Deciding on which countries to expand your business to can be a complex and difficult decision. As an aspiring entrepreneur, you might have heard of the lucrative business environment of Mauritius and might be wondering about the process of foreign company registration in Mauritius. In this article, Tetra Consultants will provide the ultimate guide on foreign company registration in Mauritius, covering not only the key advantages of starting a business there, but also the process of said registration so that you may better understand this business phenomenon and make a more informed decision about whether you should register company in Mauritius.

This article will consist of two key segments. Firstly, we will cover the key advantages of setting up a company in Mauritius. Subsequently, we will explain the process of registering this company as a foreign investor in the country.

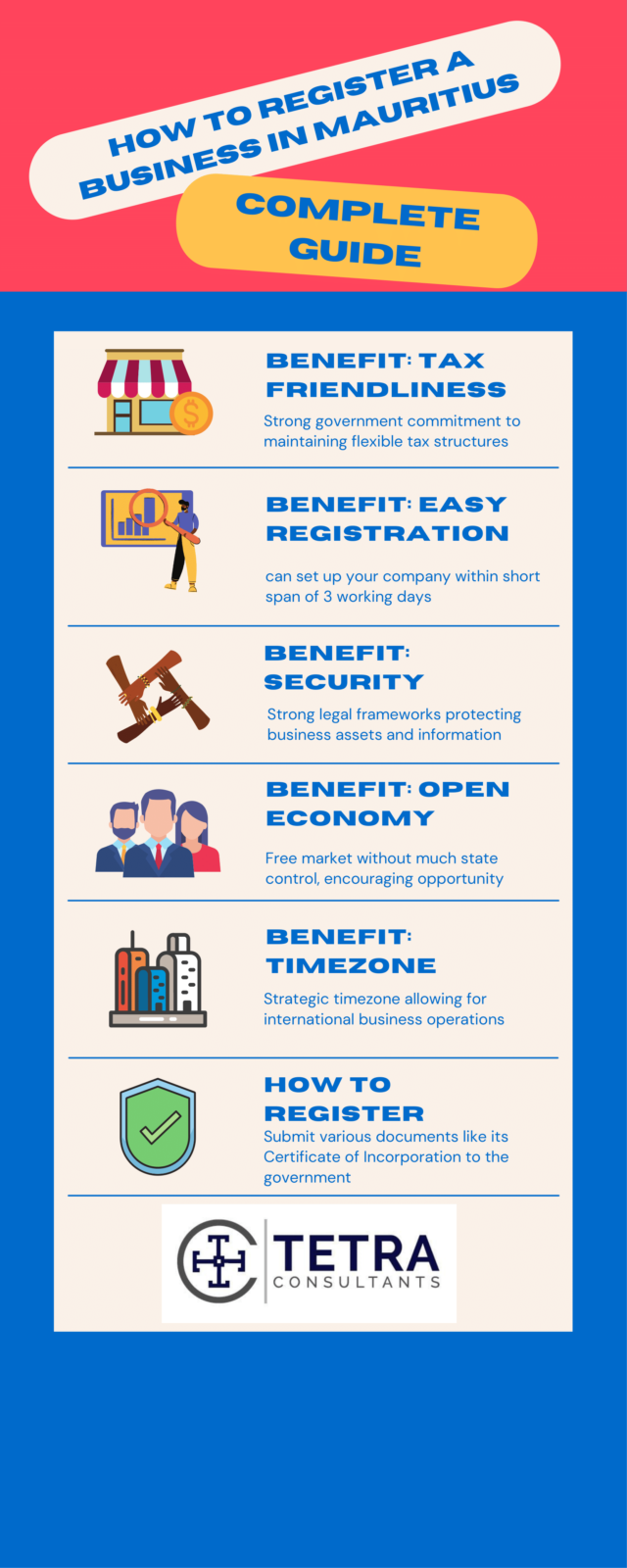

Key advantages of setting up a company in Mauritius

1. Tax friendly environment for foreign companies

The country of Mauritius boasts an Attractive and Flexible Tax System. This is because of strong government commitment to doing their best in creating an investor-friendly environment for both local and international companies. Such strong government support is showcased in the various tax benefits which many companies are entitled to.

For instance, Mauritius is a low tax jurisdiction, where there are no inheritance taxes which need to be paid. Additionally, the government also provides 80 percent tax credits to offshore companies, lowering the costs of their business operations substantially. Moreover, dividends paid by companies in Mauritius are tax exempted as well, with no capital gain tax levied on them. Furthermore, companies have access to free repatriation of dividends, capital and profits. While there are Valued Added Tax (VAT) rates of 15%, this VAT is only levied on equipment, while exemptions from custom duty ensure that such costs are kept to a minimum. Last but most certainly not least, the government has multiple DTAA (Double Tax Avoidance Agreements) with thirty-four countries, ensuring that any foreign company registration in Mauritius can operate its business activities with taxes as low as possible.

2. Convenient and easy business registration and incorporation process

Setting up business in Mauritius is relatively easy. This is because foreign entrepreneurs can set up their companies in Mauritius within 3 working days and enjoy up to 100 percent foreign ownership. Additionally, there is no minimum foreign capital required to setup a company and start operations in Mauritius as well, meaning that if foreign investors are looking to start a new business which may not have sufficient initial capital and cash, this remains feasible.

3. Security and protection for foreign investors and business owners

Mauritius is one of the countries where foreign business owners can enjoy strong protection. This is because the country, Mauritius, is signatory of many treaties as well as multilateral agreements that ensure protection of foreign investors such as the 1958 New York Convention, as well as the the International Court of Justice of the Hague and the International Centre for RoID (Regulation of Investment Dispute). Hence, access to much of these legal frameworks and statutes mean that proper security is offered even for foreign investors looking to set up shop in the country.

4. Open and free economy

In Mauritius, there is a strong and liberal free market economy with no state control over exchange. This means there is absolutely no limit when it comes to transferring dividends, capital and profits out, from Mauritius to another country. As such, for foreign investors, one can easily shift the profits earned in Mauritius to the place where your company is headquartered. Hence, this allows for smooth business operations, even for someone living abroad and not within the country itself.

5. Suitable and convenient time zone

By being geographically positioned between Madagascar’s east along the Indian Ocean, Mauritius is home to a convenient time-zone that is GMT + four by opening their markets for business early before the Far Eastern side markets close and is just in time to catch-up with the opening market in the United States. This means that it is able to maintain strong economic relations with other countries and major players like the US, ensuring that the business which you register in the country would have no trouble expanding and operating abroad if it wishes to as well.

6. Excellent business ventures and opportunities across various industries

The country of Mauritius offers amazing business opportunities across different sectors such as its agricultural industries, logistics and distribution services, manufacturing and specifically light engineering, seafood and aquaculture, information technology (IT), financial services, healthcare, medical travel, property development, hospitality, renewable energy and environment. Hence, the economic diversity of Mauritius coupled with strong business opportunities across the board means that setting up a profit making business in the country will not be a problem for many foreign or international entrepreneurs.

How to successfully complete foreign company registration in Mauritius

For a foreign company, within 1 month of establishing a place of business in Mauritius, the firm must register a branch of the foreign company in Mauritius. There are several documents which need to be prepared upon registering for your business. This includes a certificate of notice of reservation of name, an authenticated copy of its Certificate of Incorporation or a document of similar effect, an authenticated copy of its constitution or memorandum and articles, a list of directors containing full names, residential address, occupation, a memorandum of appointment or power of attorney executed by the foreign company appointing two local authorised agents to the branch, who shall signify their consent in writing, as well as a notice of its registered office in Mauritius

Once all of these key pieces of documentation are obtained, you can officially complete the process of registration for your foreign company.

Conclusion

Navigating the country of Mauritius’s complex business climate might be a challenging process – a hassle to say the least. However, with key benefits regarding tax rates and a business friendly environment outlined above, it is easy to see why many businesses would choose to set up in Mauritius. As such, Tetra Consultants hopes that this article has provided you a much better understanding about the key steps to foreign company registration in Mauritius so that you can truly decide on whether you should register company in Mauritius yourself.

So, what are you waiting for? Contact us to find out more about the process of starting a business in Mauritius, and our dedicated and experienced team will respond within the next 24 hours. Tetra Consultants will not only empower you by helping to navigate the different regulations of Mauritius, but also aid in facilitating the registration of your company there while providing invaluable, nuanced insights into any potential challenges.