离岸 银行牌照加密货币牌照

- 在大多数司法管辖区,如果您想建立加密货币业务,将需要申请加密货币牌照。这最终取决于您的预期业务活动,因为涉及不同的要求。

- 例如,如果您计划运营加密货币交易所或加密货币钱包,您很有可能需要加密货币牌照。但是,如果您使用自己的资金交易加密货币,则很有可能不需要任何牌照。

- 在承诺合并此类业务之前,明智的做法是就牌照选项寻求法律建议,以确定您是否还需要申请牌照,因为在没有牌照的情况下经营金融服务类型业务的处罚可能很严重。

- 特加商务咨询擅长为有兴趣组建获得加密货币交易所或加密货币钱包牌照的公司的企业家提供专业的法律建议。我们将为您提供从设立离岸实体到准备文件以及与获得加密货币牌照相关的许多其他方面的所有方面的建议。

什么是加密货币?

- 加密货币只是一种充当交换媒介的虚拟货币。它通过使用密码学来保护硬币所有权的金融交易,验证资产转移并控制额外单位的创建。

- 加密货币是一种用于交换在线商品和服务(数字交易)的支付方式。在大多数情况下,加密货币超出了中央当局的控制范围,但主要由支持者和社区维护。

什么是加密货币?

- 加密货币牌照是授权实体根据拟议司法管辖区的法律开展受监管的加密货币业务的文件。换句话说,它是允许实体作为加密货币交易所运营商或加密货币托管钱包运营商开展加密货币业务的文件。

Importance of Compliance and AML Policies for Cryptocurrency Licensing

- The implementation of Anti-Money Laundering (AML) policies and measures in compliance is essential for cryptocurrency businesses in achieving licensing and regulatory permission. Because cryptocurrencies are decentralized by design, such businesses involve a specific set of challenges that may facilitate various forms of illicit activities ranging from money laundering to funding terrorism. Here are several reasons why adherence to AML policies becomes crucial in the process of acquiring a cryptocurrency license:

Regulatory requirement

- There is a rising need for cryptocurrency exchanges and other VASPs to adopt stringent policies of AML in efforts to curb financial crimes by most governments around the world. International standards that have been set by organizations such as the FATF include requirements that VASPs conduct Know Your Customer (KYC) checks and monitor for suspicious transactions. Non-adherence to these standards is met with severe fines; take for instance the case whereby crypto businesses had to pay over US$5.8 billion in fines back in 2023 for failure to have adequate AML controls in place.

Risk mitigation effective

- AML measures help minimize risks associated with money laundering and fraud. Most transactions involving cryptocurrencies are anonymous; therefore, businesses should have sound processes of verification of identities and monitoring systems for transactions. Such controls not only save companies from legal exposure but also improve their operations’ integrity.

Creating trust and credibility

- The compliance aspect of AML not only instills trust in the minds of customers and investors, but it also involves showing a commitment to security as well as accountability. A compliant cryptocurrency platform shows up first both credibility as a priority, which is absolutely crucial for attracting real users as well as investors. In years to come, proof of regulatory compliance will more and more be what determines stand-out businesses in a highly competitive ecosystem.

Encouraging stability in the market

- The major concerns to the cryptocurrency market’s stability are strong compliance frameworks. In preventing illicit activities, AML policies contribute to a more transparent and reliable financial ecosystem that could add more investor confidence in it. Such stability is vital since acceptance and integration of cryptocurrencies tend to rise in mainstream finance.

Global standardization

- As national jurisdictions keep abreast with the changing AML framework benchmarked to organizations like FATF, becoming compliant becomes a norm for any crypto company registration to operate. Since regulatory standards differ from one region to another, strong AML programs become necessary and facilitate companies to do business lawfully and efficiently across more than one market, thus reducing the risk of legal hassles and smooth cross border transactions.

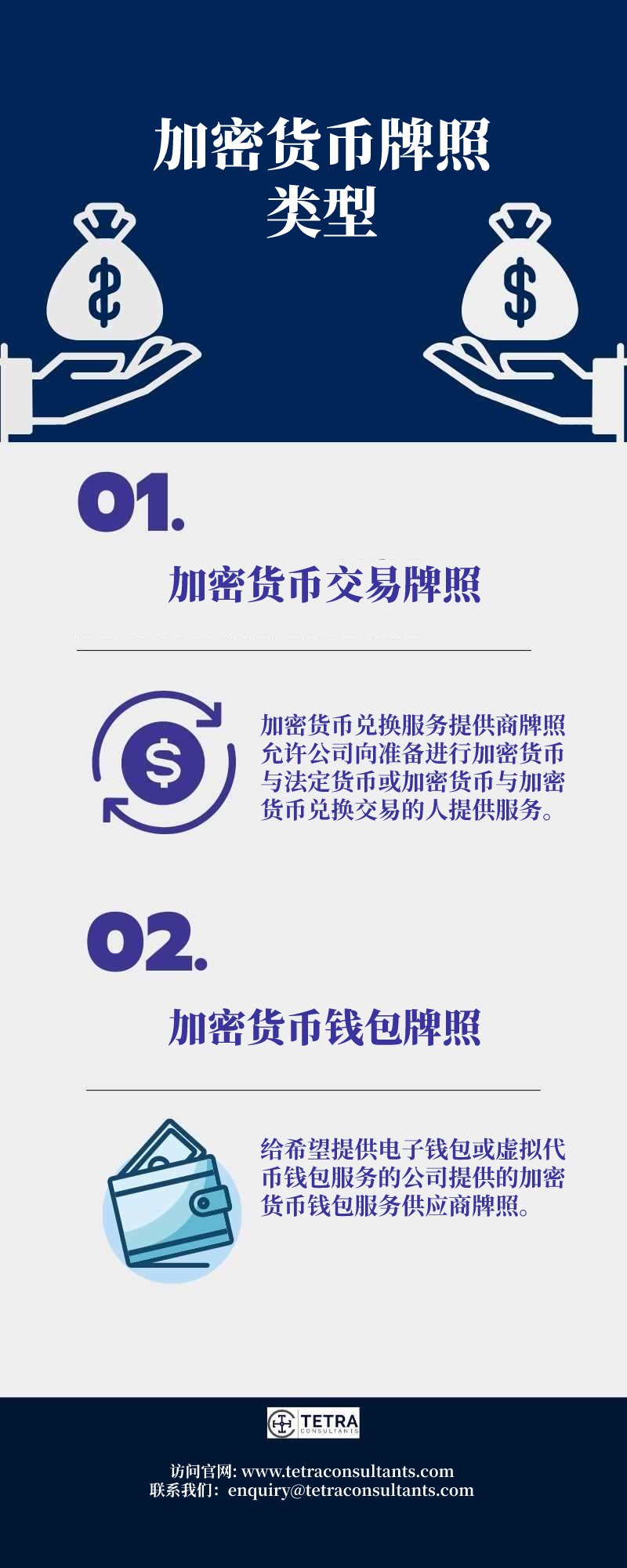

加密货币牌照的类型有哪些?

- 想要申请加密货币牌照的公司应该知道,加密货币公司通常可以获得两种类型的加密货币牌照。

加密货币交易牌照加密货币交易所牌照

- A cryptocurrency exchange license or a cryptocurrency exchange service provider license allows a company to provide exchange services to those interested in trading cryptocurrencies against fiat currencies or other cryptocurrencies.

加密货币钱包牌照

- A cryptocurrency wallet or a cryptocurrency service provider license, meanwhile, is issued to companies who wish to offer e-wallets or virtual token wallets.

加密货币牌照的颁发机构是什么?

- 加密货币牌照由监管该国加密货币业务或数字资产的监管机构颁发。

- 加密货币牌照由监管该国加密货币业务或数字资产的监管机构颁发。 例如在新加坡,加密货币公司受监管 新加坡金融管理局 根据新加坡 2020 年支付服务法。因此,加密货币企业必须从监管机构获得牌照才能运营加密货币交易所或钱包。

什么时候需要加密货币牌照?

- 根据您选择的加密货币牌照,我们讲为您提供一系列服务。

加密货币交易牌照加密货币交易所牌照

- 加密货币交换牌照允许牌照持有者提供加密交换服务,包括法定货币兑换加密货币、加密货币兑换加密货币和加密货币兑换法定货币。

加密货币钱包牌照

- 加密货币钱包牌照允许牌照持有者提供有关加密客户密钥的生成和存储的服务。

- A crypto wallet license allows your company to carry out businesses similar to a cryptocurrency wallet. Wallets are digital offline (cold wallets) and online tools (hot wallets) based on public-key cryptography used to securely send and receive cryptocurrencies. The cryptocurrency wallet license covers services where the private wallet keys are created or held, while the funds belong to the user and not to the service provider.

拥有离岸加密货币牌照有什么积极意义?

- Cryptocurrency traders can gain maximum advantages from setting up a company in an offshore jurisdiction and having an offshore cryptocurrency license. The key advantages include the following:

- 高效的资产保护;

- 实益拥有人的高度机密性和公司资产与个人资产的分离;

- Cryptocurrency-friendly policies and banking infrastructure;

- 税收优惠;

- 有几种公司所有权形式可供选择:选择取决于您的业务目标。

没有加密货币牌照有哪些风险?

- The company can be blacklisted, and international trade activities can be permanently blocked.

- Visas can be canceled, and restrictions on traveling can be applied by the respective government.

- All the managers, shareholders, and even owners can be deported.

- No local sponsors will make a deal with your company, and your business activities will be halted.

- 公司的扩张计划将终止。

- A heavy fine may be imposed, and all the company’s assets can be seized.

加密货币牌照的监管要求和文件是什么?

- 对于典型的加密货币牌照,监管机构希望您在继续申请之前考虑以下因素。

最低股本要求

- The foremost point of consideration is to meet the minimum capital requirements to operate a cryptocurrency business in the proposed jurisdiction.

- For example, in Malta, to get a 马耳他VFA牌照, there is a requirement of having a minimum capital of at least €730,000 as regulated by the Malta Digital Innovation Authority (MDIA).

经济实质要求

- Another important aspect is fulfilling the economic substance requirement to ensure the presence of your cryptocurrency business in the proposed jurisdiction.

- For example, in Estonia, a cryptocurrency business operator is required to have a physical office, local management team, and compliance officer in Estonia as regulated by the 爱沙尼亚金融情报机构 (FIU) for obtaining an 爱沙尼亚加密货币牌照.

合适的关键管理人员

- While setting up an entity for a cryptocurrency business, you need to ensure that the key managerial personnel are qualified to operate the business.

- For example, in the Philippines, when obtaining a 菲律宾加密货币牌照, there is a mandatory requirement to have an internal control system in place, ensuring that the candidates handling such critical internal control are fit & proper.

Costs Associated with Cryptocurrency Licensing

- Acquiring a cryptocurrency license varies in expense for businesses and can strongly impact a business’s budgeting. Our team at Tetra Consultants details all of the costs to secure a cryptocurrency license and maintains high transparency throughout the process.

- The scale of the licensing fee varies according to jurisdiction and license type. Beyond the one-time fees, a licensee also incurs operation costs, such as maintaining an Anti-Money Laundering and Know Your Customer fit and proper status. Other expenses include regular audits, capital reserves held to cover at least six months’ operational costs, and annual license renewals.

- At Tetra Consultants, we ensure that you are well-informed of all costs involved, from initial setup to long-term maintenance, helping you budget and avoid unexpected expenses. Our support will guide your business to regulatory compliance and financial stability in a competitive market.

所需文件

- To obtain a typical cryptocurrency license, you will need to provide the following documents to the regulators:

- 清理所有董事、UBO(最终受益人)和股东的犯罪和信用记录

- CVs of all directors, UBOs, and shareholders

- Local office address and related documents, directed by a local manager

- 公司网页

- 商业计划

- 第一年的财务预测

- 公司内部控制规范

- 公司程序规范

- 反洗钱政策

Top Jurisdictions for Obtaining a Cryptocurrency License

- With the increasing popularity of cryptocurrencies globally, some jurisdictions are gaining recognition for their favorable conditions conducive to crypto businesses. The crypto-friendliness of offshore locations often includes various regulatory frameworks and tax benefits, making them attractive for companies looking for a cryptocurrency license. Our company establishment experts at Tetra Consultants have extensive experience in helping clients obtain cryptocurrency licenses efficiently in different jurisdictions.

British Virgin Islands (BVI)

- BVI is a popular destination for crypto-related businesses seeking an offshore location. Established laws and a robust infrastructure provide security and stability for crypto businesses. The jurisdiction’s lack of income or capital gains tax on cryptocurrency companies is highly attractive for entrepreneurs. Virtual asset service providers are mandated to register as VASPs under the BVI Virtual Asset Service Providers Act 2022. Registering a company in BVI offers a safe and tax-effective base for launching your cryptocurrency business.

塞舌尔

- Seychelles provides a strategic location for crypto businesses with a favorable regulatory environment and high confidentiality for company owners. Many large cryptocurrency companies, such as Binance 加 BitMEX, have operations there. With the VASP Act 2024 in effect, crypto businesses must obtain a trading license from the FSA. Seychelles’ low tax rates, political stability, and strong financial infrastructure make it an attractive option. Company incorporation in Seychelles offers privacy and flexibility while meeting international standards.

瑞士

- Switzerland is renowned for being crypto-friendly, with many blockchain projects establishing their headquarters there. Its regulatory framework supports decentralization, innovation, and inclusivity. The country imposes no income or capital gains tax on crypto ventures, providing a tax-efficient environment for investors. Registering a company in Switzerland can position your business in a progressive, innovation-driven environment.

新加坡

- Singapore is one of the world’s leading financial centers with a stable economy and a business-friendly environment. The country’s infrastructure and high internet penetration rates make it almost ideal for crypto businesses. Singapore’s progressive stance on cryptocurrencies is evident from the number of investments in blockchain projects. Personal and corporate cryptocurrency holdings benefit from tax exemptions, although profits from active trading are taxed at a rate of 17%. Registering a company in Singapore provides a supportive regulatory framework conducive to innovative blockchain activity.

马耳他

- Malta is known as “Blockchain Island” due to its proactive approach to cryptocurrency regulation. The country has established comprehensive regulations for blockchain and cryptocurrency businesses, including the Malta Digital Innovation Authority Act and the Virtual Financial Asset Act. These regulations have solidified Malta’s reputation as a premier destination for crypto-friendly operations. Tax incentives and simplified licensing procedures further enhance its appeal. Registering a company in Malta enables you to operate in an English-speaking environment with significant support for blockchain and crypto ventures.

- With Tetra Consultants, registering a crypto company in any of these top jurisdictions ensures full regulatory compliance and positions your business for long-term success in the fast-evolving cryptocurrency sector.

获得加密货币牌照的程序是什么?

- To set up and operate a cryptocurrency exchange, a license is required. The procedure varies depending on the jurisdiction. Tetra Consultants summarizes the common steps involved in obtaining a cryptocurrency license:

第 1 步:确定适当的管辖权和加密货币牌照要求

- Based on your company’s planned activities and customer base, Tetra Consultants will advise you on the most suitable jurisdiction and type of cryptocurrency license for your business model.

- We familiarize you with requirements such as paid-up capital, local economic substance criteria, timeframes, and regulations before engagement begins.

第 2 步:实体注册和成立

- Tetra Consultants conducts due diligence on the management and shareholders of the firm. Once we receive all KYC documents, incorporation documents, and power of attorney, we begin registering the company with the local Companies Registry.

- After successful registration, we provide corporate documents, such as the Certificate of Incorporation and Memorandum and Articles of Association.

第 3 步:开立公司银行账户

- 特加商务咨询将协助您 开立企业银行账户 with a reputable financial institution. The minimum paid-up capital required for licensing will be deposited into this account.

Step 4: Document preparation

- Our legal experts will prepare the necessary documents for the cryptocurrency license application. These include the business plan, financial statements, AML/CFT policy, and insurance policy as per local regulations.

- Once documents are ready, Tetra Consultants will provide prototypes for review and send them for e-signatures before proceeding with the license application.

第 5 步:满足当地经济实质要求

- If the local regulator requires economic substance (e.g., a local registered address and approved personnel), Tetra Consultants will assist in meeting these criteria, including recruiting local employees.

- Our HR team will shortlist candidates and conduct preliminary interviews for key roles, including compliance officers. You can then finalize the selection, and we will help prepare employment contracts.

- We will compile a list of potential office spaces, considering factors like location and cost, to help you choose the best option. Tetra Consultants will also handle lease agreements once a space is selected.

Step 6: License application filing

- After completing the above steps, Tetra Consultants will submit the license application to the local regulator. Depending on the jurisdiction, you may need to attend an interview before approval. We will prepare you for the interview and assist with follow-up actions.

- Once approved, your firm will receive the cryptocurrency license and must start operations within the stipulated timeframe to maintain the license.

Maintaining a Cryptocurrency License: Post-License Requirements

- After obtaining a cryptocurrency license, it is essential to comply with ongoing regulatory requirements to ensure the license remains valid. These requirements vary by jurisdiction but commonly include:

Compliance with AML and KYC Regulations

- Ongoing compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations involves:

- Conducting regular audits of customer transactions to detect suspicious activities.

- Maintaining updated KYC records for all clients.

- Training staff on compliance protocols and regulatory changes.

Financial reporting and audits

- Many regulatory bodies require licensed cryptocurrency businesses to submit financial reports and undergo periodic audits.

Operational compliance

- Adhering to operational standards set by regulators involves:

- Ensuring cybersecurity measures are in place to protect client data.

- Maintaining a physical presence in the licensing jurisdiction.

- Updating business practices in line with evolving regulations.

Communication with regulatory authorities

- Maintaining open communication with regulatory authorities includes:

- Promptly reporting changes in business structure or ownership.

- Notifying regulators of significant incidents or breaches that may impact compliance.

Legal Implications of Operating Without a Cryptocurrency License

- Operating a cryptocurrency business without the required licenses can result in severe legal consequences. Regulations vary by jurisdiction, but common implications include:

Criminal sanctions

- Running a cryptocurrency business without the proper license is often criminalized. For instance, under 18 U.S.C. § 1960 in the U.S., operating an unlicensed money transmitting business can lead to up to five years in prison.

Financial sanctions and penalties

- Unlicensed operations can incur heavy fines. For example, Binance faced a $2.25 million fine in India for non-compliance, and similar companies in the U.S. paid over $4 billion in fines for license and AML violations.

Civil liabilities

- Unlicensed operators may face lawsuits from customers or investors for losses due to lack of oversight, leading to substantial financial liabilities and reputational damage.

Operational restrictions and shutdowns

- Regulatory authorities may shut down unlicensed businesses. For instance, offshore crypto exchanges banned in India faced severe operational risks and long-term brand damage.

Increased scrutiny and regulatory action

- Operating without a license can attract heightened scrutiny, leading to more thorough investigations and legal challenges that disrupt operations.

Loss of business opportunities

- Without proper licensing, businesses may struggle to partner with banks, payment processors, or financial institutions, limiting growth and market expansion.

获得加密货币牌照需要多长时间?

- Before starting an engagement, Tetra Consultants provides a project plan outlining timelines for company registration, document preparation, and license application, ensuring clarity for all parties.

我们的服务

- Tetra Consultants assists cryptocurrency companies with regulatory and licensing needs, providing comprehensive support for entity formation and operation.

- 特加商务咨询 specializes in obtaining cryptocurrency licenses, helping you operate legally in your chosen jurisdiction with expert guidance.

- We also assist in obtaining other offshore financial licenses aligned with your business goals.

了解更多

现在联系我们 to learn more about obtaining a cryptocurrency license. Our team will respond within 24 hours.复。

常见问题:

如何获得加密货币牌照?

我需要什么牌照才能出售加密货币?

获得加密货币牌照需要多长时间?

是否有必要在每个司法管辖区获得加密货币牌照?

获得加密货币牌照的最佳业务结构是什么?

可以在线获得加密货币牌照吗?

监管部门在审批最后阶段的牌照申请时会考虑哪些因素?

加密货币牌照的有效期是多久?

为什么需要将最低资本存入企业银行账户?