How to set up a company in Brazil as a foreigner?

Before you decide to set up a company in Brazil, Tetra Consultants advises you to read through the following comprehensive guide to fully understand the steps essential for successful incorporation. Requirements and regulations are stated clearly to help you fully understand the process of starting a company in Brazil.

Can foreigners set up a business in Brazil?

There are no restrictions on the nationality of directors and shareholders in the company and the company can be wholly foreign-owned in most industries. However, the Brazilian company must appoint a local representative to act as a liaison between the company and local institutions. The common types of business setups for foreigners in Brazil include limited liability companies, branch offices and representative offices (RO).

Is Brazil a good place to start a business?

There are numerous business opportunities in Brazil due to the booming industry and fast-growing middle class. Although the complex tax system and unnecessary bureaucracy in Brazil have historically served as deterrence for people looking to set up a company in Brazil, the government is working on creating more favourable business conditions and has implemented tax reforms to make it easier for businesses to file taxes.

What is the ease of doing business in Brazil?

It is not easy to do business in Brazil because of rampant corruption, frequent practices of bribery and inefficient bureaucratic processes. As of 2021, Brazil ranks in the 124th position in terms of ease of doing business, according to the World Bank. This has led to a decline in foreign direct investments in the country. However, the Brazilian government is working on creating more a favourable business environment and has reformed tax laws to make it easier for businesses to file taxes.

As a summary, you can expect your Brazil company to be established within 16 weeks, depending on the type of entity established upon submission of the required due diligence documents. Our team of professionals will advise and ensure a seamless Brazil company formation.

Simply put, we can break down each engagement into four different phases:

- Planning and Strategy

- Incorporation

- Corporate Bank account opening

- Staying compliance

#1 Planning and Strategy

- Tetra Consultants will assist you in the Brazil company registration procedure by adhering to the following steps below.

- Tetra Consultants will provide recommendations on the suitable type of entity catering to your business objectives and activities. Prior to the setting up of Brazil company, Tetra Consultants will advise on the optimum paid-up share capital, regulatory requirements and whether there is a need for licenses for the intended business activity.

- There are many types of companies in Brazil and it is important to choose a business structure that is most suitable for your business activity. For example in Brazil, you can choose from a limited liability company (LLC), branch office or representative office for your entity.

- The type of company to choose will depend on your business structure and long-term goals. American companies doing business in Brazil tend to choose to set up a limited liability company, especially for small and medium-sized enterprises. Ultimately, the fees incurred in Brazil company registration and the minimum amount of paid-up share capital required will differ according to the type of company you choose.

- Tetra Consultants reserves your preferred business trade name with the Brazil Junta Commercial (Board of Trade).

- Before Tetra Consultants set up your company, we will provide you with a company secretary, a local registered office and local nominee resident Director. The nominee Brazilian Director serves as your representative to submit accurate financial statements and corporate tax returns.

- Before the official business incorporation, Tetra Consultants will aid you with the preparation of the company’s legalised Articles of Incorporation and Written Resolution on decisions made by shareholders pertaining to the company’s set up, business scope and appointment of Director(s).

- Brazil’s official language is Portuguese. As such if required, Tetra Consultants will assist you to notarize and translate all KYC documents of the directors and shareholders by a certified translator. This is to be completed prior to Brazil company registration.

#2 Incorporation

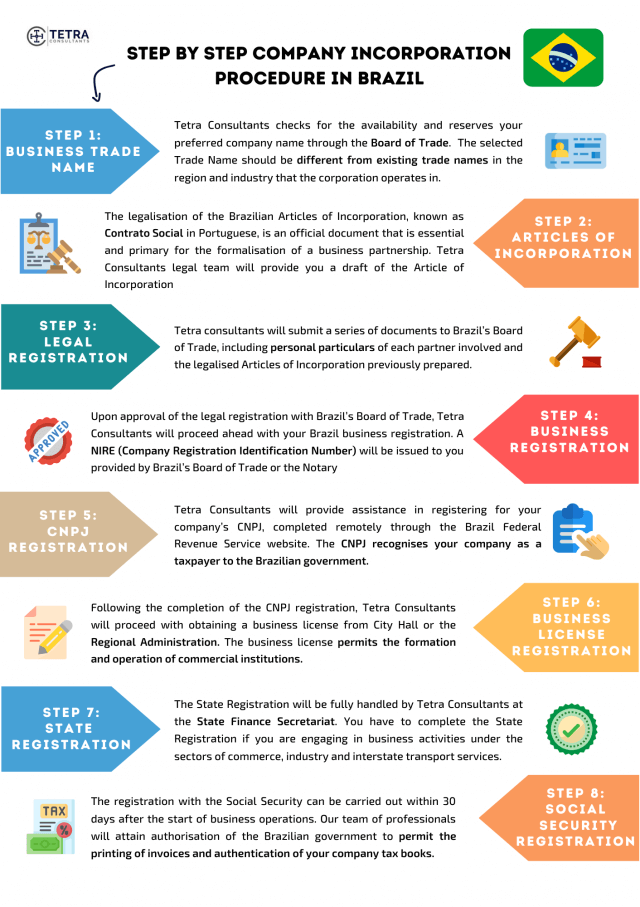

Business Trade Name

- Tetra Consultants checks for the availability and reserves your preferred company name through an application made to the Board of Trade.

- The selected Trade Name should be unique, different from existing trade names in the region and industry that the corporation operates in. Additionally, it should not violate public ethics.

Articles of Incorporation

- The legalisation of the Brazilian Articles of Incorporation, known as Contrato Social in Portuguese, is an official document that is essential and primary for the formalisation of a business partnership.

- Tetra Consultants legal team will provide you a draft of the Article of Incorporation, business plan, and other required legal documents. The Articles of Incorporation should adhere to the list of relevant regulations and standards enforced by the Junta Commercial (Board of Trade).

- The Articles of Incorporation has to be filled with the following mandatory information:

- Business Trade Name.

- Company’s Address.

- Outline and description of business activities to be carried out under company’s name.

- Restrictions on the transfer of company’s shares.

- Personal identification of each respective authorized shareholder and Director.

- Methods of distribution of losses and profits between business partners.

Legal registration with Brazil’s Board of Trade

- Tetra consultants will submit a series of documents to Brazil’s Board of Trade, including personal particulars of each partner involved and the legalised Articles of Incorporation previously prepared.

Business registration

- Upon approval of the legal registration with Brazil’s Board of Trade, Tetra Consultants will proceed ahead with your Brazil business registration. Our team of professionals will aid you in the preparation and submission of the following documents:

- Articles of Incorporation

- Certified Copy of Personal identification and Taxpayers ID of each respective authorized shareholder and Director

- National registration form

- Payment of registration fees through a bank deposit slip

- Once we have successfully received approval, a NIRE (Company Registration Identification Number) will be issued to you provided by Brazil’s Board of Trade or the Notary. The NIRE consists of a number established in the incorporation act.

National Register of Legal Entities (CNPJ)

- After incorporating in Brazil, Tetra Consultants will provide assistance in registering for your company’s CNPJ, completed remotely through the Brazil Federal Revenue Service The CNPJ recognises your company as a taxpayer to the Brazilian government.

Business License registration

- Following the completion of the CNPJ registration, Tetra Consultants will proceed with obtaining a business license from City Hall or the Regional Administration. The business license permits the formation and operation of commercial institutions. The following documents are necessary:

- Approval of address obtained from prior consultation

- A copy of CNPJ

- A copy of the Articles of Incorporation

State Registration

- The State Registration will be fully handled by Tetra Consultants at the State Finance Secretariat. It is mandatory for you to complete the State Registration if you are engaging in business activities under the sectors of commerce, industry and intermunicipal and interstate transport services.

Social Security Registration

- The registration with Social Security can be carried out within 30 days after the start of business operations. Furthermore, our team of professionals will attain authorization of the Brazilian government to permit the printing of invoices and authentication of your company tax books.

#3 Corporate Bank Account opening

- Simultaneously, Tetra Consultants will proceed to open a corporate bank account for your newly incorporated Brazilian company depending on your business goals and objectives. You can leverage on our extensive banking network and expect to receive your account numbers within 4 weeks.

- Tetra Consultants will contact multiple reputable international and Brazilian banks and present your business to the respective relationship manager and compliance team. To name a few, Tetra Consultants works with Banco do Brasil, Itaú Unibanco Holding and Banco Bradesco.

- Following that, Tetra Consultants will courier the internet banking token and access codes to your preferred addresses.

#4 Staying compliant

- You can expect Tetra Consultants to secure your newly-incorporated Brazilian company Tax Code from the Special Department of Federal Revenue of Brazil.

- Tetra Consultants will ensure your Brazil company is compliant with all accounting and tax obligations. Our team of Chartered Accountants will timely prepare your firm’s financial statements, corporate tax returns and bookkeeping on your behalf. Annual filings and tax returns will be timely completed on your behalf before the stipulated deadlines set out by the government.

- If you plan to be physically present and working in Brazil, Tetra Consultants will advise on a suitable work visa and proceed ahead with the visa procurement for you.

Contact us to find out more about the legal set up of a company in Brazil. Our team of experts will revert within the next 24 hours.

FAQs

Is it easy to start a business in Brazil?

- It is challenging and time-consuming to start a business in Brazil because of the unnecessary bureaucracy involved in the application of visas or procurement of certain documents for the Brazil Commercial Registry. Furthermore, it is not easy to find a local agent willing to act as a representative for foreign owners because they can be subjected to crackdowns from regulatory authorities where corruption is common.

What business should I start in Brazil?

- Some profitable industries which you can consider when starting a company in Brazil are the e-commerce, education, and cosmetics industries.

- E-commerce sales have been increasing steadily in the recent years, together with the number of small businesses in Brazil’s e-commerce industry. Hence, it is a very prospective industry to start a business in. Similarly, the education sector is also very profitable because of the small number of public institutions, especially for higher education courses. You may also wish to consider the cosmetic industry because Brazil has the fourth-largest cosmetic industry in the world, and one of the world’s largest consumer appetite for beauty and cosmetic products.

- In addition, the largest foreign companies in Brazil operate in the energy and food manufacturing sectors and these are also sectors which you may wish to consider when choosing your business in Brazil.

How to make business in Brazil?

- After you have successfully registered your company in Brazil, you will want to start sourcing for potential trade partners and clients. Brazilians tend to prefer a face-to-face meeting over a Skype call or video conference meeting, so do try to arrange someone to meet physically with your clients. It is also important to learn more about Brazilian culture so that you can engage in short conversations with potential clients and partners. The main language of communication in Brazil is Portuguese so it would be helpful to learn a few phrases, even if you are using an interpreter, so that you can show your interest in their country.

What are the risks of doing business in Brazil?

- Corruption in Brazil is rather common, and this is complicated by the bureaucratic judiciary and complex tax system. Businesses are often required to offer bribes to local government officials if they do not want to be clamped down by the government for tax fraud or if they wish to relax the inspection procedures. Credit risk is also another cause for concern for businesses in Brazil, as many of the small Brazilian banks have faced declining profits during the recession. However, the Central Bank in Brazil has stepped in to help these small Brazilian banks to cope with the recession by introducing measures to encourage larger banks to buy financial instruments from these smaller banks.

What is a Brazilian CPF number?

- The Brazilian CPF (Cadastro de Pessoas Físicas) number is the Brazilian individual taxpayer identification number. It is mandatory for all locals and foreign residents to have a Brazilian CPF number so that they can pay taxes in Brazil.

What is the legal environment of Brazil?

- Brazil’s legal system is based on civil law and established through the Federal Constitution enacted in 1988. While all the states in Brazil follow the constitution, each state has its own system of courts to resolve civil cases.

How much does it cost to register a company in Brazil?

- This depends on the exact services required from Tetra Consultants. Our fees are inclusive of government fees and all fees will be clearly stated in our engagement letter prior to the start of the engagement. Tetra Consultants believes in transparency with our valued clients and there are no hidden fees.

Are there any hidden fees throughout the engagement?

- Tetra Consultants believes in transparency between our firm and our international clients. All terms and conditions will be stated clearly within the appointment letter to ensure that there are no hidden fees.

- Our engagement fees consist of the government fees for company formation. However, it does not include third-party fees such as notarization, translation or legalization.