Hong Kong Money Lenders License Application

- Applying for the Hong Kong money lenders license application is an important regulatory component for any business in the financial services sector that wishes to provide lending services in one of Asia’s most sophisticated markets.

- To apply for a license, entities must first register company in Hong Kong to ensure compliance with the law and readiness to operate from the outset. When paired with more than 2,124 licensed money lenders as of November 2024, this demonstrates Hong Kong’s compelling credit market and the level of regulatory oversight.

- To process the application, a company will need to demonstrate financial capability, submit extensive documentation, and then pass a review of the application in a licensing court. All of this reflects Hong Kong’s high standards of corporate governance and anti-money laundering standards.

- In relation to processing the application, Tetra Consultants provides seamless company registration, preparation of documentation in the application process, and post-licensing compliance updates and support tailored to your organization.

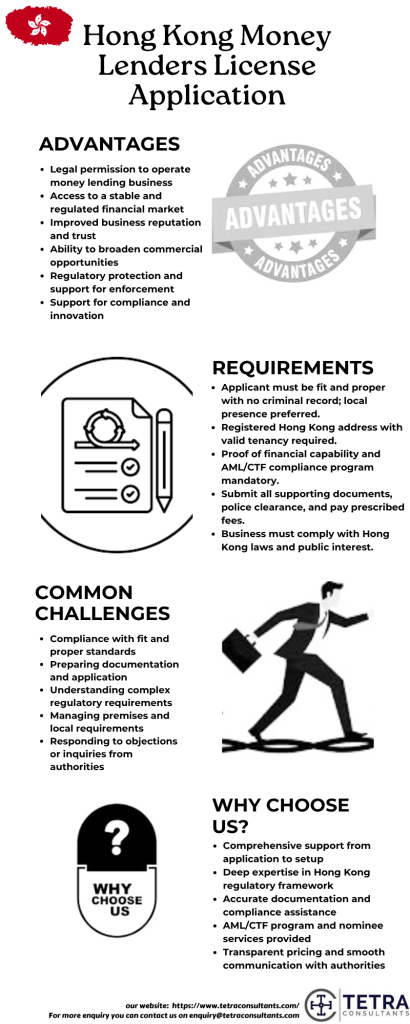

Benefits of Hong Kong Money Lenders License Application

Legal permission to operate money lending business

- Getting a Hong Kong Money Lenders License allows the holder to legally engage in money lending under the Money Lenders Ordinance (Cap. 163). This removes legal risk stemming from lending without a license, including unenforceable loans and fines, and enables a lawfully compliant money lending business.

Access to a stable and regulated financial market

- The license provides access to a mature and regulated financial market in Hong Kong, administered under strict rules regarding anti-money laundering (AML) and consumer protection. The regulatory framework provides credibility for businesses and confidence for investors, making it attractive to competent customers and partners.

Improved business reputation and trust

- Licensed money lenders are recognized and trusted by both borrowers and financial institutions. Licensing serves as an indication of compliance with fit and proper test criteria, operating transparency, and governance standards; all of which are critical components in developing ongoing client relationships in a competitive market.

Ability to broaden commercial opportunities

- A valid license allows you to diversify your mix of services, for example, by providing commercial loans or specialized credit products. This permits a broader-based revenue stream and market penetration, allowing lenders to take advantage of Hong Kong’s strategic position as a global financial center.

Regulatory protection and support for enforcement

- Licensed lenders have access to protections under the law, such as the ability to enforce loan agreements and enforce debts based on a court’s authority. Additionally, the licensing court also oversees and helps with disputes and checks and balances to guarantee fair play and ethical dealings among licensed entities.

Support for compliance and innovation

- The licensing process promotes the introduction of enhanced compliance frameworks through innovative technologies such as data analytics to assess risk and enhance service and offerings. Hong Kong’s supportive business ecosystem offers licensed lenders infrastructure in the form of various government initiatives and consulting services designed to assist licensed lenders expand their business.

Who can apply for the Hong Kong Money Lenders License Application?

- Anyone carrying on the business of making loans in Hong Kong or holding themselves out as a money lender must apply for a Hong Kong Money Lenders License. This includes individuals, companies, partnerships, or any other entity intending to offer lending services. Certain exemptions apply, such as licensed banks, deposit-taking companies, insurance firms, employers lending to employees, and loans secured by mortgages.

- Applicants must be fit and proper persons, financially sound, competent, and reputable, with suitable business premises for the money-lending activities. The application is subject to investigation by the Police, and the Licensing Court ultimately grants the license after reviewing the application and any objections. This regulatory framework ensures that only qualified and compliant entities operate as money lenders in Hong Kong.

Timeline for completing the Hong Kong Money Lenders License Application

- Acquiring a Hong Kong Money Lenders License is expected to take around 5 to 6 months to finish. The process starts with company registration, which can be completed within 1 week. We will assist in finding a physical office, recruiting a local Compliance Officer, and hiring or appointing a local Loan Approver, as well as facilitating the Top Talent Pass Scheme (TTPS) if required. These activities can be carried out concurrently and are expected to be completed within approximately 3 weeks.

- Once established, we then draft and finalize the license application to the Licensing Court for approval, which is expected to take 4 to 6 months. Once the license is attained, we will assist clients in corporate bank account opening in 4 to 6 weeks.

Regulator for Hong Kong Money Lenders License Application

- The authority that administers the Hong Kong Money Lenders License Application is the Licensing Court, which determines and grants money lenders licenses under the Money Lenders Ordinance (Chapter 163 of the Laws of Hong Kong). The Registrar of Money Lenders, which is currently the responsibility of the Registrar of Companies, reviews the applications for licenses and renewals as well as manages the public register of money lenders.

- The Commissioner of Police has the responsibility of enforcing the Money Lenders Ordinance, reviewing applications, investigating complaints, and ensuring the operation of money lenders complies with the law.

- The Money Lenders Ordinance addresses licensing, interest caps, access fees and charges restrictions, advertising content, and borrower protection. Collectively, they provide a comprehensive legal framework that requires money lending businesses to operate legally, responsibly, and transparently within the financial system of Hong Kong.

Activities allowed under Hong Kong Money Lenders License Application

- Carrying on the business of making loans or advances to individuals or businesses

- Providing credit facilities or financial accommodations excluding those regulated under the Banking Ordinance (Cap. 155)

- Engaging in peer-to-peer lending arrangements under licensing conditions

- Offering secured and unsecured lending products compliant with Money Lenders Ordinance (Cap. 163)

- Advertising money lending services within prescribed regulatory guidelines

- Operating from a registered business premise within Hong Kong

- Collecting repayment of loans including interest and charges as permitted by law

- Renewal and variation of licensing conditions as imposed by the Licensing Court

Activities excluded under Hong Kong Money Lenders License Application

- Lending by licensed banks and deposit-taking companies regulated under the Banking Ordinance.

- Loans made by employers to their employees as an employment benefit.

- Loans under bona fide credit card schemes.

- Loans secured by mortgage on immovable property.

- Lending by pawnbrokers licensed under the relevant laws.

- Loans made by finance companies licensed under the Hong Kong Companies Act.

- Corporate or commercial loans are not primarily for money lending business purposes.

- Lending solely to corporations, limited liability partnerships, trustees of business trusts or real estate investment trusts.

- Loans made to accredited investors under the Hong Kong Securities and Futures Commission (SFC).

- Lending activities covered under other regulatory regimes are exempt from the Money Lenders Ordinance.

Steps for obtaining a Hong Kong Money Lenders License

Step 1: Engagement, planning and company incorporation

- To begin, we will understand your business objectives, confirm scope, timelines, and fees, and collect initial KYC and corporate documents. After the engagement is confirmed, our team will then incorporate your Hong Kong company by preparing and filing all the necessary statutory documents with the Companies Registry.

- This process is usually wrapped up within a week. And in addition to the incorporation, we can also assist you in obtaining international trademark registration to help protect your brand identity on a global scale an important consideration for newly established companies entering the Hong Kong market.

Step 2: Local office and compliance officer sourcing

- We identify an appropriate local office address and recruit a qualified Compliance Officer that meets the Hong Kong regulatory requirements. Our team undertakes the property sourcing/purchase process, commercial terms, and all recruitment, including reference checking and onboarding.

Step 3: Arrangement of local loan approver

- We will help you appoint a local Loan Approver as required under the Money Lenders Ordinance. If you wish for the same person who will be a foreign director to act as Loan Approver, we will assist you in the Top Talent Pass Scheme (TTPS) application if eligible. Otherwise, we can also recruit a suitable local Loan Approver and ensure they meet all the fit and proper criteria, if applicable.

Step 4: Preparation of license application documents

- After incorporating the company and appointing a key person, we will start preparing the necessary documents for the Money Lenders License application. This includes drafting internal compliance policies, business plans, and other supporting documents related to the Money Lenders License to meet the expectations of the Commissioner of Police, so that we have a complete package that meets their quality standard.

Step 5: Submission, interview and regulatory coordination

- The submitted application is completed, and we coordinate the required local Loan Approver interview with the Commissioner of Police (CP). As your point of contact throughout the application processing period of four to six months, we continue to respond to any regulatory questions, provide clarification, and communicate the progress of your application.

Step 6: Corporate bank account opening

- After the approval of the Hong Kong business license, we can help you with corporate bank account opening in Hong Kong. We will liaise with several banking partners to prepare your documentation and guide you through the due diligence process to ensure that your account opens quickly and smoothly.

Step 7: Compliance and continued support after licensing

- Once your Money Lenders License has been obtained and the bank account opens, we support your business with compliance services post licensing. We assist with continued statutory filings, keeping your compliance policies updated and verifying your business is fully compliant with Hong Kong financial regulations. We are also available for advisory support as your business grows.

Documents required for the Hong Kong Money Lenders License Application

The documents required for the Hong Kong Money Lenders License Application include, but are not limited to:

- Completed application form (Form 2 for individuals/partnerships or Form 3 for companies).

- Statement in support of application (Form 4 for individuals/partnerships or Form 5 for companies).

- Supplementary Information Sheets (SIS) are relevant to the applicant type, including fit and proper criteria for forms.

- Business plan detailing the money lending activities.

- Documentary proof supporting capability in managing money lending business (e.g., reference letters, relevant certificates).

- Evidence of financial standing, such as bank statements of the applicant or company.

- Tenancy agreement for the premises intended to be used for the money lending business.

- Written consent from landlord permitting the use of premises for money lending activities.

- Permit to occupy a new building’ issued by the Buildings Department, indicating the approved use of premises.

- Land register document from the Land Registry confirming ownership or lease of the premises.

- Annual return of company showing directors and shareholders (if applicant is a company).

- Character references and police clearance certificates for key persons and directors.

- Payment of application fees.

Requirements for Hong Kong Money Lenders License Application

- The applicant must be a fit and proper person with no criminal background or disqualification.

- A minimum of one director is required, with no strict residency requirement, but having a local presence is preferable. For local presence Tetra Consultants can provide nominee director and shareholder services.

- Shareholders may be individuals or corporations, with no requirement to reside in the territory.

- A registered business address in Hong Kong is required, along with a tenancy agreement and landlord’s permission.

- Evidence of satisfactory financial capabilities, including bank statements and a business plan, is required.

- The applicant must maintain a robust AML/CTF compliance program.

- Directors and key individuals’ police clearance certificates.

- Filled application form and supporting statement form.

- Supplementary Information Sheets (SISs) according to applicant type.

- Permit to occupy premises by the Buildings Department.

- Land Registry documents proving ownership or lease of the business premises.

- Annual returns disclosing the company’s directors and shareholders (for corporate applicants).

- Payment of prescribed application fees.

- The applicant’s business must not be contrary to the public interest or laws of Hong Kong.

Renewal of Hong Kong Money Lenders License Application

- A Hong Kong Money Lenders License must be renewed three months prior to the expiration of the license. Licenses are valid for 12 months, as per the Money Lenders Ordinance. These license renewals require updated application forms, supplementary information sheets, and supporting documentation for submission to the Companies Registry and Licensing Office of the Hong Kong Police Force. Tetra Consultants provides seamless license management process and supports clients from start to finish which include documentation handling, regulatory contact, and accurate and timely submission for license renewals to ensure compliance in the Hong Kong financial sector.

Cost for obtaining a Hong Kong Money Lenders License

- When engaging with Tetra Consultants for the Hong Kong Money Lenders License Application, clients can rest assured that there will be full transparency and no hidden fees. The standard costs associated with each license would include application fees to the Companies Registry, police vetting fees, submission fees for the supporting documents, and license renewal fees. Professional fees for consulting, documentation, and compliance advisories are additional services provided to the client.

- Tetra Consultants maintains full transparency regarding all costs and options before the engagement to ensure accurate budgeting considerations. This transparency promotes trust and collaborative working relationships during the licensing engagement and allows applicants to be confident in their final budget upfront.

Common challenges in Hong Kong Money Lenders License Application

Compliance with fit and proper standards:

- Making sure that directors and other key persons meet rigorous standards of integrity, competence, and financial soundness can be challenging. Tetra Consultants assist with the assessment and preassessment process for clients, so they might select and prepare their application and supporting documentation in line with these standards, mitigating the risk of rejection.

Preparing documentation and application:

- Preparing the application forms, the required supporting statements, business plans, and other legal documents in full and accurate detail can take time. Tetra Consultants can help expedite the drafting and review of documentation to satisfy the necessary requirements in full and accurate detail.

Understanding complex regulatory requirements:

- It can be difficult to understand and navigate the Money Lenders Ordinance, conditions of licensing, and ongoing compliance obligations. Tetra Consultants has regulatory compliance consulting services to help clarify laws and develop integrated AML/CTF programs tailored to client needs.

Managing premises and local requirements:

- Before licensing, you must secure an appropriate business address in order to have a lawful tenancy and incorporate all relevant legal consents. Tetra Consultants will assist you in finding compliant office premises and arrange appropriate leasing agreements that comply with licensing requirements.

Responding to objections or inquiries from authorities:

- Objections or follow-up inquiries from the Licensing Court or Police will cause delays in your approval process. Tetra Consultants will act as an intermediary, communicating with the regulator on your behalf to be able to solve the matter expeditiously for licensing.

Looking to obtain a Hong Kong Money Lenders License

- By providing end-to-end support to meet the specific requirements of each client, Tetra Consultants is the partner you can trust to obtain a Hong Kong Money Lenders License. By leveraging their extensive experience and knowledge of Hong Kong’s regulatory framework, the team can navigate the complexities of licensing requirements efficiently and with clear communication and updates along the way.

- Our services encompass everything clients need, including offshore company incorporation, compliance advisory, documentation preparation, and liaison with regulatory authorities, helping clients avoid common mistakes and delays. Clients benefit from Tetra Consultants’ extensive relationships with local banks to expedite the corporate bank account opening, which is essential to obtain the Money Lenders license.

- Tetra Consultants prioritize a clear fee structure and tailored service to give clients an understanding of the engagement and expenditures from the start. This total approach not only facilitates faster approvals but also gives ongoing compliance and operating assistance to businesses entering a highly competitive market in Hong Kong’s financial landscape. By working with Tetra Consultants, future money lenders will find a straightforward and credible avenue for achieving full regulatory compliance and operating success.

- Contact us to know more about the Hong Kong Money Lenders License Application, and we will get back within 24 hours.

FAQ:

Who needs a Money Lenders License in Hong Kong?

What services are covered under this license?

How long is the license valid?

What documents are required for application?

Is the applicant required to be a resident in Hong Kong?

What occurs if an objection is made during application?

Will the license be renewed?

What is the Commissioner of Police's role?

How will changes be reported after obtaining the license?