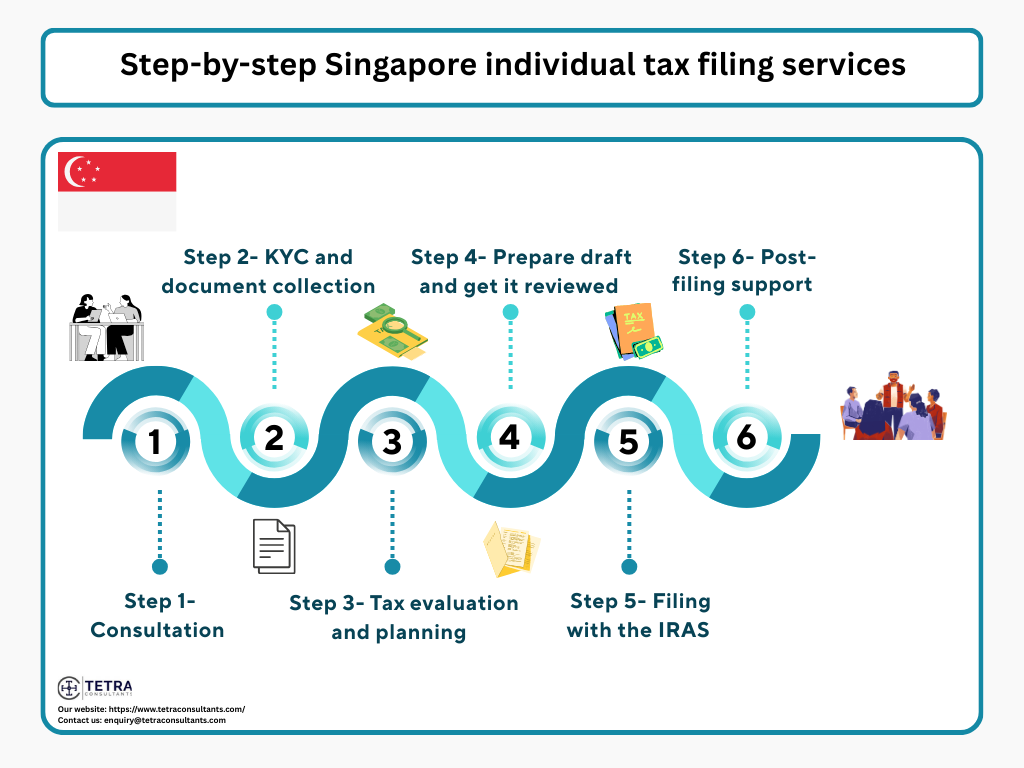

- Here is the step-by-step process of Singapore individual tax filing services that Tetra Consultants follows:

Step 1- Consultation

- At Tetra Consultants, we start with consultation in order to understand your sources of income, residential status, and specific tax filing needs. This allows us to evaluate your tax situation and recognize potential deductions that we can apply for.

Step 2- KYC and document collection

- Our team will start collecting necessary personal and financial documents like identification, statement of employee income, receipts for deductions, and CPF contribution records. Tetra Consultants will offer you a detailed checklist of all the documents needed in order to simplify this process.

Step 3- Tax evaluation and planning

- Our team then reviews all the information you have offered, predicts your residency status, and then calculates your estimated taxes. After this, we then recognize applicable reliefs, deductions, as well as exemptions in order to reduce your tax amount.

Step 4- Prepare draft and get it reviewed

- Tetra Consultants then prepares your draft return and gets it reviewed by you, which helps us to ensure that all the correct details are entered and adhere to the IRAS regulations.

Step 5- Filing with the IRAS

- After getting your approval, our team will then file your tax returns electronically through the IRAS myTax Portal, and Tetra Consultants will offer confirmations once your tax return is successfully submitted.

Step 6- Post-filing support

- Even after the submission of your tax return, our team is there for you and helps you with any IRAS correspondence that may arise.

- Furthermore, if you wish to start a business in Singapore, then at Tetra Consultants we also provide offshore company incorporation and corporate bank account opening services.

Documents needed for individual tax filing services

- The main documents needed for individual tax filing services are:

- Singpass or Singpass foreign user account (SFA)- This is needed for logging into the IRAS myTax Portal.

- Particulars of the dependents- This consists of information regarding the children, parents or even other dependents if the person has to make or update relief claims.

- Supporting documents for deductions and reliefs- This consists of relevant receipts, bills, or records of major claims for deductions such as CPF contributions, course fees, and insurance premiums.

- Form IR8A- This form is provided by your employer if they have not participated in the AIS scheme.

- Details of additional income– This consists of documents for rental income, such as tenancy agreements, rental receipts, investment income, and even other forms of income that are generated outside of your regular employment.

- Business information for self-employed individuals or partners

- Business registration number or partnership tax reference number

- Latest certificates of business registration, balance sheets, and profit & loss statements.

- Pay slips and letter of employment- Pay slips are required for recent months, and if you are newly employed letter of employment or proof of income is needed.

- Taxation forms- Form B1 for employees who are tax residents, Form B for the self-employed, and Form M for non-residents.

- Previous year tax documents- This consists of past tax notices and relevant receipts.

Costs for Individual tax filing services

- The costs of engaging in the professional Singapore individual tax filing services are based on multiple factors, like the complexity of your income tax structure, sources of income, if you need expatriate tax planning, and whether you need help in corresponding with IRAS. At Tetra Consultants, our fees are transparent and personalized to suit the unique requirements of every client. Before starting the individual tax filing service procedure, our team will provide you with a consultation in order to understand your situation. On the basis of this, we will offer you a quote based on the services you need.

Why choose Tetra Consultants

- Selecting the right service partner is significant in order to ensure accuracy, peace of mind, and compliance. Here is why Tetra Consultants stands out as a trusted service provider:

- Experienced professionals- At Tetra Consultants, our team consists of qualified consultants, trained specialists, and accountants.

- Accuracy and compliance- Our team conducts a thorough review process to ensure that your tax filing is free of errors and compliant with the Singapore tax laws.

- Personalized solutions- We customize our tax strategies based on your income profile.

- Transparent prices- We also provide clear and upfront prices with no hidden fees, so our clients know exactly what they are paying for.

Looking for individual tax filing services

- You do not have to stress every time you file for your personal income tax in Singapore. Whether you are a salaried employee or an entrepreneur, at Tetra Consultants, our team makes sure that all your tax obligations are fulfilled in adherence with the IRAS regulations.

- Our team simplifies the entire tax filing process, from calculating your tax liability, and recognizing tax eligible reliefs to file your return, and dealing with the IRAS on your behalf.

- Contact us to get individual tax filing services today.

FAQs

Who all needs to file for the personal income tax in Singapore?

What will happen if I miss the deadline to file for the tax return?

How do I know if I am a tax resident or not?

How long does the entire procedure take?

Do freelancers and self-employed individuals have to file for taxes in Singapore?

How much do your tax filing services usually cost?

Incorporation Process

Nominee Director Services

Bank Account Opening

Singapore Shelf Company

Common Types

Singapore Family Office

Singapore Foundation

Singapore Trust

Compliance Officer Services

Cryptocurrency Company

Payment Institution License

Immigration Services

Individual Tax Filing Services

Recruitment Services

Accounting & Tax

Annual Filing Requirements

Singapore Yacht Registration

Successful Case Study