Being the fifth largest consumer market in the world, Brazil offers an attractive option for foreign investors looking to start a business in Latin America. Combining the size of their domestic market with the increase in their pro-foreign policies, the country has been able to enjoy a mixture of domestic consumer driven and external driven economic growth. Sharing a border with multiple countries also makes Brazil a suitable place for you to establish a foothold to subsequently branch out and expand into the Latin Americas and the Caribbean. This has allowed it to become the biggest economy by Gross Domestic Product (Purchasing Power Parity) in the Latin American and Caribbean region. However, Brazil company registration may not be as straightforward as you think since the country is still very much a developing country where business regulatory policies are not entirely polished. Hence, registration and opening of a corporate bank account takes 16 weeks, a longer period of time as compared to other jurisdictions. Fortunately, you will not be required to travel down during this process. Tetra Consultants has summarized the 5 things you need to know before setting up a business in Brazil.

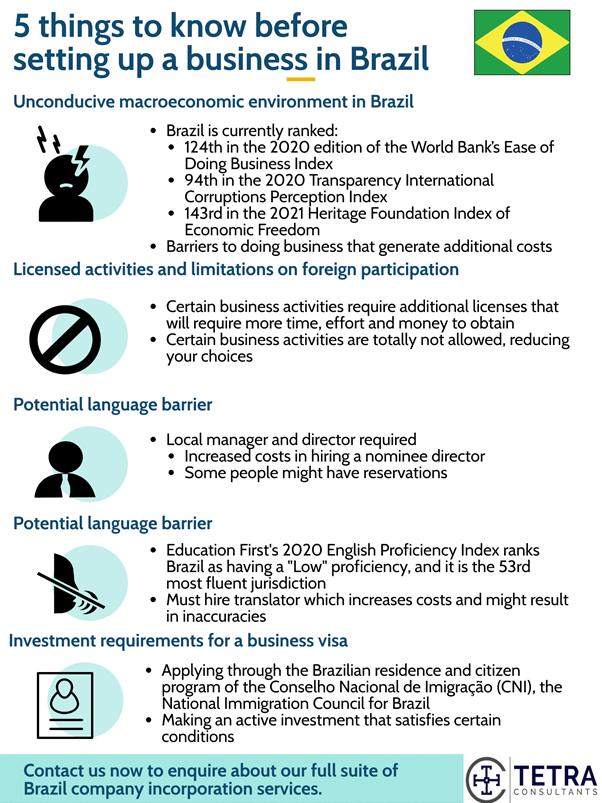

Unconducive macroeconomic environment in BrazilDespite scoring well in terms of the size of their domestic market and other macro-indicators such as Gross Domestic Product, the macroeconomic environment is still underdeveloped in terms of the facilitation of business. These market barriers may represent additional costs for companies that are new to operating in Brazil and unfamiliar in navigating the business environment. These costs can come either in terms of distribution costs, employee benefits or tax. Commonly known as “Custo Brasil”, these must also be taken into account before setting up a business in Brazil. Brazil is currently ranked

These rankings show the relative ranking of Brazil’s macroeconomic environment as compared to other jurisdictions. There is still a lot of improvements that should be made in terms of the ease of the process of company registration and its subsequent management, as well as in terms of the access to economic opportunities. More importantly, corruption might be a pressing issue since it reduces the trust and credibility of the country and might also lead to unnecessary costs or lower quality services than paid for. These negative associations will also have spill over effects on your company and might even affect your company’s reputation during international business deals. Licensed activities and limitations on foreign participation

|

Home > Brazil > 5 Things to Know Before Setting up a Business in Brazil

Tetra Consultants

Tetra Consultants is the consulting firm that works as your advisor and trusted partner in your business expansion. We tell our clients what they need to know, instead of what they want to hear. Most importantly, we are known for being a one-stop solution for our valued clients. Contact us now at enquiry@tetraconsultants.com for a non-obligatory free consultation. Our team of experts will be in touch with you within the next 24 hours.

Related articles and guides

How to Register a Business in Mauritius: Complete Guide

1 year ago

Tetra Consultants

新加坡公司结构对比

7 months ago

Tetra Consultants

Latest Guide To Setup Limited Company In Taiwan 2024

3 years ago

Tetra Consultants

6 Advantages of Doing Business in Luxembourg

1 year ago

Tetra Consultants

Important Considerations To Know About Estonia Cryptocurrency Exchange License

3 years ago

Tetra Consultants

2024年爱沙尼亚加密货币许可证初学者指南

6 months ago

Tetra Consultants

Ultimate Guide of Starting a Business in Lithuania as a Foreigner

2 years ago

Tetra Consultants

3 Things to Know about a Labuan Holding Company

2 years ago

Tetra Consultants

4 advantages of starting a business in the Bahamas

2 years ago

Tetra Consultants

在中国设立业务的4类公司结构对比

6 months ago

Tetra Consultants

Common Mistakes to Avoid When Registering Your Company in Seychelles

8 months ago

Tetra Consultants

7 Ways You Can Incorporating a Business in Alberta

4 weeks ago

Tetra Consultants

4 Reasons Why Delaware Is a Tax Haven

2 years ago

Tetra Consultants

Do You Need A License To Trade Cryptocurrency?

3 years ago

Tetra Consultants

Open Offshore Company In Dubai 2024

3 years ago

Tetra Consultants

Steps To Incorporate a Company in BVI

2 years ago

Tetra Consultants

9 Disadvantages of Setting up a Company in the Isle of Man

1 year ago

Tetra Consultants

6 Types Of Companies In Bangladesh You Should Know Before Starting Business

2 years ago

Tetra Consultants

Top 5 Requirements To Open A Corporate Bank Account

3 years ago

Tetra Consultants

5 Reasons to Register Llc in Delaware

2 years ago

Tetra Consultants

What Are The Requirements for an Australian Financial Services License?

1 year ago

Tetra Consultants

5 Best Business to Start in Georgia in 2024

2 years ago

Tetra Consultants

How to set up an offshore company in Dubai?

3 years ago

Tetra Consultants

5 Things To Know About Industrial Zone in Thailand in 2023

10 months ago

Tetra Consultants

4 Steps to Know about Hong Kong Limited Company Registration

2 years ago

Tetra Consultants

10 Top Advantages of Setting Up a BVI Company in 2024

2 years ago

Tetra Consultants

4 Things To Know About Korea Free Trade Zone in 2024

10 months ago

Tetra Consultants

A Step-by-Step Guide to Obtaining a Money Services Business License in Canada

1 year ago

Tetra Consultants

What is a resident director in Australia and why is it needed?

3 years ago

Tetra Consultants

5 Disadvantages of Setting up a Business in Ireland

2 years ago

Tetra Consultants

5 Reasons To Open Offshore Business Bank Account

3 years ago

Tetra Consultants

A Comprehensive Guide to Obtaining a Serbia Residence Permit

9 months ago

Tetra Consultants

2024年卢森堡最佳商机和公司结构选择

3 months ago

Tetra Consultants

Cayman Islands Tax Haven – Good or Bad?

2 years ago

Tetra Consultants

5 benefits of attaining crypto license in Estonia

1 year ago

Tetra Consultants

加拿大 MSB 牌照的主要好处及优势

7 months ago

Tetra Consultants

Company Registration in Japan as Foreigner: Advantages & Disadvantages

2 years ago

Tetra Consultants

注册爱尔兰公司可能面临的5大挑战

6 months ago

Tetra Consultants

A Detailed Comparison Between the 3 Types of Companies in Mauritius

1 year ago

Tetra Consultants

Guide To Register Company In UK From India

3 years ago

Tetra Consultants

Benefits of Register a Business in Alberta in 2024

2 months ago

Tetra Consultants

7 Things To Know About Vietnam Industrial Zones in 2023

10 months ago

Tetra Consultants

Compare and Contrast the 6 Types of Companies in Luxembourg

2 years ago

Tetra Consultants

How To Run An Online Business In Netherlands (Netherlands E-Commerce Guide)

1 year ago

Tetra Consultants

4 Accounting and Tax Obligations to Know about Private Limited Company in Hong Kong

2 years ago

Tetra Consultants

Setting up LLC in Cayman Islands – 5 Things You Need to Know

2 years ago

Tetra Consultants

Benefits of Starting an LLC in Delaware 2023

2 years ago

Tetra Consultants

在佛罗里达州申请营业执照的5种方法

1 month ago

Tetra Consultants

8 Things To Know Before Starting A Small Business In Singapore

2 years ago

Tetra Consultants

Are cryptocurrencies considered legal tender in Canada?

2 years ago

Tetra Consultants

9 Best Crypto Exchanges In Canada 2024

2 years ago

Tetra Consultants

Ultimate Guide on How to Register a Cryptocurrency Company in Estonia

2 years ago

Tetra Consultants

Ultimate Guide on Registering a Business in Ireland

2 years ago

Tetra Consultants

5 Disadvantages of Setting up a Company in Hong Kong

2 years ago

Tetra Consultants

8 Things to Know Before You Open a Trading Company in Hong Kong

2 years ago

Tetra Consultants

Best business opportunities in Brunei and types of business in 2024

5 months ago

Tetra Consultants

3 Best Business to Start in Germany in 2024

2 years ago

Tetra Consultants

4 Things to Know Before You Register Small Business in Georgia

2 years ago

Tetra Consultants

2023年在越南工业区设立公司须知

9 months ago

Tetra Consultants

Best Business Opportunities in Hong Kong and Types of Business in 2024

4 months ago

Tetra Consultants

A Step-by-Step Guide on Starting a Business in Finland

12 months ago

Tetra Consultants

在卢森堡注册公司的 6 大优势

6 months ago

Tetra Consultants

Starting a Company in Finland? Things To Note

12 months ago

Tetra Consultants

2024年格鲁吉亚最佳商机和结构推荐

4 months ago

Tetra Consultants

4 Steps To Set Up A New Company In Singapore

3 years ago

Tetra Consultants

Best Business Opportunities in India and Types of Business in 2024

3 months ago

Tetra Consultants

6 Steps To Set Up New Company In Singapore

3 years ago

Tetra Consultants

5 Things to Know about Foreign Company Registration in India

2 years ago

Tetra Consultants

2024年如何注册列支敦士登投资基金

5 months ago

Tetra Consultants

BVI VASP 牌照简介:全新BVI VASP制度概述

10 months ago

Tetra Consultants

A Detailed Comparison Between 7 Types of Companies in India

2 years ago

Tetra Consultants

Setting Up Company In Papua New Guinea – What You Need To Know?

3 years ago

Tetra Consultants

A Comprehensive Guide to Singapore Business Registration: Everything You Need to Know

8 months ago

Tetra Consultants

5 Key Steps for LLC Company Registration in USA: A Comprehensive Guide for Small Business Owners

7 months ago

Tetra Consultants

2024年香港最佳商机及公司类型介绍

4 months ago

Tetra Consultants

如何申请新加坡MAS牌照

2 years ago

Tetra Consultants

10 Best Businesses in Cyprus 2023

2 years ago

Tetra Consultants

The Benefits of Setting Up a Company in Iceland

6 months ago

Tetra Consultants

6 Advantages of Setting up a Gibraltar Holding Company

2 years ago

Tetra Consultants

Ultimate Guide to Private Limited Company Registration in India

2 years ago

Tetra Consultants

Ultimate Guide on How to Register a Company in UK for a Foreigner

2 years ago

Tetra Consultants

How To Set Up Investment Holding Company In Singapore?

3 years ago

Tetra Consultants

注册马来公司前的几个重要考虑因素

9 months ago

Tetra Consultants

Guide to Starting a Business in Dubai as a Foreigner in 2024

1 month ago

Tetra Consultants

Starting Business in Brazil: What You Need To Know?

2 years ago

Tetra Consultants

Benefits of Registering a Business in Toronto

2 months ago

Tetra Consultants

Understanding the legal requirements for business registration in Poland

8 months ago

Tetra Consultants

Guide to Starting a Business in Dubai as a Foreigner in 2024

4 days ago

Tetra Consultants

Why Do Companies Register in British Virgin Islands?

2 years ago

Tetra Consultants

9 Important Tips for Opening a Business in the Netherlands

12 months ago

Tetra Consultants

Ultimate Guide to Company Registration Process in Saudi Arabia

2 years ago

Tetra Consultants

A Step-by-Step Guide to Obtaining a Business License Australia

9 months ago

Tetra Consultants

5 Best Offshore Company Jurisdictions For Foreigners In 2023

3 years ago

Tetra Consultants

Ultimate Guide On Foreign Company Registration In Bangladesh 2024

2 years ago

Tetra Consultants

Best Business Opportunities and Types of Business in Australia in 2024

2 months ago

Tetra Consultants

Accounting For Cryptocurrency In 2024: An Ultimate Guide

3 years ago

Tetra Consultants

Process to Setup Foreign Company Registration in China

3 months ago

Tetra Consultants

Obtaining a Cyprus Forex brokerage license: What’s the best way to do it

1 year ago

Tetra Consultants

4 Simple Steps on How to Check Indonesia Company Registration

2 years ago

Tetra Consultants

3 Important Considerations Before Incorporating Your Company In Malaysia

3 years ago

Tetra Consultants

如何起草新加坡支付牌照的企业范围风险评估

6 months ago

Tetra Consultants

Best Business Opportunities in Bangladesh and Types of Business in 2024

5 months ago

Tetra Consultants

6 Labuan Company Benefits You Should Know

2 years ago

Tetra Consultants

5 Advantages of Oman Free Zone Company

2 years ago

Tetra Consultants

Steps To Change Partnership To Sole Proprietorship Company In Malaysia

3 years ago

Tetra Consultants

How To Setup Offshore Company: 2024 Guide

3 years ago

Tetra Consultants

15 Interesting Facts About South Korea That You Should Know Before Starting A Business As A Foreigner

3 years ago

Tetra Consultants

Compliance and Regulations to Take Note Register Business in USA

10 months ago

Tetra Consultants

7 Reasons To Setup Company In Canada In 2024

2 years ago

Tetra Consultants

Demystifying the Process: A Step-by-Step Guide to Obtaining a Business License in USA

7 months ago

Tetra Consultants

Ultimate Guide on Delaware Company Registration for Non-residents

2 years ago

Tetra Consultants

Introduction to the BVI VASP License: An overview of the new BVI VASP regime

9 months ago

Tetra Consultants

2023年加拿大MSB注册最全指南

10 months ago

Tetra Consultants

如何申请加拿大MSB牌照?

2 years ago

Tetra Consultants

Understanding the Role of Compliance Manager in Canada MSBs

10 months ago

Tetra Consultants

What is the process for applying for an Australian financial services license?

1 year ago

Tetra Consultants

2024年爱沙尼亚加密货币牌照基础指南

4 months ago

Tetra Consultants

5 Steps to Proceed with Seychelles Company Formation with Bank Account

2 years ago

Tetra Consultants

How to Get a Small Business License in Australia: Step-by-Step Guide

2 months ago

Tetra Consultants

Advantage and Disadvantage of Open a Company in Alberta

3 weeks ago

Tetra Consultants

6 Things to Know Before Setting up a Mauritius Investment Fund

1 year ago

Tetra Consultants

5 Reasons Why You Should Use Estonian Crypto Licenses

2 years ago

Tetra Consultants

How to Start an Offshore Company for Cryptocurrency Benefits?

2 years ago

Tetra Consultants

13 Popular Businesses for Foreigners to Start up in Japan 2024

2 years ago

Tetra Consultants

Top 7 Best Business Setup Consultants in Dubai

7 days ago

Tetra Consultants

Guide To The 4 Types Of Companies In Canada

2 years ago

Tetra Consultants

Ultimate guide to attaining VFA license in Malta

1 year ago

Tetra Consultants

5 Simple Steps for Setting up a Company in Ireland from Abroad

2 years ago

Tetra Consultants

Introduction To 10 countries Without Income Tax

3 years ago

Tetra Consultants

What Are the Types of Business in Bahrain in 2024

12 months ago

Tetra Consultants

How To Get A Crypto License In Estonia 2024

3 years ago

Tetra Consultants

加拿大工作签证申请流程:不同类型和如何选择

5 months ago

Tetra Consultants

Ajman Free Zone Company Registration: Step By Step Guide

3 years ago

Tetra Consultants

5 Steps To Open Business in Belize in 2023

2 years ago

Tetra Consultants

3 Important Considerations Before Incorporating Your Company in Malaysia

1 year ago

Tetra Consultants

What Are The Benefits Of An Offshore Bank Account?

3 years ago

Tetra Consultants

7 Best Business to Start in Cayman Islands 2023

2 years ago

Tetra Consultants

5 steps to Register company in Brazil

2 years ago

Tetra Consultants

5 Advantages Of Doing Business In Australia

3 years ago

Tetra Consultants

A guide to applying for a forex license in Belize

1 year ago

Tetra Consultants

How Much Does It Cost To Register A Company In Dubai?

3 years ago

Tetra Consultants

Subsidiary Vs Branch Office: Which Entity Is Most Suitable For A Foreign Entrepreneur

3 years ago

Tetra Consultants

3 Best Business in Poland to Consider in 2024

2 years ago

Tetra Consultants

6 Things To Note Before Company Formation in Bahrain

11 months ago

Tetra Consultants

4 Things To Know If You Plan To Register Company In Australia As A Non-Resident

3 years ago

Tetra Consultants

4 Things to Know Before You Register a Company in Ireland as a Non-resident

2 years ago

Tetra Consultants

Popular Businesses For Foreigners To Start Up In Japan 2024

2 years ago

Tetra Consultants

Ultimate Guide on How to Register Offshore Company in Cyprus

2 years ago

Tetra Consultants

3 Reasons Why Foreign Investors Are Shifting Towards a Holding Company in Cyprus

2 years ago

Tetra Consultants

Complete Guide To Resident Directors In Australia

3 years ago

Tetra Consultants

5 Steps to Setting Up a Tanzanian Company

1 year ago

Tetra Consultants

4 Things to Know About the New Singapore Payment Institution License

4 years ago

Tetra Consultants

在冰岛设立公司的8大优势

7 months ago

Tetra Consultants

How To Register A Small Business In New Zealand (NZ)?

3 years ago

Tetra Consultants

Why Oman’s Free Zone Company Setup is Ideal for International Businesses

10 months ago

Tetra Consultants

Ultimate Guide to Attaining Barbados Offshore Banking License

1 year ago

Tetra Consultants

Advantage and Disadvantage of Incorporating a Company in British Columbia

3 weeks ago

Tetra Consultants

How to do business registration in Toronto 2024

2 months ago

Tetra Consultants

4 things to know about Bahamas LLC registration in 2023

2 years ago

Tetra Consultants

Best Business Opportunities in Georgia and Types of Business in 2024

5 months ago

Tetra Consultants

5 Things To Know Before You Open a Company in Belize

2 years ago

Tetra Consultants

How To Proceed With Business Registration Process in Tanzania

1 year ago

Tetra Consultants

新加坡商业登记综合指南

8 months ago

Tetra Consultants

2024 年加密货币会计指南

8 months ago

Tetra Consultants

巴哈马注册企业快速指南

3 months ago

Tetra Consultants

2024年开曼群岛商机分析

4 months ago

Tetra Consultants

设立毛里求斯投资基金的6大须知

11 months ago

Tetra Consultants

Starting A Business In Netherlands As A Foreigner: What You need To Know

1 year ago

Tetra Consultants

8 Things To Know Before You Consider Registering A Branch Office In Japan

2 years ago

Tetra Consultants

加拿大MSB的合规经理角色分析

10 months ago

Tetra Consultants

了解马耳他EMI牌照:金融科技创新门户

5 months ago

Tetra Consultants

5 Disadvantages to Know Before You Set up Company in Indonesia

2 years ago

Tetra Consultants

3 Advantages of a Malta Holding Company

1 year ago

Tetra Consultants

7 Things to Know About MSO License in Hong Kong

1 year ago

Tetra Consultants

3 Things To Know Before You Register Business Name In NZ

2 years ago

Tetra Consultants

Ultimate Guide on How to Register a Business in Wyoming

2 years ago

Tetra Consultants

在加利福尼亚州注册企业的步骤完整清单

2 months ago

Tetra Consultants

6 Benefits of Registering a Company in Cayman Islands

2 years ago

Tetra Consultants

Ultimate Guide on How to Register Business in Indonesia

2 years ago

Tetra Consultants

Why and How to Open Small Business Toronto?

3 months ago

Tetra Consultants

Advantage and Disadvantage of Open a Company in Ontario

2 months ago

Tetra Consultants

3 Types Of Small Business In Japan For Foreigners To Start In 2024

2 years ago

Tetra Consultants

How To Start A Business In Singapore As A Foreigner

3 years ago

Tetra Consultants

5 Things To Know About BVI Holding Company

2 years ago

Tetra Consultants

非居民注册美国公司的流程步骤

10 months ago

Tetra Consultants

成功申请塞浦路斯外汇经纪牌照:具体事项

4 months ago

Tetra Consultants

7 Accounting and Tax Considerations of a Malta Offshore Company

1 year ago

Tetra Consultants

5 Advantages of Registering a Small Business in Canada

2 years ago

Tetra Consultants

Ultimate Guide on Starting a Company in Hong Kong as a Foreigner

2 years ago

Tetra Consultants

Benefits and Drawbacks of Obtaining an Offshore Banking License

12 months ago

Tetra Consultants

Ultimate Guide On How To Set Up A Sole Trader Business In Australia

3 years ago

Tetra Consultants

迪拜有限责任公司设立和有限责任公司执照费 – 指南

4 weeks ago

Tetra Consultants

How To Register Business In New Zealand (NZ)

2 years ago

Tetra Consultants

Best Business Opportunities in China and Types of Business in 2024

5 months ago

Tetra Consultants

9 Key Differences Between A Limited Company And Public Limited Company In Bangladesh

2 years ago

Tetra Consultants

8 Things to Know Before Starting a Small Business in Singapore

1 year ago

Tetra Consultants

Tips to Optimize Your Budget When Applying for a Curacao eGaming License

5 months ago

Tetra Consultants

Understanding the Canada work permit process: Different Categories and Options

5 months ago

Tetra Consultants

Doing Business In Liechtenstein in 2024: What You Need to Know

1 year ago

Tetra Consultants

巴林加密货币监管对数字资产行业的影响

5 months ago

Tetra Consultants

Estonia Crypto Regulation Guide 2024

3 years ago

Tetra Consultants

5 Differences Between Branch Office And Subsidiary In Taiwan

3 years ago

Tetra Consultants

Guide on LLC Setup and LLC License Cost in Dubai

1 month ago

Tetra Consultants

Ultimate Guide on Starting a Business in Vietnam as a Foreigner

2 years ago

Tetra Consultants

Beginners’ guide to Canada cryptocurrency regulation in 2024

2 years ago

Tetra Consultants

4 Things To Know Before You Register A Limited Partnership In New Zealand

2 years ago

Tetra Consultants

Demystifying the Process: A Step-by-Step Guide to Obtaining a Business License China

6 months ago

Tetra Consultants

Iceland Company Formation for Non-Residents: What You Need to Know

6 months ago

Tetra Consultants

VARA发布的新迪拜虚拟资产法案:介绍及指南

9 months ago

Tetra Consultants

Ultimate Guide on How to Register a Business in Isle of Man

2 years ago

Tetra Consultants

Introduction to 8 types of business entities in Cambodia

2 years ago

Tetra Consultants

7 Steps to Proceed with Non-profit Company Registration in India

2 years ago

Tetra Consultants

A Detailed Comparison of the 6 Types of Companies in Lithuania

2 years ago

Tetra Consultants

Step-by-Step Guide to LLC Company Formation in Dubai

8 months ago

Tetra Consultants

Key Factors To Consider: NCC License Requirements for Broadcasting and Media in Nigeria

5 months ago

Tetra Consultants

7 马耳他离岸公司的会计和税务注意事项

6 months ago

Tetra Consultants

5 Best Businesses To Start in Belize in 2023

2 years ago

Tetra Consultants

6 differences between sole proprietorship and Sdn Bhd in Malaysia

3 years ago

Tetra Consultants

Top 6 Countries To Open Offshore Company And Bank Account For 2024

3 years ago

Tetra Consultants

尼日利亚NCC牌照要求及考虑因素

5 months ago

Tetra Consultants

4 Reasons To Register A New Company In New Zealand (NZ)

3 years ago

Tetra Consultants

Introduction to 4 Types of Delaware Corporations

2 years ago

Tetra Consultants

Key Benefits and Advantages of Obtaining an MSB License in Canada

9 months ago

Tetra Consultants

6 Things to Know Before Starting a Business in Indonesia as a Foreigner

2 years ago

Tetra Consultants

The Complete Guide To Business Setup In Bahrain in 2024

1 year ago

Tetra Consultants

在爱尔兰设立企业的优劣势分析

6 months ago

Tetra Consultants

Top 7 Best Offshore Banks For Cryptocurrency In 2024

3 years ago

Tetra Consultants

How to Acquire an Uk EMI Licence?

1 year ago

Tetra Consultants

在挪威创业的5大优势?

3 months ago

Tetra Consultants

Quick Checklist Before You Open a Company in Malta

2 years ago

Tetra Consultants

2024年如何在加拿大多伦多设立公司?

3 months ago

Tetra Consultants

加密货币在加拿大被视为法定货币吗?

10 months ago

Tetra Consultants

Hong Kong VASP License: Navigating the Evolving Regulatory Landscape for Virtual Assets

11 months ago

Tetra Consultants

Sole Trader vs. Limited Company in Ireland: Choosing the Right Business Structure for Your Enterprise

7 months ago

Tetra Consultants

5 Things to Know About Opening Offshore Bank Account in Seychelles

2 years ago

Tetra Consultants

What is the Cost of MSB License in Canada

2 years ago

Tetra Consultants

Ultimate Guide On Setting Up A Company In New Zealand As A Foreigner

2 years ago

Tetra Consultants

A Detailed Comparison of the 4 Types of Companies in China

2 years ago

Tetra Consultants

Ultimate Guide on Starting a Business in Switzerland as a Foreigner

2 years ago

Tetra Consultants

How to Set up a Company in the Bahamas: Complete Guide

2 years ago

Tetra Consultants

How to Get Ecommerce License in Dubai a Step by Step Guide

1 week ago

Tetra Consultants

注册中国公司综合指南

3 months ago

Tetra Consultants

迪拜新虚拟资产法:VARA 为企业带来的机遇和挑战

10 months ago

Tetra Consultants

What Is The Cost To Register A Business In Australia?

3 years ago

Tetra Consultants

合规性解析:在德克萨斯州注册公司

2 months ago

Tetra Consultants

4 Reasons Why You Should Proceed With Bangladesh Company Registration In 2024

2 years ago

Tetra Consultants

Business Opportunities in Ireland and Types of Business in 2024

4 months ago

Tetra Consultants

4 Best Business in Oman to Consider in 2024

2 years ago

Tetra Consultants

Key Changes for Companies under the 2024 Revised China Company Law

1 month ago

Tetra Consultants

Corporate Tax in UAE 2024 – Alternative Solutions to Consider

2 years ago

Tetra Consultants

How to Obtain a Work Visa in Malaysia for Foreign Entrepreneurs

2 years ago

Tetra Consultants

Unveiling the Downsides of Incorporating in Delaware: What Entrepreneurs Should Know

6 months ago

Tetra Consultants

4 Accounting and Tax Obligations to Know Before You Set up Company in Ireland

2 years ago

Tetra Consultants

4 benefits of registering a company in Australia compared to New Zealand

2 years ago

Tetra Consultants

How To Register an Liechtenstein Investment fund in 2024

5 months ago

Tetra Consultants

4 Things to Prepare Before Setting up a Business in Hong Kong

2 years ago

Tetra Consultants

Top 3 Requirements To Open A Business Account

2 years ago

Tetra Consultants

申请库拉索电子博彩牌照时如何优化预算

2 months ago

Tetra Consultants

4 Advantages of Setting up a Wyoming Limited Liability Company

2 years ago

Tetra Consultants

Best Business Opportunities in Estonia and Types of Business in 2024

5 months ago

Tetra Consultants

Managing Compliance: Staying on Top of Regulations for Your Foreign Company Registration in Qatar

8 months ago

Tetra Consultants

Latvia’s Company Formation and what to expect when starting a company

7 months ago

Tetra Consultants

香港创办公司的指南

4 months ago

Tetra Consultants

7 Considerations to Know Before You Register New Company in India

2 years ago

Tetra Consultants

Ultimate Guide to Company Formation in China in 2024

2 years ago

Tetra Consultants

如何在迪拜申请加密货币牌照

6 months ago

Tetra Consultants

Best Business Opportunities in Cambodia and Types of Business in 2024

5 months ago

Tetra Consultants

How does An Australian Financial Services License Work? What You Need To Know

1 year ago

Tetra Consultants

What Is An Offshore Company And Why Should You Consider Registering One?

3 years ago

Tetra Consultants

How To Register Limited Liability Partnership (LLP) In Singapore?

2 years ago

Tetra Consultants

6 Things to Know Before You Register Business in Cayman Islands

2 years ago

Tetra Consultants

Ultimate guide to Canada MSB registration: Process and Registration

2 years ago

Tetra Consultants

6 Disadvantages of Setting up a Company in Gibraltar

2 years ago

Tetra Consultants

The Complete Guide on Marshall Islands Company Formation

1 year ago

Tetra Consultants

4 Advantages of New Business Registration in Georgia

2 years ago

Tetra Consultants

Business Considerations for Starting and Operating an MSB in Canada

1 year ago

Tetra Consultants

5 Reasons To Start A Business In Singapore

3 years ago

Tetra Consultants

How To Open A Company In Liechtenstein in Online

1 year ago

Tetra Consultants

拉脱维亚成立业务前有哪些考量?

6 months ago

Tetra Consultants

如何成功申请英国EMI牌照

9 months ago

Tetra Consultants

7 best small business to start in Australia in 2023

2 years ago

Tetra Consultants

Bermuda Offshore Company Registration: What you need to know

1 year ago

Tetra Consultants

Best Business Opportunities and Steps to Register Business in Ontario

2 months ago

Tetra Consultants

An Overview of Company Registration Fees in Tanzania & Timeline

1 year ago

Tetra Consultants

Exploring the Most Profitable Business in Dubai 2024

8 months ago

Tetra Consultants

Is BVI A Tax Haven: Top 5 Things To Know

2 years ago

Tetra Consultants

8 Advantages Why You Should Register Business in Malta

1 year ago

Tetra Consultants

Understanding Vietnam Company Foreign Ownership Policies: A Guide for Companies

9 months ago

Tetra Consultants

4 Best Business to Start in Switzerland in 2024

2 years ago

Tetra Consultants

Registering Business In South Africa: What You Need To Know

3 years ago

Tetra Consultants

Advantages of Register Business in USA in 2024

8 months ago

Tetra Consultants

Guide To The Best Countries To Open Offshore Bank Account

3 years ago

Tetra Consultants

2 Things To Know About The Business Owner Visa In Australia

3 years ago

Tetra Consultants

在英属哥伦比亚成立公司的优点和缺点

1 month ago

Tetra Consultants

Ultimate guide on Money Service Operator License Hong Kong

1 year ago

Tetra Consultants

Key advantages of doing business in Brazil 2023

2 years ago

Tetra Consultants

Best Business Opportunities in Latvia and Types of Business in 2024

4 months ago

Tetra Consultants

申请加拿大MSB的好处及优势

8 months ago

Tetra Consultants

Navigating the Process of Obtaining Serbia Residence Permit: Requirements and Procedure

9 months ago

Tetra Consultants

6 Types of Business Structures in Australia in 2024

2 months ago

Tetra Consultants

Quick Guide on How to Register a Business in the Bahamas

2 years ago

Tetra Consultants

特加商务咨询协助申请加拿大工作许可

10 months ago

Tetra Consultants

2024年印度尼西亚最佳商机以及如何选择正确的公司结构

3 months ago

Tetra Consultants

7 Steps for Malta Offshore Company Formation: A Detailed Guide

2 years ago

Tetra Consultants

Cost Of Setting Up A Branch Office In Dubai

3 years ago

Tetra Consultants

Business License Tanzania: Legal Requirements To Start a Business

11 months ago

Tetra Consultants

Pros and Cons of Setting Up a Limited Company in Ireland: A Comprehensive Guide

7 months ago

Tetra Consultants

9 Pros and Cons to Know Before You Set up Company in China

2 years ago

Tetra Consultants

How To Setup Freezone Company In Dubai

3 years ago

Tetra Consultants

5 Reasons Why You Should Use Estonian Crypto Licenses

3 years ago

Tetra Consultants

Setting Structure: Comparing Business Structures in Singapore

6 months ago

Tetra Consultants

注册美国公司并开设银行账户有哪些税收要求及影响

8 months ago

Tetra Consultants

Starting a Small Business in Thailand for Foreigners in 2024

9 months ago

Tetra Consultants

线上注册一家列支敦士登公司

5 months ago

Tetra Consultants

The Responsibilities of Compliance Officers in Canadian MSBs

10 months ago

Tetra Consultants

7 Things to Know About Forex License Georgia

1 year ago

Tetra Consultants

Reducing the MSB License Cost Canada: Strategies for Cutting Down Expenses

8 months ago

Tetra Consultants

10 Interesting Facts about the Country Before Starting Business in Cambodia

2 years ago

Tetra Consultants

4 Things to Know about an Isle of Man Limited Company

1 year ago

Tetra Consultants

Best Business In Taiwan To Do In 2024

3 years ago

Tetra Consultants

波兰公司注册流程指南及几大要素

6 months ago

Tetra Consultants

Company Setup in Tanzania: 5 Points To Note

12 months ago

Tetra Consultants

Best business opportunities in Cayman Islands in 2024

5 months ago

Tetra Consultants

涉外公认证一站式解决方案

1 year ago

Tetra Consultants

在加州设立独资企业的优势

2 months ago

Tetra Consultants

注册开曼经济区公司须了解的7大事项

6 months ago

Tetra Consultants

Reasons Why Malta is Home to Many Online Casinos

1 year ago

Tetra Consultants

5 Things to Know Before you Register a Limited Company in Poland

2 years ago

Tetra Consultants

How to Start a Business in Netherlands For Foreigners – The Ultimate Guide

1 year ago

Tetra Consultants

2023在韩国开展的几种业务类型

7 months ago

Tetra Consultants

Types of Business in South Korea You Can Start in 2023

9 months ago

Tetra Consultants

Is It Easy Starting A Business In Brazil As A Foreigner?

2 years ago

Tetra Consultants

Ultimate Guide On How To Set Up A Holding Company In Australia

3 years ago

Tetra Consultants

非居民特拉华州公司注册终极指南

7 months ago

Tetra Consultants

Which Business Is Best In Canada In 2024?

2 years ago

Tetra Consultants

4 most profitable businesses in Brazil for foreigners

2 years ago

Tetra Consultants

7 Things to Know About Malta Gaming License in 2024

1 year ago

Tetra Consultants

2024年在迪拜投资哪些行业?

8 months ago

Tetra Consultants

A Comprehensive Guide to Different Types of Companies in the Czech Republic

6 months ago

Tetra Consultants

Step-by-Step Guide to Company Registration in Poland

10 months ago

Tetra Consultants

4 Most Profitable Business in Indonesia in 2024

2 years ago

Tetra Consultants

What Are the Different Types of Companies in Japan?

1 year ago

Tetra Consultants

如何注册毛里求斯投资经纪公司?

11 months ago

Tetra Consultants

群岛公司注册 – 塞舌尔注册公司须避免7大错误

8 months ago

Tetra Consultants

4 Things to Know About a Limited Liability Company in Saudi Arabia

2 years ago

Tetra Consultants

A Step-by-Step Guide to Company Registration in Qatar

8 months ago

Tetra Consultants

Understanding the EMI License in Malta: A Gateway to Fintech Innovation

6 months ago

Tetra Consultants

Guide on Estonia’s New Anti-money Laundering Act and Virtual Currencies

1 year ago

Tetra Consultants

新加坡标准支付牌照和大型支付牌照的区别

2 years ago

Tetra Consultants

英国营业执照申请指南

7 months ago

Tetra Consultants

What Is The Purpose Of Having An Offshore Company?

3 years ago

Tetra Consultants

7 Types of Companies in Finland

1 year ago

Tetra Consultants

5 Advantages of Starting Up a Business in Brunei

2 years ago

Tetra Consultants

4 Things To Know About Taiwan Business Registration In 2024

3 years ago

Tetra Consultants

Company Registration In South Korea: 2024 Requirements & Procedures

3 years ago

Tetra Consultants

3 Advantages Of Business Registration In Bangladesh

2 years ago

Tetra Consultants

What Is The Best Country To Set Up An Offshore Company In?

3 years ago

Tetra Consultants

4 Accounting and Tax Obligations to Know Before Staritng a Business in Luxembourg

2 years ago

Tetra Consultants

5 Advantages of an Isle of Man Holding Company

2 years ago

Tetra Consultants

Ultimate Guide on Foreign Company Registration in Mauritius

2 years ago

Tetra Consultants

Beginners’ Guide on How to Get Estonia Cryptocurrency License in 2024

1 year ago

Tetra Consultants

3 Steps to Setup Business in Singapore

2 years ago

Tetra Consultants

Top Small Business In Taiwan To Do In 2024

2 years ago

Tetra Consultants

How To Register Offshore Company In Hong Kong In 6 Easy Steps

2 years ago

Tetra Consultants

5 Things To Know Before You Consider Registering Sole Proprietorship In Singapore

2 years ago

Tetra Consultants

Quick Guide: Types Of Companies In the Netherlands

1 year ago

Tetra Consultants

10 Disadvantages of Setting up a Cayman Islands Company

2 years ago

Tetra Consultants

外国人在波兰注册公司需注意的合规法规要求

3 months ago

Tetra Consultants

Ultimate Guide on Registration of a Limited Liability Company in Latvia

2 years ago

Tetra Consultants

Guide to the 5 Types of Companies in Canada

2 years ago

Tetra Consultants

4 Benefits of Registering a Company in Isle of Man

2 years ago

Tetra Consultants

4 Best Business to Start in Mauritius

1 year ago

Tetra Consultants

What Is the Process for Obtaining a Crypto License in Estonia?

1 year ago

Tetra Consultants

Dubai New Virtual Asset Law: Opportunities and Challenges for Businesses by VARA

11 months ago

Tetra Consultants

5 Best Business To Start In Singapore 2024

3 years ago

Tetra Consultants

Ultimate Guide To Hong Kong Offshore Company Formation

2 years ago

Tetra Consultants

Understanding Dubai’s New Virtual Asset Law released by VARA: A Comprehensive Guide

9 months ago

Tetra Consultants

Starting Business In Taiwan: Complete Guide

3 years ago

Tetra Consultants

成立马来公司前的重要考量(签证类型分析)

3 months ago

Tetra Consultants

A Comprehensive Guide: How To Apply for a Business License UK

9 months ago

Tetra Consultants

迪拜最佳 7 家业务设立商务顾问 – 推荐

1 month ago

Tetra Consultants

2024 年阿联酋企业税 – 可供考虑的替代解决方案

9 months ago

Tetra Consultants

如何作为外国人在立陶宛创办业务的终极指南

7 months ago

Tetra Consultants

公司合规服务 – 遵守卡塔尔外资注册法规

6 months ago

Tetra Consultants

Open Company In Taiwan With These 5 Steps

2 years ago

Tetra Consultants

4 Things to Know Before You Register Business in Mauritius

2 years ago

Tetra Consultants

Top 3 Countries With The Best Offshore Bank Account For 2024

3 years ago

Tetra Consultants

Opening A Business In Taiwan: Top Advantages

3 years ago

Tetra Consultants

Ultimate Guide to Belize Company Formation With Bank Account

2 years ago

Tetra Consultants

毛里求斯FSC交易商牌照含金量如何?

11 months ago

Tetra Consultants

8 Things About Offshore Company Registration In Dubai You May Not Have Known

3 years ago

Tetra Consultants

Best Business Opportunities in Finland and Types of Business in 2024

5 months ago

Tetra Consultants

5 Disadvantages of Setting Up a Business in Belize

2 years ago

Tetra Consultants

Types of Business in South Korea You Can Start in 2024

7 months ago

Tetra Consultants

菲律宾企业注册指南

5 months ago

Tetra Consultants

Introduction to 4 types of companies in Brazil

2 years ago

Tetra Consultants

Ultimate Guide on Starting a Business in Norway as a Foreigner

2 years ago

Tetra Consultants

Understanding the Tax Implications of Registering Your US Company with a Bank Account

8 months ago

Tetra Consultants

Everything Non-Residents Need to Know About US Company Registration for Non Residents: A Step-by-Step Guide

10 months ago

Tetra Consultants

Benefits To Open Offshore Company In Hong Kong

2 years ago

Tetra Consultants

7 Reasons Why Do Companies Set up in Luxembourg

1 year ago

Tetra Consultants

6 Top Reasons To Start a Business in Brazil

2 years ago

Tetra Consultants

8 Requirements to Set up a Public Limited Company in Cambodia

2 years ago

Tetra Consultants

关于在塞舌尔开设离岸银行账户的5件事

7 months ago

Tetra Consultants

8 Steps on How to Start a Business in Qatar

2 years ago

Tetra Consultants

2024 年澳大利亚最佳商业机会和公司实体类型

1 month ago

Tetra Consultants

5 Things To Look Out For When Setting Up A Business In Japan

2 years ago

Tetra Consultants

How to set up company as a sole trader in New Zealand (NZ)?

3 years ago

Tetra Consultants

How To Get a Dubai Cryptocurrency License in Dubai

12 months ago

Tetra Consultants

Here are 6 Requirements to Register a Business in Ontario

2 months ago

Tetra Consultants

Best Business Opportunities in Guernsey and Types of Business in 2024

4 months ago

Tetra Consultants

4 Reasons to Open Business in Cyprus 2024

2 years ago

Tetra Consultants

Investor’s Guide to Canada Cryptocurrency Taxes

2 years ago

Tetra Consultants

3 Best Countries For Offshore Banking

3 years ago

Tetra Consultants

7 Advantages of a Private Limited Company in Lithuania

2 years ago

Tetra Consultants

Ultimate Guide on Starting a Business in Malta as a Foreigner

1 year ago

Tetra Consultants

4 Advantages of Setting up a Business in Thailand

2 years ago

Tetra Consultants

4 Top Business Ideas to Consider Before You Start a Company in Malta

2 years ago

Tetra Consultants

How to Get Business License in Dubai a Step by Step Guide

1 month ago

Tetra Consultants

Guernsey Company Setup Cost and Timeline in 2024

1 year ago

Tetra Consultants

5 Top Benefits of Starting a Business in Norway

1 year ago

Tetra Consultants

2024年印尼商机和公司类型分析

4 months ago

Tetra Consultants

Ultimate Guide to Georgia Business Registration

2 years ago

Tetra Consultants

3 Reasons Why You Should Register Business In Japan

2 years ago

Tetra Consultants

5 Advantages to Know Before You Register a Limited Company in Ireland

2 years ago

Tetra Consultants

Introduction to the 9 Different Germany Legal Entity Types

2 years ago

Tetra Consultants

7 Advantages of Setting up a Company in Oman

1 year ago

Tetra Consultants

Ultimate Guide on Setting up Company in PNG

2 years ago

Tetra Consultants

How to Register Business in Florida in 2024

2 weeks ago

Tetra Consultants

9 Best Business Opportunities in Cambodia for Foreigners 2023

2 years ago

Tetra Consultants

2024年关于韩国自由贸易区的4要点

9 months ago

Tetra Consultants

2024年如何办理加州外资有限责任公司LLC

2 months ago

Tetra Consultants

The Ultimate Guide on China Entrepreneur Visa

4 weeks ago

Tetra Consultants

5 Things To Know About Free Trade Zone in Brazil in 2024

11 months ago

Tetra Consultants

申请澳大利亚ASIC监管AFS牌照

9 months ago

Tetra Consultants

Singapore New GST regulations

4 years ago

Tetra Consultants

特加商务带您了解成功获得加拿大营业执照的步骤

6 months ago

Tetra Consultants

Ultimate Guide To Private Limited Company Incorporation In Malaysia For Foreigners

3 years ago

Tetra Consultants

The Complete Guide to Guernsey Company Incorporation

1 year ago

Tetra Consultants

Best Business Opportunities in Indonesia and Types of Business in 2024

4 months ago

Tetra Consultants

卡塔尔公司注册分步指南

8 months ago

Tetra Consultants

Guide to Get Business License Ontario in 2024

3 months ago

Tetra Consultants

创业理念到商业帝国:纽约独资企业设立指南

2 months ago

Tetra Consultants

2024年印度最佳商机和公司结构选择

3 months ago

Tetra Consultants

8 Benefits of Setting up a Company in Hong Kong

2 years ago

Tetra Consultants

A Comprehensive Guide to China Company Setup

3 months ago

Tetra Consultants

3 Key Steps To Setting Up Business In Malaysia

3 years ago

Tetra Consultants

香港VASP牌照:如何应对不断变化的虚拟资产监管环境

10 months ago

Tetra Consultants

Ultimate Guide: How to do New Company Setup in Dubai- 10 Essential Steps for Success

4 weeks ago

Tetra Consultants

7 Things to Know About MSO License in Hong Kong

1 year ago

Tetra Consultants

Top 3 Profitable Business in Canada 2024

2 years ago

Tetra Consultants

Demystifying the Process: A Step-by-Step Guide to Obtaining a Business License in Canada

7 months ago

Tetra Consultants

6 Types Of Business Entities In Malaysia

3 years ago

Tetra Consultants

2024年中国大陆最佳商机及公司结构选择

5 months ago

Tetra Consultants

All you need to know about Delaware money transmitter license

1 year ago

Tetra Consultants

Cost To Register Company In New Zealand

3 years ago

Tetra Consultants

How To Start A Business In New Zealand As A Foreigner

3 years ago

Tetra Consultants

Introduction to the types of business entities in Canada

2 years ago

Tetra Consultants

Compliance and Regulations to Take Note Incorporating in Poland as a foreigner

8 months ago

Tetra Consultants

如何优化库拉索电子博彩牌照申请预算

5 months ago

Tetra Consultants

4 Top Challenges of Starting a Business in Cyprus

2 years ago

Tetra Consultants

A Comprehensive Guide to Registering a Business in the Philippines

6 months ago

Tetra Consultants

12 Things To Take Note Of Before Choosing To Setup Business In Canada

2 years ago

Tetra Consultants

5 Steps to Set Up a New Business in Singapore

8 months ago

Tetra Consultants

Ultimate Guide on How to Start a Business in Brunei for Foreigners

2 years ago

Tetra Consultants

5 Advantages of Starting a Business in Belize

2 years ago

Tetra Consultants

All You Need To Know About Hong Kong Offshore Company Tax

2 years ago

Tetra Consultants

如何在2024年注册美国佛罗里达州公司

1 month ago

Tetra Consultants

3 Things to Know Before you Register a Business in UK

1 year ago

Tetra Consultants

How to Get a Crypto Wallet License in Estonia 2024

2 years ago

Tetra Consultants

How To Start A Business In Japan In 8 Easy Steps

2 years ago

Tetra Consultants

Is It Easy Starting a Business in Brazil As a Foreigner?

2 years ago

Tetra Consultants

波兰公司注册分步指南

9 months ago

Tetra Consultants

2024年孟加拉最佳商机和企业类型

5 months ago

Tetra Consultants

Top 4 Profitable Business In Canada 2023

2 years ago

Tetra Consultants

Doing Business In Saudi Arabia 2024: Complete Guide

3 years ago

Tetra Consultants

6 Things to Take Note of Before Choosing to Setup Business in Canada

2 years ago

Tetra Consultants

捷克不同类型企业实体介绍

5 months ago

Tetra Consultants

How to draft an Enterprise-Wide Risk Assessment for Singapore Payment Institution License

2 years ago

Tetra Consultants

5 Reasons Why You Should Choose to Set up a Private Limited Company in Cambodia

2 years ago

Tetra Consultants

Guide on Setting up a Limited Company in BC

3 weeks ago

Tetra Consultants

6 Steps to Setting up a Company in Cyprus

2 years ago

Tetra Consultants

与新西兰相比,在澳大利亚注册公司的 4 大优势

7 months ago

Tetra Consultants

6 Things to Know Before Opening a Business in South Korea

2 years ago

Tetra Consultants

A Guide to Netherlands Company Incorporation for Foreign Entrepreneurs

12 months ago

Tetra Consultants

5 Accounting and Tax Obligations You Should Know about Isle of Man Company Set Up

2 years ago

Tetra Consultants

海外银行开户的三大要求

4 months ago

Tetra Consultants

7 Advantages of Setting up Business in Indonesia

2 years ago

Tetra Consultants

Top Benefits Of Forming Offshore Company In Dubai

3 years ago

Tetra Consultants

Demystifying the Process: A Step-by-Step Guide to Obtaining a Business License Australia

7 months ago

Tetra Consultants

5 Ways to Apply for Business License Florida

2 weeks ago

Tetra Consultants

申请离岸银行牌照的优缺点

6 months ago

Tetra Consultants

2024 年芬兰最佳商机和公司类型

6 months ago

Tetra Consultants

7 Things To Know About Cayman Special Economic Zone in 2024

11 months ago

Tetra Consultants

Quick Links

- Home |

- Jurisdictions |

- Testimonials |

- Careers |

- Blog |

- Contact Us

Address

22 Sin Ming Lane #06-76 Midview City, Singapore 573969

©2010-2024 Tetra Global Consultants. All rights reserved.